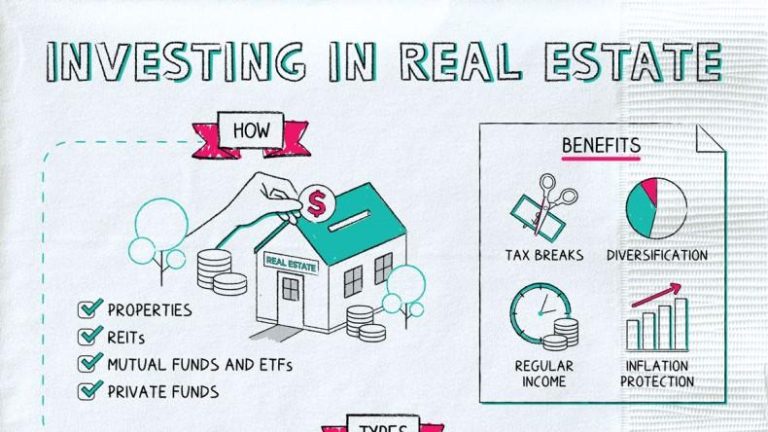

In a world where conventional savings accounts yield meager returns and stock market volatility can leave even seasoned investors feeling uneasy, real estate has emerged as a beacon of stability and opportunity. With the right strategy,investing in property can unlock significant financial growth and long-term wealth. However, navigating the complexities of real estate investment requires more then just a desire for profit; it demands knowledge, foresight, and a robust understanding of market dynamics.

This complete guide aims to equip aspiring investors with the essential tools and insights needed to embark on a accomplished real estate journey. From understanding market trends and financing options to mastering the art of property management, we will delve into the strategies that can turn your investment dreams into tangible results. Whether you’re a novice looking to purchase your first rental property or an experienced investor seeking to expand your portfolio, our insights will illuminate the path to unlocking profit in the exciting world of real estate. Let’s explore how you can make informed decisions, mitigate risks, and achieve the financial success you’ve always envisioned.

Table of Contents

- Identifying High-Potential Markets for Real Estate Investment

- Crafting a Winning Investment Strategy with Risk Management

- Maximizing Returns: Effective Property Management Techniques

- Leveraging Financing Options to Amplify Your Investment Gains

- The Conclusion

Identifying High-Potential Markets for Real Estate Investment

When delving into the realm of real estate investment,recognizing lucrative markets is essential to maximize returns. Begin by analyzing economic indicators that reflect the overall health of a region. Focus on areas with strong job growth, population influx, and infrastructure development. Such elements signal an increasing demand for housing, making them ripe for investment. Hear are some critical factors to consider while identifying promising locations:

- Employment Opportunities: Look for cities with flourishing industries or companies moving in.

- demographics: Pay attention to the age and income levels of residents. A growing population of young professionals can drive rental demand.

- Real Estate Trends: Analyze historical data to see how property values have changed over time in potential areas.

Moreover, consider local amenities and lifestyle factors that can attract residents. Access to good schools, parks, and entertainment options can enhance the appeal of a neighborhood. Additionally, you might want to create a comparison table to highlight key markets efficiently:

| City | avg.Property Value | job Growth Rate | Population Growth |

|---|---|---|---|

| Austin, TX | $550,000 | 3.3% | 2.5% |

| Raleigh, NC | $400,000 | 3.0% | 1.8% |

| Denver,CO | $600,000 | 4.1% | 1.9% |

This table showcases a snapshot of cities with high investment potential. By assessing such critical statistics alongside other personal metrics, you can effectively narrow down your focus to the most promising markets, thereby elevating your real estate investment strategy.

Crafting a Winning Investment Strategy with Risk Management

Developing a robust investment strategy is essential for anyone looking to thrive in the competitive realm of real estate. It involves a deep understanding of market dynamics, local trends, and your financial capacity.Key components to consider include:

- Market Research: Analyze property values, identify emerging neighborhoods, and examine historical price trends.

