In the ever-evolving landscape of investment opportunities, peer-to-peer (P2P) lending has emerged as an attractive option for both seasoned investors and newcomers alike. With the promise of higher returns compared to conventional investment vehicles, P2P lending platforms are revolutionizing the way individuals lend and borrow money. Though, like any investment, it comes with its own set of risks and challenges. In this complete guide, we’ll explore the key strategies for navigating the P2P lending ecosystem, providing you with the essential tools to unlock profit while mitigating risk. Whether you’re looking to diversify your portfolio, generate passive income, or support borrowers in your community, understanding the intricacies of P2P lending is vital for success. Join us as we delve into the mechanics of this dynamic industry and uncover how you can make informed decisions that align with your financial goals.

Table of Contents

- understanding Peer-to-Peer Lending Platforms and Their mechanisms

- Evaluating Risk and Reward: Key Metrics for Investors

- Strategies for Diversifying Your Peer-to-Peer Lending Portfolio

- Maximizing Returns: Best Practices for Successful lending Decisions

- Future Outlook

Understanding Peer-to-Peer Lending Platforms and Their Mechanisms

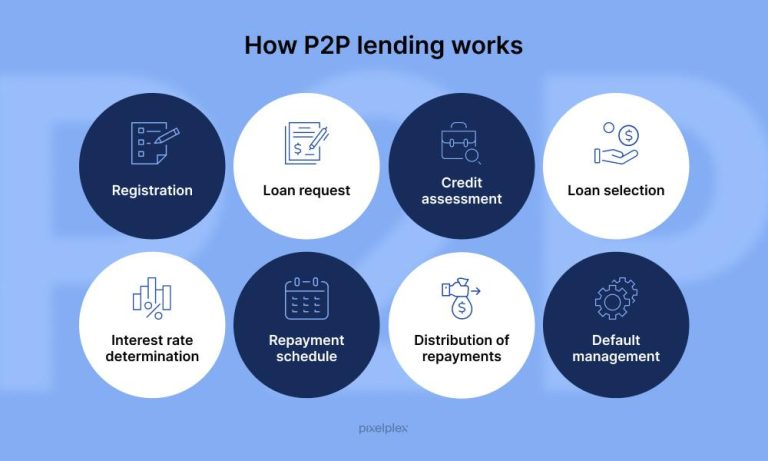

Peer-to-peer lending platforms have revolutionized how individuals and businesses access loans and invest in opportunities. By connecting borrowers directly with investors, these platforms eliminate traditional financial intermediaries like banks, resulting in more competitive interest rates and better returns for lenders. Borrowers can apply for various loan types, including personal loans, business financing, and educational loans, benefiting from a more streamlined application process and quicker funding times. Investors, conversely, can choose from a wide selection of loans to fund, allowing them to diversify their portfolios while potentially achieving higher yields compared to traditional investment options.

Understanding the mechanisms behind these platforms is key to leveraging them effectively. Most peer-to-peer lending sites operate on a marketplace model where investors create profiles, set their risk preferences, and bid on loans they wish to fund. The risk assessment process typically includes evaluating the borrower’s credit score and financial history. Many platforms provide detailed information on each loan listing, including interest rates, repayment terms, and borrower ratings. Here’s a simple overview of common platform mechanisms:

| Mechanism | Description |

|---|---|

| Loan Listings | Borrowers submit loan requests that investors can review. |

| Risk Assessment | Evaluation of the borrower’s creditworthiness by the platform. |

| Investor Bidding | Investors can choose and bid on loans that match their criteria. |

| Yield Distribution | Returns on investments are distributed based on repayment status. |

Evaluating Risk and Reward: Key Metrics for Investors

In the world of peer-to-peer lending, understanding the balance between risk and reward is crucial for making informed investment decisions. Key metrics that investors should evaluate include interest rates, default rates, and loan grades. Each of these factors can significantly impact the potential return on investment. As an example, loans with higher interest rates often come with increased default risks, while loans graded as lower risk may offer smaller returns but a steadier income stream. Assessing these metrics helps investors align their portfolio with their risk tolerance, ensuring a strategic approach to maximizing their financial gains.

To further aid in evaluating opportunities, consider analyzing historical performance data of loans within the platform. Key performance indicators (KPIs) such as annualized return, delinquency rates, and average loan term can provide insights into the lending platform’s reliability and the borrowers’ repayment behaviors. For a clearer comparison, the following table summarizes these essential metrics:

| Metric | Description | Ideal Value |

|---|---|---|

| Annualized Return | The expected yearly return on investment | 8%-12% |

| Default Rate | Percentage of loans that fail to be repaid | 2%-5% |

| Loan Grade | Borrowers rated based on creditworthiness | B or better |

By continuously monitoring these key metrics and adapting investment strategies accordingly, investors can navigate the complexities of peer-to-peer lending while effectively managing their risks. With a keen eye on performance and a well-researched approach, the potential for unlocking substantial profits in this growing marketplace is within reach.

strategies for Diversifying Your Peer-to-Peer Lending Portfolio

Diversifying your peer-to-peer lending portfolio is essential for mitigating risks and enhancing returns. To achieve this, consider allocating your investments across various borrower profiles, such as credit scores, loan purposes, and geographic locations. This approach not only reduces the impact of any single default but also captures opportunities across different market segments. Such as, investing in borrowers with varying credit ratings can yield different levels of return, allowing you to balance higher-risk loans with safer options.

Additionally, explore the potential of funding different loan types, such as personal loans, small business loans, and real estate loans. Each of these categories can behave differently depending on economic conditions, providing a buffer against market volatility. To effectively manage your allocations, consider the table below showcasing sample distribution strategies:

| Loan Type | Percentage Allocation |

|---|---|

| Personal Loans | 40% |

| Small Business Loans | 30% |

| Real Estate Loans | 20% |

| diversified Risk Portfolio | 10% |

Maximizing Returns: Best Practices for Successful Lending Decisions

When engaging in peer-to-peer lending, it is essential to establish a robust framework for evaluating potential borrowers. Start by conducting thorough credit assessments to ensure you are lending to individuals with a sound repayment history. utilize various metrics such as:

- Credit scores: A primary indicator of a borrower’s financial history.

- Debt-to-income ratio: Helps assess financial stability.

- employment status: A steady job often correlates with consistent repayments.

Additionally, diversifying your lending portfolio is crucial to minimizing risk while maximizing returns. Rather than bidding the entirety of your budget on a single loan, consider distributing your funds across multiple borrowers, which can lead to a more balanced exposure. Review the following strategies for effective diversification:

| Strategy | Description |

|---|---|

| Loan Amount Distribution | Invest small amounts into multiple loans instead of large sums into a few. |

| Sector Variation | Diverse borrowing purposes (e.g., personal, business, education) can hedge against sector-specific risks. |

| Geographic Diversification | Consider borrowers from different regions to mitigate local economic downturns. |

Future Outlook

navigating the world of peer-to-peer lending can open up a wealth of opportunities for savvy investors. By understanding the intricacies of this dynamic market, evaluating risk effectively, and employing strategic investment techniques, you can unlock the potential for substantial returns. Remember that, like any investment, success in peer-to-peer lending requires diligence, continual learning, and a keen awareness of market trends.

As you embark on your peer-to-peer lending journey, stay informed, diversify your portfolio, and build a network of insights from fellow investors. Armed with the right knowledge and approach, you can turn peer-to-peer lending into a powerful tool for financial growth.

So, whether you’re a seasoned investor or just starting, the world of peer-to-peer lending awaits you—ready to be explored, mastered, and, ultimately, profited from. Happy investing!