Navigating the world of study abroad can be an exhilarating yet overwhelming experience, especially when it comes to financing your adventure. With the dream of exploring new cultures, gaining international perspectives, and enhancing your educational journey, many students find themselves wondering how to make those dreams a reality without breaking the bank. This is where financial aid comes into play. Whether you’re eyeing a semester in Europe, an internship in Asia, or a volunteering possibility in South America, understanding the various financial aid options available to you is crucial. In this guide, we’ll break down the essentials of securing financial assistance for your study abroad program, providing you with practical tips, resources, and strategies to help turn your global aspirations into a reality. Get ready to embark on a transformative educational experience without the financial stress!

Table of Contents

- Understanding Different Types of Financial Aid Available for Study Abroad Programs

- Navigating the Application Process for Scholarships and Grants

- Maximizing Your Eligibility for Federal and Institutional Aid

- Tips for Creating a compelling Financial Aid Proposal

- To Conclude

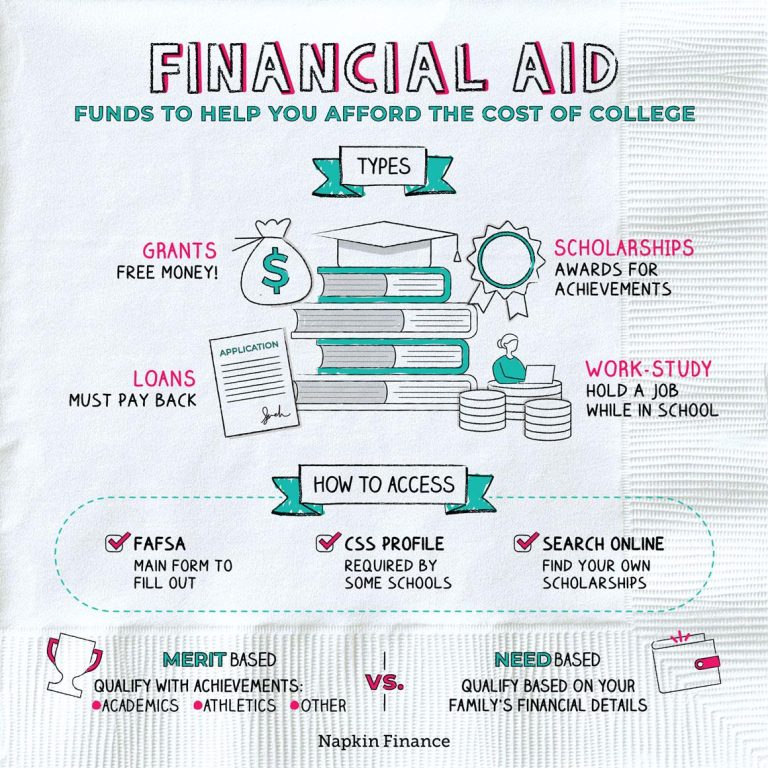

Understanding Different Types of Financial Aid Available for Study Abroad Programs

When exploring financial aid options for your study abroad journey, it’s crucial to recognize the diverse forms of support available. Grants and scholarships are among the most sought-after options, as they do not require repayment and can significantly alleviate financial burdens. Common sources include institutional awards offered by your home university or host institution, as well as external scholarships from organizations dedicated to promoting international education.Additionally, some countries have governmental grants aimed at students wishing to study abroad. Another meaningful category is student loans, which can provide ample funding, albeit with the obligation of repayment. Be sure to check with your financial aid office to see how these loans can be applied to international programs.

Besides traditional financial aid methods, students can explore programs like work-study arrangements or internships specifically designed for study abroad experiences. These opportunities allow students to earn money while gaining valuable experience abroad. Moreover, crowdfunding has emerged as a popular alternative financing method; platforms enabling students to connect with friends, family, and even strangers to raise money for their educational adventures. It’s essential to remember that financial aid eligibility can vary widely depending on the type of program, so always read the fine print and clarify with your program coordinators. Here’s a simplified table summarizing the different types of financial aid:

| Type of Financial Aid | repayment Required? | Key Sources |

|---|---|---|

| Grants | No | Government,Universities,Foundations |

| Scholarships | No | External Organizations,Universities |

| Student Loans | yes | Federal,Private Lenders |

| Work-Study | No | Universities |

| Crowdfunding | No | Online Platforms |

Navigating the Application Process for Scholarships and Grants

Embarking on the journey to secure financial aid for study abroad programs may seem daunting,but with a strategic approach,you can simplify the process. Here are several key steps to consider:

- Research Opportunities: Investigate various scholarships and grants available for your target destination and field of study. Websites like Fastweb and the College Board can be treasure troves of facts.

