In the complex world of investing, where market volatility and economic fluctuations can frequently enough feel overwhelming, finding a reliable strategy to build wealth is paramount. One such strategy that has stood the test of time is dollar-cost averaging (DCA). This method allows investors to mitigate the risks associated with market timing and emotional decision-making by spreading out their investment purchases over regular intervals,nonetheless of market conditions. In this article, we’ll delve into the intricacies of dollar-cost averaging, exploring how it works, its numerous benefits, and why it could be the key to unlocking your investment potential. Whether you’re a seasoned investor or just embarking on your financial journey, understanding the mechanics of DCA can empower you to take control of your financial future with confidence.

Table of Contents

- Understanding Dollar-Cost Averaging and Its Benefits

- Implementing a Consistent Investment Strategy for Long-Term Growth

- Mitigating Market Volatility Through Dollar-Cost Averaging

- Key Considerations and Best Practices for Effective Investment execution

- Closing Remarks

Understanding Dollar-cost Averaging and Its Benefits

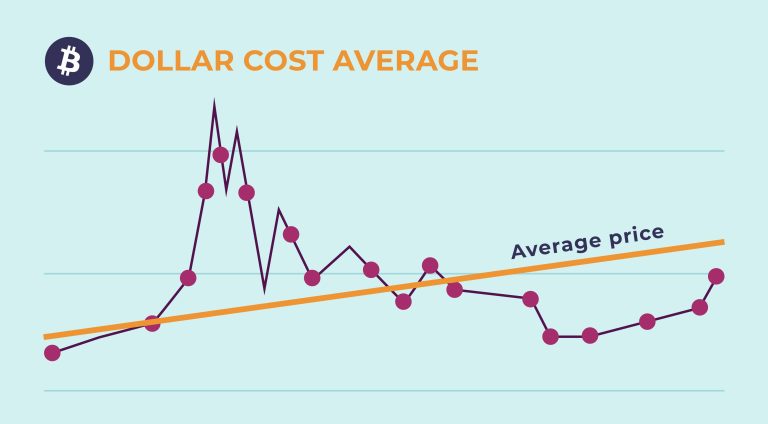

Dollar-cost averaging (DCA) is an investment strategy that involves consistently investing a fixed amount of money into an asset at regular intervals, regardless of its price.This approach minimizes the impact of market volatility, allowing investors to buy more shares when prices are low and fewer shares when prices are high. By spreading investments over time, DCA can help reduce the emotional stress of timing the market, enabling investors to maintain a disciplined approach to their portfolios.

The benefits of adopting a dollar-cost averaging strategy include:

- Reduced Risk: Lessens the impact of market fluctuations on total investment.

- Consistency: Encourages regular investing habits, which can build wealth over time.

- Lower emotional Stress: Helps investors avoid the pitfalls of panic selling or holding out for the perfect timing.

Consider the following table that highlights hypothetical investments over a six-month period using dollar-cost averaging:

| Month | Investment Amount | Price per Share | Shares Purchased |

|---|---|---|---|

| 1 | $100 | $10 | 10 |

| 2 | $100 | $8 | 12.5 |

| 3 | $100 | $12 | 8.33 |

| 4 | $100 | $11 | 9.09 |

| 5 | $100 | $9 | 11.11 |

| 6 | $100 | $7 | 14.29 |

Implementing a Consistent Investment Strategy for Long-Term Growth

Establishing a consistent investment strategy is crucial for maximizing returns and managing risk over the long haul. One effective approach is to adopt a dollar-cost averaging strategy. This method involves investing a fixed amount of money at regular intervals, regardless of market fluctuations. By doing so, investors can mitigate the impact of volatility and reduce the risk of making poor investment decisions based on short-term price movements. The key benefits of this method include:

- Reduced emotional stress: Regular investments help eliminate the temptation to time the market.

- Lower average costs: Investing consistently allows you to buy more shares when prices are low and fewer when prices are high.

- Disciplined investing: It encourages a habit of investing continuously, regardless of market conditions.

