In today’s financial landscape, credit cards are more than just a tool for making purchases; they can be powerful instruments for enhancing your financial well-being. However, many cardholders are unaware of the full spectrum of benefits that their credit cards offer.From cashback rewards and travel perks to purchase protection and credit score building, a treasure trove of advantages awaits those who take the time to explore their options. In this comprehensive guide, we’ll demystify the frequently enough-overlooked features of credit cards and provide you with actionable insights to maximize your rewards. Whether you’re a seasoned credit card user or just starting your journey, our aim is to empower you with the knowledge to unlock valuable benefits and make the most of your financial tools. Let’s dive in and discover how you can turn your credit card into a valuable asset!

Table of Contents

- Understanding Credit Card Rewards and Offers

- Maximizing Your Earnings: Strategies for Effective Use

- Navigating fees and Interest Rates: What to Watch For

- Choosing the right Card for Your Lifestyle and Spending Habits

- Key Takeaways

Understanding Credit Card Rewards and Offers

Credit card rewards programs can offer significant benefits, but understanding how to navigate them is essential for maximizing your perks. Typically, these programs fall into a few categories, including cash back, points, and miles. Each type has its own advantages, making it crucial to choose a card that aligns with your spending habits. For example, cash back cards return a percentage of your spending directly as a cash rebate, while points and miles can perhaps be redeemed for travel, merchandise, or other experiences, frequently enough at a greater value than their cash equivalents.

To ensure you’re making the most of your credit card,consider the following strategies:

- Understand the Terms: Familiarize yourself with the rewards structure,including any ongoing promotions or bonus categories that can amplify your rewards.

- Keep Track of Expiration Dates: Many rewards programs have expiration dates for points or miles, so be proactive in using them before they vanish.

- Use for Everyday Purchases: Leverage your card for routine expenses to earn rewards without altering your spending patterns.

| Card Type | Benefit | Ideal For |

|---|---|---|

| Cash Back | % back on purchases | Everyday spending |

| Travel Points | Redeem for flights/hotels | Frequent travelers |

| Rewards Points | Versatile redemption options | Flexible spenders |

Maximizing Your Earnings: Strategies for Effective Use

To truly maximize your credit card earnings, it’s essential to understand the various benefit categories that different cards offer. Focus on utilizing your card for purchases that yield higher reward rates. Many credit cards provide extra points for specific categories, such as dining, grocery shopping, or travel expenses. by aligning your spending habits with the perks of your card, you can significantly boost your rewards.Additionally, consider utilizing limited-time promotions or sign-up bonuses. These offers often provide substantial point boosts if you meet certain spending thresholds within the initial months. Keeping an eye on these promotions can add significant value to your overall earnings.

Another effective strategy for maximizing benefits is to monitor your spending habits and adjust accordingly.Track where you spend the most and invest time in researching cards that reward those categories. For example, if you frequently travel, look for cards that offer travel insurance, no foreign transaction fees, and lounge access. Below is a simple comparison table of different types of cards and their key benefits to help guide your choices:

| Card Type | Key Benefits | Rewards Rate |

|---|---|---|

| Cashback | Flat-rate cashback on all purchases | 1.5% – 2% |

| Travel | Airline miles,hotel points,travel insurance | 2x – 5x points |

| Business | Office supply rewards,employee cards | 1% – 3% bonuses |

Navigating Fees and Interest rates: What to Watch For

- Annual Fee: Some cards charge a yearly fee for access to benefits.

- foreign Transaction Fee: Typically found with cards not designed for international use.

- late Payment Fee: Failing to pay on time can lead to hefty charges.

- Cash Advance Fee: Withdrawals can come with high-interest rates and additional fees.

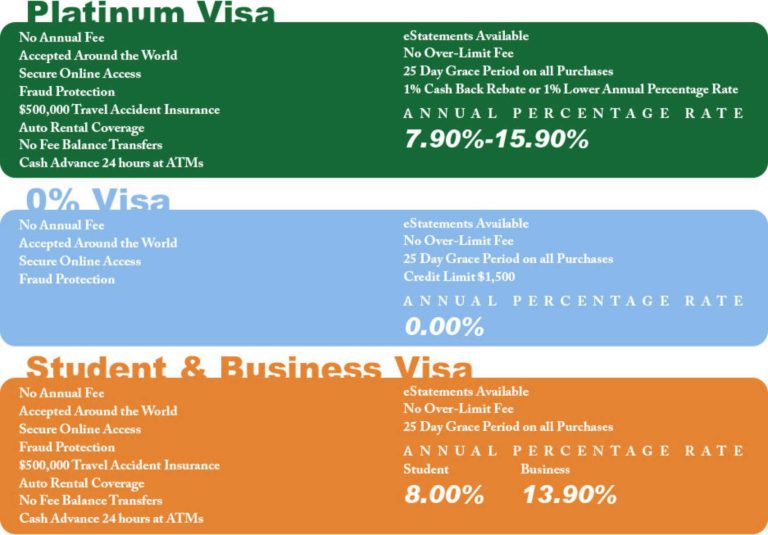

Interest rates play a critical role as well. The Annual Percentage Rate (APR) defines how much interest you’ll accrue on your outstanding balance, which can vary significantly between cards. Consider these factors:

- Introductory Rates: Some cards offer 0% APR for a limited time to encourage sign-ups.

- Variable vs. fixed rates: Be cautious of cards that have variable rates as they can fluctuate over time.

- Grace Periods: Knowing your card’s grace period can definitely help avoid interest on new purchases.

Choosing the Right card for Your Lifestyle and Spending Habits

When selecting a credit card, it’s essential to align your choice with your unique lifestyle and spending patterns. For frequent travelers, a card offering travel rewards or airline miles could enhance your adventures, while someone who dines out frequently enough may benefit more from cards that provide cashback on restaurant purchases. Consider your primary expenses and how you can maximize returns based on your everyday habits. Analyze your spending by categorizing your main costs such as:

- Groceries

- Dining

- Travel

- Gas

- online Shopping

Another factor to consider is the overall cost associated with the card. Sometimes, a card with a high annual fee can provide greater benefits than a no-fee card, but only if those rewards suit you. Compare the following elements to find the best fit:

| Feature | High-reward Card | No Annual Fee Card |

|---|---|---|

| Annual Fee | $95 | $0 |

| Rewards Rate | 5% on groceries | 1.5% on all purchases |

| Introductory Offer | 50,000 points | N/A |

By evaluating these factors, you can choose a card that not only complements your financial behavior but also rewards you for the spending you’re already doing.

key Takeaways

unlocking the full potential of your credit card benefits is not just about using your card—it’s about leveraging the array of rewards, protections, and services at your disposal. By understanding the intricacies of your credit card, you can maximize your rewards, save on travel, and even enhance your financial security. Remember to read the fine print, keep track of expiration dates, and make the most of the unique perks offered by your card issuer.

Armed with the knowledge from this guide, you’re well on your way to becoming a savvy credit card user. So go ahead—take control of your finances and unlock the benefits that can help you achieve your financial goals. Whether you’re an experienced cardholder or new to the world of credit, there’s always room for improvement and revelation.Happy spending, and may your credit card rewards bring you closer to your aspirations!