In today’s interconnected world,managing finances wiht a partner,family member,or roommate can provide remarkable benefits,from facilitating shared expenses to fostering financial openness. A joint bank account offers a practical solution for anyone looking to streamline their budgeting efforts and enhance their financial collaboration. Whether you’re embarking on a new relationship, planning a big move, or simply seeking a better way to manage household finances, the process of opening a joint bank account may be simpler than you think. In this comprehensive guide, we’ll walk you through each step of establishing a joint account, from selecting the right bank and understanding essential requirements to navigating the paperwork and managing the account responsibly. Let’s dive in and explore how to take this important step toward financial partnership.

Table of Contents

- Understanding the Benefits of a Joint Bank Account

- Choosing the Right Bank and Account Type

- Essential Documents and Requirements for Opening a Joint Account

- Managing Your Joint Account: Best Practices and Tips

- Insights and Conclusions

Understanding the Benefits of a Joint Bank Account

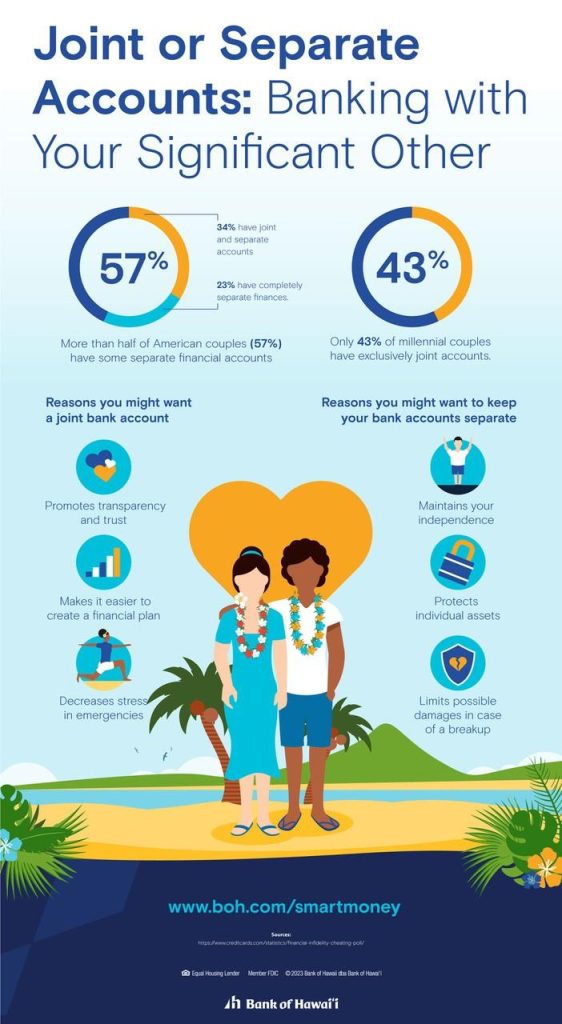

Opening a joint bank account can substantially enhance the financial collaboration between partners, family members, or roommates. This type of account promotes transparency and shared duty,making it easier to manage household expenses and savings goals. Some of the key advantages include:

- Shared Financial Management: Joint accounts allow all account holders to monitor spending and contributions, fostering better financial communication.

- Equal Access: All parties can withdraw, deposit, and manage funds, which simplifies transactions and budgeting.

- Streamlined Bill Payments: Joint accounts make it easier to pay shared bills like rent, utilities, or groceries, reducing the hassle of transferring money between accounts.

Along with these practical benefits, a joint bank account can further strengthen the bond between individuals by promoting trust and teamwork. It encourages mutual financial accountability and planning, resulting in a holistic approach to spending and saving.Consider the following factors when deciding on a joint account:

| Factor | Importance |

|---|---|

| Communication | Essential for discussing financial goals and concerns. |

| Trust | Critical for maintaining harmony in joint financial decisions. |

| Shared Goals | Aligning on saving and spending priorities enhances collaboration. |

Choosing the Right Bank and Account type

When embarking on the journey to open a joint bank account, it’s crucial to evaluate different banks and account types to find the best fit for both parties involved. Consider the following factors to streamline your decision-making process:

- Fees: Investigate monthly maintenance fees, transaction fees, and any penalties for falling below minimum balance requirements.

