When choosing a college, the sticker price often grabs the attention of aspiring students and their families, but the reality is that the total cost of attendance can be surprisingly nuanced. Beyond tuition and fees, countless hidden expenses can catch even the savviest planners off guard. From textbook expenses and lab fees to dormitory necessities and meal plans, a college education often comes with a price tag that exceeds initial estimates. In this article, we aim to unveil these hidden costs and equip you with smart strategies to navigate the financial landscape of higher education. whether you are a high school senior planning your next steps or a current college student seeking to better manage your finances,our insights will help you prepare effectively,empower you to make informed decisions,and ultimately ease the financial burden of your academic journey. Let’s dive into the intricacies of college costs and uncover how you can take charge of your educational finances.

Table of Contents

- Understanding the true Cost of Attendance Beyond Tuition

- Identifying Hidden Fees and Expenses in College Life

- Smart Financial Planning: Creating a Comprehensive budget

- Leveraging Resources and scholarships to Reduce Overall Expenses

- In Summary

Understanding the True Cost of Attendance Beyond Tuition

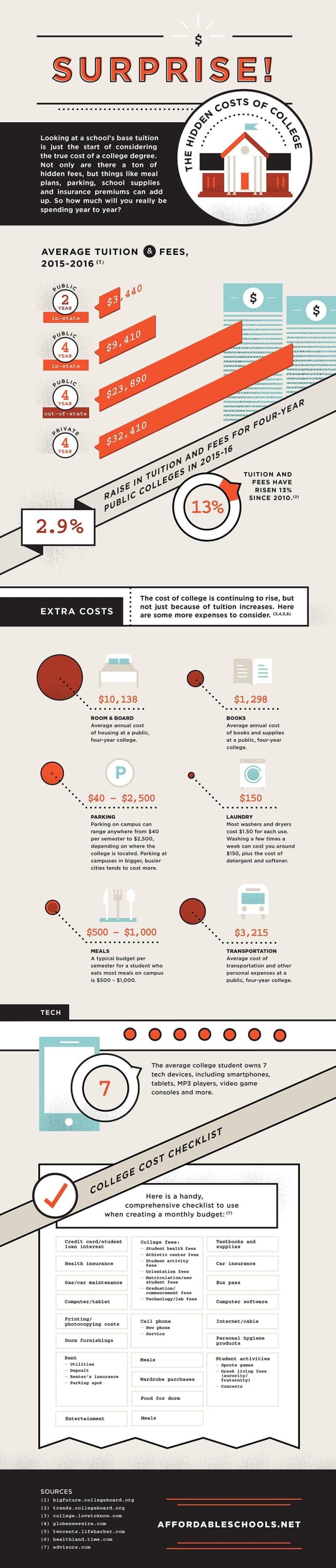

When considering higher education, many students and families solely focus on tuition, overlooking additional expenses that can significantly impact their overall financial planning. These hidden costs frequently enough include essentials such as housing, meals, and textbooks, alongside unexpected expenses like transportation, technology fees, and personal supplies. A comprehensive understanding of these financial obligations is crucial, as they can easily escalate the total cost of attendance. Here are a few common expenses to keep in mind:

- Housing Costs: On-campus vs. off-campus living

- Meal Plans: Variety and versatility

- Textbooks and Supplies: New vs. used vs. rentals

- Transportation: Commuting expenses

- Health Insurance: Mandatory coverage policies

To better illustrate the potential financial burden, consider creating a budget table that outlines all anticipated expenses over a semester. This will help you prepare a realistic financial picture. Below is a simplified example:

| Expense Type | Estimated Cost |

|---|---|

| Tuition | $12,000 |

| Housing | $4,500 |

| Meals | $2,000 |

| Textbooks | $600 |

| Transportation | $800 |

| Miscellaneous | $1,000 |

| Total Estimated Cost | $22,900 |

By anticipating these costs and creating a detailed financial plan,students can proactively manage their finances,seek scholarships or aid,or adjust their spending habits accordingly. Being aware of the myriad expenses associated with college can empower students to make informed decisions and fully enjoy their educational experience without the burden of financial surprises.

Identifying Hidden Fees and Expenses in College Life

As you embark on your college journey,it’s essential to look beyond tuition fees and room-and-board expenses.Many students find themselves surprised by the hidden costs lurking around campus that can significantly impact their budget. To avoid the scramble for excess funds mid-semester, it’s wise to identify potential expenses early on. Common hidden fees include:

- Lab and Course Fees: Certain majors may require additional fees for lab materials or special course supplies.

