In an unpredictable world, financial stability is more crucial than ever. Life is full of surprises, from unexpected medical expenses to sudden job loss, and teh best defense against these curveballs is a well-prepared emergency fund. An emergency fund is not just a safety net; it’s a foundation for peace of mind and financial resilience. Yet, despite its importance, many individuals find themselves without this crucial financial buffer. If you’re looking to safeguard your future and ensure you’re equipped to handle life’s uncertainties, you’ve come to the right place. In this article, we’ll explore the imperative reasons why building an emergency fund should be a priority for everyone, and we’ll provide you with practical steps to kickstart your own fund today. Let’s dive in and discover how taking this vital financial step can empower you to face the unexpected with confidence.

Table of Contents

- Understanding the Importance of an Emergency Fund for Financial Security

- Key Components of a Sustainable emergency Fund Strategy

- Practical Steps to Establishing and Growing Your Emergency Fund

- Common Pitfalls to Avoid When Building Your Emergency Fund

- Wrapping Up

Understanding the Importance of an Emergency Fund for Financial Security

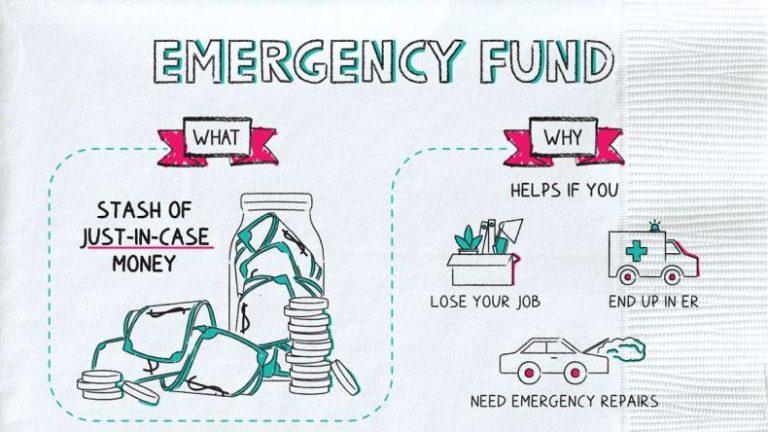

establishing an emergency fund is a fundamental pillar of financial security. It serves as a safety net during unpredictable situations, such as medical emergencies, car repairs, or unexpected job loss. Having readily accessible savings can prevent you from relying on credit cards or loans, which can lead to debt and financial strain. Additionally, an emergency fund can provide peace of mind, allowing you to make decisions without the constant worry of financial instability. In essence, it’s not just about having money saved; it’s about fostering confidence in your ability to handle life’s uncertainties.

to build an effective emergency fund, consider the following strategies:

- Set a Target Amount: Aim for three to six months’ worth of living expenses.

- Choose a Seperate Account: Keep your emergency savings in a dedicated account to avoid dipping into it for non-emergencies.

- Automate Savings: Set up automatic transfers from your checking account to your emergency fund to make saving effortless.

- Start Small: If you’re unsure about saving a large sum,start with a small,manageable amount and gradually increase it.

By implementing these steps, you can pave the way toward a solid emergency fund that will bolster your financial health and security over time.

Key Components of a Sustainable Emergency Fund Strategy

Building a resilient emergency fund involves a few critical components that ensure its effectiveness and sustainability. First, establish a clear savings target based on your individual needs. Consider factors such as monthly expenses, potential income loss, and unexpected costs. Typical recommendations suggest aiming for three to six months’ worth of living expenses,though this might vary depending on personal circumstances. Next, prioritize regular contributions to your fund. Setting up automatic transfers from your checking account to a dedicated emergency savings account can help create consistency in your savings habits.

Another essential element is selecting the right type of account for your emergency fund. Look for options that offer high interest rates without penalty for withdrawals.High-yield savings accounts or money market accounts are often ideal,thanks to their liquidity and better interest rates compared to standard savings accounts. Additionally, maintain a discipline to avoid tapping into this fund for non-emergencies. Tracking your savings progress not only motivates you but helps keep you focused on your goal. Remember, a well-structured emergency fund is not just a safety net; it’s a cornerstone of your financial stability.

Practical Steps to Establishing and Growing Your Emergency Fund

Building an emergency fund may seem daunting, but following a structured approach can simplify the process. Start by determining your financial goals; aim to save at least three to six months’ worth of living expenses. This amount acts as a safety net for unexpected costs such as medical emergencies or urgent home repairs. Once you’ve set your target, break it down into manageable chunks. Consider adopting the 50/30/20 budgeting rule, where 50% of your income goes to necessities, 30% to discretionary spending, and 20% specifically towards savings. Automate your savings by setting up monthly transfers to a high-yield savings account dedicated solely to your emergency fund.This way, you’re not only prioritizing your saving goals but also making the process effortless.

As your fund grows, regularly review your budget and adjust your contributions as necessary. Monitor your spending habits and identify areas where you can cut back without feeling deprived. You could also enhance your emergency fund by exploring additional income sources, such as side jobs or freelance opportunities. Set up a savings challenge, like the “52-week challenge,” where you save an escalating amount each week, starting with just $1. To visualize your progress, consider creating a simple table:

| Week Number | Amount to Save | Total Savings |

|---|---|---|

| 1 | $1 | $1 |

| 2 | $2 | $3 |

| 3 | $3 | $6 |

| 4 | $4 | $10 |

| Total | – | $1,378 (by Week 52) |

Implementing these practical steps effectively will help you build a solid foundation for your emergency fund while ensuring financial peace of mind.

Common Pitfalls to Avoid When Building Your Emergency fund

Building an emergency fund is a prudent financial strategy, but many individuals stumble into common traps that can hinder their progress. One major pitfall is failing to set a specific savings goal. Without a clear target, it’s easy to become complacent and neglect regular contributions. Establishing a defined amount based on your monthly expenses—as a rule of thumb, aim for three to six months’ worth—can create a sense of urgency and purpose. Additionally,avoid the temptation to dip into your emergency fund for non-emergencies. Using these savings for impulsive purchases or minor financial hiccups can quickly deplete your hard-earned buffer.

Another common mistake is not automating your savings. Many people think they will ‘get to it later’ but end up realizing too late that they haven’t made any progress. By setting up automatic transfers from your checking account to your emergency fund, you ensure consistent contributions happen without fail. Consider also the impact of inflation; letting your funds sit in a low-interest account can mean losing purchasing power over time. Explore higher-yield savings options or accounts specifically designed for emergency funds. Here’s a simple overview of savings options:

| Account Type | Typical Interest Rate | Accessibility |

|---|---|---|

| High-Yield Savings Account | 0.50% – 1.00% | easy |

| Money Market Account | 0.10% – 0.80% | Somewhat easy |

| Certificates of Deposit (CD) | 0.05% – 1.50% | Restricted |

Wrapping up

establishing an emergency fund is an essential step toward securing your financial future and achieving greater peace of mind. Life is unpredictable, and having a safety net can protect you from unforeseen expenses that can otherwise derail your financial stability. By taking the time to assess your current situation, setting clear savings goals, and automating your contributions, you can create a robust emergency fund that empowers you to face life’s surprises with confidence.Remember, even small contributions can add up over time, so start where you are, and remain consistent. As you build your fund, you’ll not only equip yourself with a financial cushion but also foster a sense of security that promotes healthier financial habits overall.

If you haven’t already, now is the perfect time to start prioritizing your emergency savings.Don’t wait until you find yourself in a crisis. Take charge of your financial future today—because when it comes to protecting yourself and your loved ones, preparation is the best defense. Happy saving!