- Understand eligibility: Carefully review eligibility criteria to ensure you meet all requirements before applying. This includes academic performance, financial need, and targeted demographic groups.

- Prepare Documentation: Gather necessary documents such as transcripts, letters of recommendation, and personal statements, ensuring they highlight your suitability for the scholarship or grant.

- Create a Timeline: Develop a timeline for your applications to keep track of deadlines. This will help you avoid last-minute rushes that can lead to errors or missed opportunities.

As you move forward, effective interaction is crucial. Reach out to scholarship offices or financial aid advisors for guidance and clarification.

| Task | Deadline |

|---|---|

| Research scholarships | 2 months before applications |

| Prepare Documents | 1 month before applications |

| Submit Applications | 3 weeks before deadlines |

| Follow-Up | 1 week after submission |

Highlighting your unique experiences and aspirations can significantly enhance your application. Engage in self-reflection to articulate your motivations effectively. Remember, persistence is vital; if your first attempts are unsuccessful, continue to explore new options and revise your approach accordingly.

Maximizing Your Eligibility for Federal and Institutional Aid

To enhance your chances of receiving federal and institutional aid for your study abroad program, it is essential to actively engage in the financial aid process. Start by completing the Free Application for Federal Student Aid (FAFSA) as early as possible. this allows you to get a head start and ensures that you meet all deadlines that may be set by your institution. In addition, consider these strategies:

- research</strong: thoroughly explore both federal and institutional resources available for study abroad programs.

- Consult Financial Aid Advisors: Schedule meetings with financial aid experts at your school to discuss your intentions and seek personalized advice.

- Maintain Good Academic Standing: Ensure you meet GPA and course load requirements, as these factors directly impact your eligibility for aid.

Furthermore, keep a close eye on any specific scholarship opportunities that align with your study abroad destination or field of study. Many institutions offer merit-based or need-based scholarships that can significantly offset costs. To help identify what’s available, use the table below to keep track of potential funding sources:

| Funding Source | Type | Eligibility Requirements |

|---|---|---|

| Gilman Scholarship | Federal | Undergraduates receiving Pell Grant |

| University Study Abroad Scholarship | Institutional | Varies by program and GPA |

| Critical Language Scholarship | Federal | U.S. citizens enrolled in college |

By staying informed and proactive, you can successfully maximize your eligibility for various forms of financial aid and make your dream of studying abroad a reality.

Tips for Creating a Compelling Financial Aid Proposal

Crafting a compelling financial aid proposal hinges on clarity and persuasion. Begin by clearly outlining your goals and the academic program you wish to pursue. Highlight how studying abroad aligns with your educational and career aspirations, creating a narrative that resonates with the funding body. Remember to provide specific details about the program, such as location, duration, and importance, and also the costs involved. This meticulous explanation not only demonstrates your commitment but also aids reviewers in understanding the importance of the aid they are considering granting.

To strengthen your proposal, include supporting documents that bolster your case. Consider providing:

- Letters of recommendation from faculty or advisors who can vouch for your academic merit

- A detailed budget that outlines estimated expenses, including tuition, travel, and living costs

- Evidence of your academic achievements, such as transcripts or awards

Your ability to communicate your need for financial support is crucial.Create a concise table that succinctly presents your financial situation in comparison with your projected expenses.

| Expense Type | Estimated Cost ($) |

|---|---|

| Tuition Fees | 12,000 |

| Travel Costs | 1,500 |

| Accommodation | 4,000 |

| Living Expenses | 3,000 |

| Total Estimated Cost | 20,500 |

By illustrating both your financial needs and the unique opportunities that study abroad presents, you’ll be better positioned to make a persuasive case for your financial aid proposal.

To Conclude

As you embark on the exciting journey of securing financial aid for your study abroad program, remember that thorough research and proactive planning are your best allies. Whether it’s scholarships, grants, or loans, there are numerous options available designed to support your aspirations of global education.

Take the time to explore every avenue—connect with your university’s financial aid office, tap into community resources, and don’t hesitate to apply for multiple scholarships to enhance your funding opportunities. Every effort counts, and the investment you make in securing support is a crucial step toward enriching your academic experience abroad.

As you prepare for this monumental adventure, keep in mind that studying abroad is not just an educational opportunity; it’s a chance to broaden your horizons, immerse yourself in new cultures, and develop a unique global viewpoint.With the right financial planning in place, your dreams of studying in an international setting are well within your reach.

Thank you for reading our guide! We hope you found it helpful as you navigate the financial aid landscape. If you have any questions or need further assistance, feel free to leave a comment or reach out. Happy travels and best of luck in your studies abroad!