- Textbooks and supplies: the cost of books can add up quickly, especially when considering options like access codes for online resources.

- Health Insurance: Students might be automatically enrolled in health plans that charge extra unless they provide proof of coverage.

- Parking and Transportation: Fees for parking permits or local transportation can be surprisingly steep.

Creating a detailed budget can definitely help uncover these frequently enough-overlooked costs. It’s wise to gather all necessary information upfront and even consult with upperclassmen or academic advisors. Additionally, keep an eye on potential recurring charges such as:

| Expense Category | Estimated Monthly Cost |

|---|---|

| Groceries | $150 – $300 |

| Utilities (if applicable) | $50 – $100 |

| Dining Out | $50 – $200 |

| Entertainment | $30 – $100 |

By taking the time to assess these factors, you can better prepare for the financial demands of college and enable yourself to focus on your studies without the weight of unexpected expenses.

Smart Financial Planning: Creating a Comprehensive Budget

Developing a thorough budget is essential for navigating the myriad expenses associated with college. To start, identify both fixed costs—like tuition and room and board—and variable costs, which can include textbooks, supplies, and personal expenses. It’s important to be realistic and detailed in your calculations; consider factors such as travel expenses during holidays, potential fees associated with lab courses, and even the costs of dining out or participating in extracurricular activities. By making an exhaustive list and categorizing your anticipated expenses, you can achieve a clearer picture of your financial landscape.

Once you have a comprehensive snapshot, it’s crucial to prioritize these expenses and look for strategies to manage them effectively. Here are some tips for creating a solid budget:

- utilize financial aid resources: Research scholarships,grants,and work-study opportunities.

- Buy or rent used textbooks: Look for alternatives to purchasing new books, like library rentals or online resources.

- Monitor your spending: Keep track of daily expenses using budgeting apps or spreadsheets to stay on target.

| Expense Type | Estimated cost |

|---|---|

| Tuition | $10,000 |

| Room & Board | $8,000 |

| Textbooks & Supplies | $1,200 |

| Personal Expenses | $2,500 |

Leveraging Resources and Scholarships to Reduce Overall Expenses

Harnessing available resources and actively pursuing scholarships can significantly diminish the financial burden of college. Many students underestimate the wealth of opportunities that lie beyond federal aid. Start by visiting your school’s financial aid office, where you can discover local scholarships, grants, and work-study programs tailored to your specific needs. Additionally, consider leveraging the following resources:

- Community Organizations: Many local nonprofits and clubs offer scholarships based on merit or need.

- Employer Programs: Some companies provide scholarships or tuition reimbursement for employees or their children.

- Online Scholarship Databases: Websites such as Fastweb and Cappex can definitely help you find scholarships that fit your profile.

It’s equally essential to remember that scholarships often come with unique requirements. Stay organized by creating a table to track application deadlines and required materials. This proactive approach helps you maximize your chances of receiving financial aid and allows you to tailor your applications effectively.

| Scholarship Name | Deadline | Amount |

|---|---|---|

| Local Hero Scholarship | March 1 | $1,000 |

| Tech Future Scholarship | April 15 | $2,500 |

| Arts & Culture Grant | May 30 | $1,500 |

By tapping into these funding avenues and leveraging the skills and resources at your disposal, you can significantly slash your college expenses and alleviate the stress of financial commitments. Don’t shy away from applying for multiple scholarships, as every bit counts towards making your educational journey more affordable.

In Summary

navigating the often-overlooked costs of college requires both awareness and strategic planning. By taking the time to identify and understand these hidden expenses—from textbooks and supplies to transportation and living costs—you can effectively prepare for the financial challenges ahead. Implementing the smart strategies outlined in this article,such as creating a comprehensive budget,exploring financial aid options,and utilizing campus resources,can help you avoid surprises and ensure you allocate your funds wisely.

Remember, the journey through higher education is as much about financial literacy as it is about academic achievement. By proactively addressing these hidden costs, you’re not only setting yourself up for academic success but also fostering long-term financial well-being. So, as you embark on your college journey, keep these strategies in mind, stay informed, and embrace the opportunities that await. Your future self will thank you!