- Portfolio Diversification: consider spreading your investments across various property types or locations to mitigate risks.

- Financial Projections: Estimate potential returns and cash flows to determine the profitability of real estate ventures.

However, no strategy is complete without robust risk management practices. Identifying potential risks allows investors to take proactive steps to minimize their impact. focus on the following aspects:

- Due Diligence: Conduct thorough inspections and obtain property histories to avoid hidden pitfalls.

- Insurance and Contingencies: Safeguard your investments with adequate insurance and contingency plans for various scenarios.

- Regular Review: Continuously monitor your portfolio’s performance and be ready to adapt your strategy as market conditions evolve.

Maximizing Returns: Effective Property Management Techniques

Optimizing your property’s performance requires a blend of strategic planning and daily management practices. Regular maintainance should be at the forefront of your strategy, as it not onyl preserves the value of the property but also enhances tenant satisfaction. Implementing a preventive maintenance schedule can definitely help in mitigating costly repairs down the line. other essential techniques include:

- Tenant Screening: Selecting reliable tenants minimizes risks associated with rental defaults.

- Clear Dialog: Establishing effective channels for interaction fosters positive relationships with tenants.

- Market Analysis: Staying updated on local market trends ensures competitive pricing and better occupancy rates.

Moreover, leveraging technology can significantly streamline property management processes. Utilizing property management software can help automate tasks such as rent collection and maintenance requests,allowing you to focus on strategic growth.Below is a simple comparison of popular types of property management software to consider:

| Software | Key Features | Best For |

|---|---|---|

| Buildium | Tenant Portal, Maintenance Tracking | Multi-family Properties |

| AppFolio | Online Payments, Automated Marketing | Residential Management |

| propertyware | Custom Reporting, Vendor Management | Single-Family homes |

Leveraging Financing Options to Amplify Your Investment Gains

In the realm of real estate investment, understanding the array of financing options available to you can significantly enhance your potential returns. Using leverage wisely enables investors to acquire properties that may have otherwise been out of reach. By utilizing mortgages, home equity lines of credit, or even private loans, investors can effectively multiply their purchasing power. This approach not only allows for the acquisition of more valuable assets but can also increase the cash flow generated from rental income.Though, it’s crucial to carefully assess your risk tolerance and ensure that the returns on investment outweigh the cost of borrowing.

To maximize your investment gains, consider the following strategies when leveraging financing:

- Low-Interest Loans: Seek financing options with the lowest interest rates to minimize your overall cost.

- Property Thankfulness: focus on neighborhoods with strong growth potential,ensuring that borrowed funds contribute to appreciating assets.

- Cash Flow Management: Utilize the rental income generated from properties to cover loan payments and reinvest profits back into your portfolio.

| Financing Option | Benefits | Considerations |

|---|---|---|

| Conventional Mortgage | Lower interest rates | Down payment required |

| Home Equity Line of Credit | Flexible borrowing | Risk of foreclosure |

| Private Loans | Fast access to funds | Higher interest rates |

The Conclusion

As we bring this guide to a close, remember that unlocking profit in real estate investment is not just about numbers and market trends; it’s also about strategic planning, continuous education, and adaptability. The real estate landscape is ever-evolving, presenting a myriad of opportunities for those willing to take the plunge and remain informed.

Investing in real estate can be one of the most rewarding paths to financial independence, but it requires patience, diligence, and a clear understanding of your goals. Whether you’re looking to build a portfolio of rental properties, flip houses for profit, or explore commercial real estate opportunities, the principles outlined in this article serve as your foundation for success.

Embrace the journey with an open mind and a willingness to learn from both your successes and setbacks. Surround yourself with like-minded individuals, seek out mentorship, and never hesitate to ask questions. The world of real estate is vast and full of potential, and with the right strategy and a proactive attitude, you can unlock the doors to profitability.

Thank you for joining us on this journey to understand the nuances of real estate investment.We wish you all the best in your endeavors and look forward to seeing you succeed in this dynamic market. Keep investing in your knowledge—it will pay the best dividends of all!