- Accessibility: Look for a bank with convenient locations and robust online banking services.

- Account Features: Determine the services offered such as overdraft protection, interest rates, and budgeting tools.

- Customer Service: Check reviews and ratings to ensure that the bank provides reliable and helpful customer support.

After narrowing down your options, it’s helpful to compare specific account types. Some may offer better benefits suited to your joint financial goals.Here’s a simple comparison that highlights common account attributes:

| Account Type | Interest Rate | Minimum Balance | Overdraft Protection |

|---|---|---|---|

| Basic joint Account | None | $0 | Available |

| Joint Savings Account | 0.5% APY | $100 | Not Included |

| High-yield Joint Account | 1.0% APY | $1,000 | Available |

Essential Documents and Requirements for opening a Joint account

Before you can embark on the journey of opening a joint bank account, it’s crucial to gather and organize the necessary documents. Typically, banks require both account holders to provide specific identification and proof of residency.Here’s a list of essential items you should prepare:

- Government-issued IDs: Such as a passport, driver’s license, or national ID card for both parties.

- Social Security Numbers: Each applicant must provide their SSN or taxpayer identification number.

- Proof of Address: documents like utility bills, lease agreements, or bank statements, stating the current residential address.

- Joint Agreement: Some banks may require a written agreement outlining the terms of the joint account.

In addition to personal identification documents, joint account applicants may also be asked to provide supplementary data regarding their financial situation. This can definitely help the bank assess the account’s needs and benefits.Depending on the institution, you might need to prepare the following:

| Information Required | Description |

|---|---|

| Initial Deposit Amount | Specify the minimum amount both parties are willing to deposit to open the account. |

| Joint Account Purpose | Discuss and state the primary purpose for the joint account, such as savings, travel, or shared expenses. |

| Contact Information | Provide updated phone numbers and email addresses for both account holders. |

Managing Your Joint Account: Best Practices and Tips

Managing a joint account can be a rewarding experience,but it requires clear communication and responsibility from both account holders. To ensure smooth operation,both parties should establish clear spending limits and commit to regular discussions about finances.This approach not only prevents conflicts but also promotes transparency and trust,essential for any joint financial relationship. Additionally, consider implementing a monthly review of transactions to stay aware of your spending habits and to adjust your budget as necessary.

When it comes to handling day-to-day transactions, utilizing apps and tools can be beneficial. Many banking institutions now offer features that allow you to categorize expenses or set shared goals, which can make managing your finances simpler and more engaging.Here are some helpful practices to keep in mind:

- Set up alerts: Enable notifications for withdrawals and deposits to stay informed about account activity.

- Automate shared expenses: Use standing orders for recurring bills to ensure timely payments and reduce the risk of overdraft.

- Consider a budgeting tool: Apps like Mint or YNAB (You Need a Budget) can definitely help both holders track their spending and savings together.

Insights and Conclusions

As we wrap up our comprehensive guide to opening a joint bank account, we hope you feel equipped and confident to take this financial step with your partner, family member, or trusted friend. Remember, a joint bank account can simplify shared finances, enhance transparency, and foster trust in your financial relationship.

Before you proceed, take time to choose an account that aligns with both your needs and financial goals.And don’t forget to have open discussions about your expectations, responsibilities, and how you’ll manage spending.

With the right preparation and communication, a joint bank account can be a powerful tool for achieving your financial objectives together. Thank you for reading, and here’s to your prosperous banking journey ahead! If you have any questions or would like to share your experiences, feel free to leave a comment below. Happy banking!