To illustrate the effectiveness of this strategy, consider a hypothetical investment scenario.If an investor commits to $500 per month into a diversified portfolio, their total investment over one year could be reflected in the following table:

| Month | Investment Amount | Price per Share | Shares Purchased |

|---|---|---|---|

| January | $500 | $50 | 10 |

| February | $500 | $40 | 12.5 |

| march | $500 | $25 | 20 |

| April | $500 | $30 | 16.67 |

| May | $500 | $35 | 14.29 |

This table demonstrates how consistent monthly investments accumulate shares independently of price without the stress of market timing. By the end of the year, the investor has built a significant portfolio that not only capitalizes on the market’s ups and downs but also fosters a more sustainable investment habit. Thus, adopting a disciplined approach like dollar-cost averaging can lead to ample long-term growth and financial security.

Mitigating Market Volatility Through Dollar-Cost Averaging

Market fluctuations can often induce anxiety in investors, causing them to react emotionally rather than strategically. This is where a disciplined approach, like dollar-cost averaging, comes into play. By regularly investing a fixed sum, regardless of market conditions, investors can reduce the impact of volatility on their portfolios. This method ensures that purchases happen at various price points, typically leading to a lower average cost per share over time. Rather than attempting to time the market—a near impractical feat—investors can focus on their long-term goals and let the power of compounding interest work in their favor.

Moreover, dollar-cost averaging cultivates a consistent investment habit. It makes the investment process straightforward and less stressful. By setting up automatic contributions, whether weekly, monthly, or quarterly, investors can align their buying strategy with market fluctuations naturally. This strategy not only simplifies tracking investments but also infuses discipline into one’s financial habits. Below is a simplified exmaple of how dollar-cost averaging can lower the average cost of investment over several months:

| Month | Investment Amount | Share Price | Shares Purchased |

|---|---|---|---|

| 1 | $100 | $10 | 10 |

| 2 | $100 | $8 | 12.5 |

| 3 | $100 | $12 | 8.33 |

| 4 | $100 | $9 | 11.11 |

By examining the example above, it is clear that consistent investments across various price points lead to a totaled investment amount of $400, resulting in 41.94 shares. Consequently, the average cost per share comes out to approximately $9.54. This could be substantially better than trying to invest a lump sum during a market peak and further illustrates how dollar-cost averaging empowers investors to navigate market turbulence with confidence.

Key Considerations and Best Practices for Effective Investment Execution

Executing investments effectively requires a nuanced approach that accounts for market dynamics and personal financial goals.Investors should focus on timing—not just in terms of market fluctuations, but also regarding when to allocate funds. One of the most effective strategies is dollar-cost averaging, which mitigates the risks associated with market volatility by spreading investments across various intervals. To maximize the benefits of this strategy, consider the following best practices:

- Consistent Contributions: Invest fixed amounts regularly, regardless of market conditions.

- Long-term Perspective: Maintain focus on long-term gains rather than short-term fluctuations.

- Diversification: Allocate investments across different assets to spread risk.

Moreover, monitoring performance is crucial to ensure that the investment strategy aligns with changing financial goals and market conditions. Regularly reviewing your portfolio allows you to make necessary adjustments, such as reallocating funds or modifying contribution amounts. To track and analyze your investments effectively, consider utilizing a portfolio management tool. Below is a simplistic overview of tracking elements:

| Element | Description |

|---|---|

| Time Period | duration for which performance is measured (e.g., monthly, quarterly). |

| Investment Amount | Capital allocated during each interval of dollar-cost averaging. |

| Market Value | Current value of investments relative to initial contributions. |

Closing Remarks

dollar-cost averaging stands as a powerful investment strategy that can definitely help you navigate the complexities of the financial markets with greater confidence and ease. By consistently investing a fixed amount at regular intervals, you not only mitigate the impact of market volatility but also cultivate a disciplined approach to wealth-building over time.

As we’ve explored, this strategy aligns well with the principles of long-term investing, allowing both novice and seasoned investors to take advantage of market fluctuations without the stress of timing the market. Remember, investment success isn’t measured by the timing of your entry, but rather by the consistency of your contributions and your unwavering commitment to staying the course.

So, whether you’re just starting your investment journey or looking to refine your existing strategy, consider integrating dollar-cost averaging into your plans. As with all forms of investing, knowledge is power—continuously educate yourself, stay informed, and adapt to changing market conditions. With thes principles in mind, you’re well on your way to unlocking the true potential of your investment portfolio and building a brighter financial future. Happy investing!