In today’s fast-paced digital world, convenience is king, and nowhere is this more evident than in the realm of personal finance. Enter online banking apps, the innovative tools revolutionizing how we manage our money. Gone are the days of standing in long lines at brick-and-mortar banks; now, everything from checking balances to transferring funds is just a tap away. This article delves into the myriad advantages of online banking apps, highlighting how they not only streamline financial transactions but also enhance security, provide valuable insights into spending habits, and offer round-the-clock access to banking services. Whether you’re a tech-savvy millennial or a seasoned professional, understanding the perks of these digital platforms is essential for navigating the modern financial landscape. Join us as we unlock the convenience of online banking and explore how it can transform your financial management experience.

Table of Contents

- Exploring the Seamless User Experience of Online Banking Apps

- Maximizing Security Features for Peace of Mind

- streamlining Financial Management with Innovative Tools

- Choosing the Right Online Banking App for Your Needs

- Key Takeaways

Exploring the Seamless User Experience of online Banking Apps

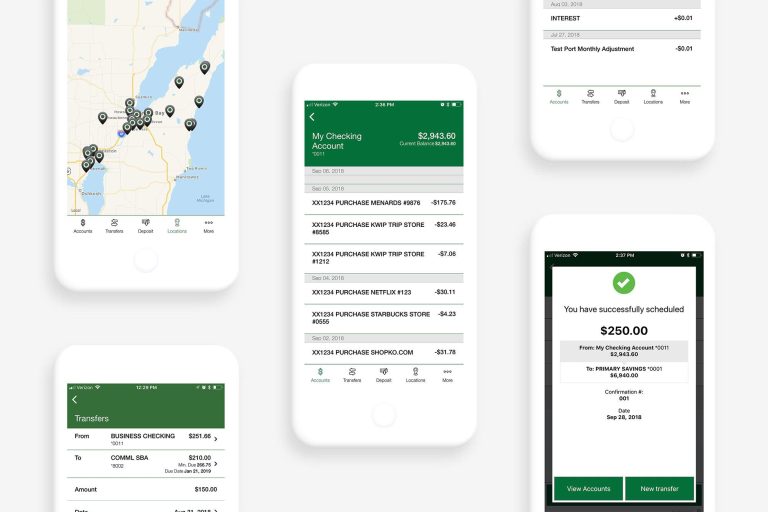

Online banking apps have revolutionized the way we handle our finances, creating a user experience that is not only streamlined but also tailored to meet the diverse needs of consumers.With intuitive interfaces and fast access to essential features, customers can manage their banking tasks efficiently from the comfort of their homes or on-the-go. Key features that enhance the overall experience include:

- 24/7 Access: Customers can conduct transactions anytime, ensuring they have control over their finances.

- User-Kind Design: Intuitive navigation minimizes learning curves, making banking accessible to all age groups.

- Instant Notifications: Customers receive real-time alerts about account activities, enhancing security and awareness.

Moreover, the integration of advanced security protocols and personalized services within these applications adds to their appeal.Features like biometric logins and fraud detection ensure a safe banking environment while offering peace of mind to users. To illustrate,hear are some typical user actions often executed seamlessly within mobile banking platforms:

| Action | Time Taken (Approx.) |

|---|---|

| Check account Balance | 5 seconds |

| Transfer Funds | 10 seconds |

| Pay Bills | 15 seconds |

As technology continues to evolve, we can expect even greater innovations from online banking apps, making them an indispensable tool for modern financial management.

Maximizing Security Features for Peace of Mind

In a world where digital transactions are a daily norm, ensuring the safety of your online banking activities has never been more crucial. Modern online banking apps come equipped with an array of advanced security features designed to protect your financial information.By leveraging these tools, users can feel empowered to manage their finances without fear. Key features often include:

- Multi-Factor Authentication (MFA): This additional layer of security requires not only a password but also something you have, such as a mobile device.

- Biometric Recognition: Fingerprint and facial recognition technologies provide quick yet secure access to your banking app.

- Real-Time Transaction Alerts: Stay informed with notifications for transactions, enabling you to quickly detect any unauthorized activities.

Moreover, many banking apps utilize strong encryption protocols to ensure that your data remains confidential while in transit. This level of encryption safeguards sensitive information from cyber threats,providing peace of mind as you conduct your daily transactions. Complementing these measures are:

| Security Feature | Benefit |

|---|---|

| Fraud Detection Algorithms | Identify and alert users to unusual banking patterns. |

| Secure Socket layer (SSL) | Protects data transmission by preventing eavesdropping. |

By incorporating these robust security measures, online banking apps strive to achieve the delicate balance between user convenience and data protection, transforming the banking experience into one that’s both accessible and secure.

Streamlining Financial Management with Innovative Tools

In today’s fast-paced world,the importance of efficient financial management cannot be overstated. Online banking apps have redefined how individuals and businesses manage their finances, offering a suite of features that enhance productivity and ease of use. With these innovative tools, users can enjoy the convenience of 24/7 access to their accounts, eliminating the need for time-consuming trips to the bank. Features such as instant account notifications, smart budgeting tools, and seamless fund transfers empower users to take control of their financial health like never before.

Moreover,online banking apps are designed with user experience in mind,making financial management not only easier but also more enjoyable.Key features include:

- Real-time transaction tracking: Instantly see where your money goes.

- Automated savings plans: Set aside funds for specific goals effortlessly.

- Secure digital payment options: Complete transactions safely with just a few taps.

With the integration of innovative technologies like AI and machine learning, these applications can also provide personalized insights, helping users make informed financial decisions. As more people embrace these digital solutions, it is indeed clear that the future of financial management is at their fingertips.

Choosing the Right Online Banking App for Your Needs

Selecting the right online banking app is crucial for enhancing your financial management experience. As you explore the options available, consider the following features that can considerably impact your banking efficiency:

- User Interface: A clean and intuitive design ensures easy navigation and quick access to essential features.

- Security Measures: Look for apps offering two-factor authentication and encryption to safeguard your financial data.

- Customer Support: Reliable customer service can resolve issues efficiently, enhancing user satisfaction.

- Integration with Other Services: Compatibility with budgeting tools and payment platforms can streamline your financial processes.

To further help you make an informed decision,consider creating a comparison chart of your top candidates. Here’s a sample table comparing key functionalities:

| Feature | App A | App B | App C |

|---|---|---|---|

| User Interface | Excellent | good | Average |

| Security Measures | High | Medium | Low |

| Customer Support | 24/7 | Business Hours | Limited |

| Integrations | Multiple | Few | None |

By considering these aspects, you can choose an online banking app that not only meets your immediate needs but also adapts to your evolving financial lifestyle.

Key Takeaways

the rise of online banking apps has transformed the way we manage our finances, offering unparalleled convenience and efficiency. From instant access to account balances to seamless payment solutions and robust security features, these digital tools empower users to take control of their financial lives like never before. As we continue to embrace technology in our daily routines, online banking apps stand out as essential allies in navigating the complexities of modern banking. Whether you’re a tech-savvy millennial or someone looking to simplify your financial management,these apps offer a smart solution tailored to meet your needs.

As you consider making the switch or optimizing your current banking experience, remember to explore the options available to you. Each app presents unique features that could further enhance your banking journey. So, take advantage of this digital era—unlock the convenience of online banking apps today and experience a new level of financial freedom.Your future self will thank you!