In today’s fast-paced world, the traditional 9-to-5 job is often no longer enough to meet financial goals, let alone provide a cozy lifestyle. As the cost of living continues to rise, more and more individuals are turning to side hustles as a viable solution for enhancing their income streams. Whether it’s turning a hobby into a profitable venture, freelancing in your area of expertise, or exploring new market trends, side hustles offer an array of benefits that extend beyond just financial gain. In this article, we will delve into the powerful advantages of embracing a side hustle, exploring how it can lead to greater financial security, personal growth, and even greater job satisfaction. Whether you’re looking to pay off debt, save for a dream vacation, or simply gain a newfound sense of purpose, unlocking the potential of a side hustle could be the key to achieving your goals. Join us as we explore the myriad ways a side hustle can transform your life, one project at a time.

Table of Contents

- Exploring Diverse Side Hustle Options to Maximize Earnings

- Building Essential Skills Through Your Side Hustle Experience

- Strategic Time Management: Balancing Your Side Hustle and Full-Time Job

- Financial Insights: How a Side Hustle Can enhance Your Financial Security

- Wrapping Up

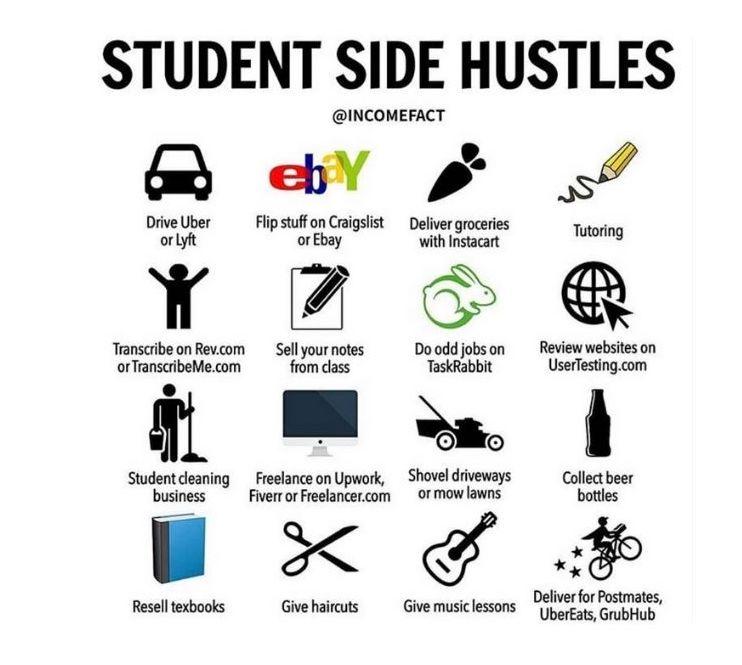

Exploring Diverse Side Hustle Options to Maximize Earnings

In today’s dynamic economy, tapping into diverse side hustle opportunities can considerably enhance your financial portfolio.With the rise of digital platforms and remote work, the options are vast and varied, catering to different skills and interests.Freelancing, as an example, allows individuals to leverage their expertise in writing, design, or programming by offering services on platforms like Upwork or Fiverr. Additionally, e-commerce provides a straightforward avenue for selling products through Etsy or Amazon, enabling creative entrepreneurs to monetize their hobbies. Other favorable options include online tutoring, where educators can share their knowledge and help students excel, or virtual assistance, which involves providing administrative support to businesses remotely.

Moreover, exploring the gig economy can also be quite lucrative. Consider the following popular side hustle ideas:

- Pet Sitting or Dog Walking: Ideal for animal lovers, this hustle offers flexibility and enjoyment.

- Delivery Services: Companies like uber Eats and DoorDash offer opportunities for rapid cash.

- Content Creation: Platforms like youtube and TikTok reward creativity and engagement.

- Online Courses or Memberships: If you have specialized knowledge, this can become a passive income stream.

To provide a clearer perspective, here’s a comparative table showcasing the earning potential and time commitment of various side hustles:

| side Hustle | Earning Potential (Monthly) | Time Commitment (Hours/Week) |

|---|---|---|

| Freelancing | $500 – $3,000 | 5 – 20 |

| Pet Sitting | $300 – $1,500 | 5 – 15 |

| Delivery Services | $200 – $1,000 | 10 – 30 |

| Online Tutoring | $400 – $2,000 | 5 – 15 |

Building Essential Skills Through Your Side Hustle Experience

Taking on a side hustle isn’t just an avenue for additional income; it’s a dynamic way to hone valuable skills that can significantly enhance your professional toolkit. Engaging in different tasks outside of your primary job pushes you to adapt and learn quickly.Through this process, you can develop essential competencies such as:

- Time Management: Juggling multiple responsibilities teaches you how to prioritize effectively.

- Negotiation Skills: you’ll gain experience in discussing payment and project terms, which is invaluable in any career.

- Networking: A side hustle exposes you to new communities, expanding your professional circle.

- Problem-Solving: Facing unexpected challenges requires innovative thinking and quick decision-making.

Moreover, the practical experience acquired through a side hustle often surpasses traditional learning environments. The hands-on application allows you to refine soft skills such as communication and adaptability while also enhancing your technical abilities related to your niche. Consider how pursuing a freelance graphic design gig could elevate your creative software proficiency in addition to enriching your portfolio. here’s how different side hustles align with essential skill-building:

| Side Hustle | Skills Developed |

|---|---|

| Freelance Writing | Research,Communication,Editing |

| Ride-sharing Driver | Customer Service,Navigation,Time Management |

| Online Tutoring | Teaching,Communication,Empathy |

| E-commerce store Owner | Marketing,Sales,Financial Planning |

Strategic Time Management: Balancing Your Side Hustle and Full-Time Job

Managing a side hustle while juggling a full-time job can feel overwhelming,but with the right time management strategies,you can achieve a healthy balance that fosters success in both areas. Start by prioritizing tasks using the Eisenhower Matrix to distinguish between what is urgent and important. Utilize a digital calendar to schedule blocks of time dedicated specifically to your side hustle; this way,you’re not only managing your hours but also ensuring that both your primary job and side project receive the attention they deserve. Incorporating techniques like the Pomodoro technique can enhance focus and efficiency, allowing you to accomplish more in shorter bursts of time.

Establishing clear boundaries is essential in maintaining productivity and keeping stress levels in check.Consider these strategies for effective management:

- Set specific Work Hours: allocate dedicated hours for your side hustle, making it part of your routine.

- Limit Distractions: Identify and minimize distractions during your focused work periods.

- Review and Adjust: Regularly assess your workload and adjust your schedule as necessary to avoid burnout.

By implementing these practices, you can cultivate a sustainable approach that not only promotes success in your side hustle but also enhances performance in your full-time role.Remember, consistency is key; over time, your commitment will yield both financial and personal fulfillment.

Financial insights: How a Side hustle Can Enhance Your Financial Security

Exploring side hustles can lead to meaningful improvements in your financial landscape. By creating additional income streams, you not only bolster your savings but also prepare yourself for unexpected expenses. These ventures can definitely help in diversifying your income sources, providing a buffer against economic uncertainties. With the right approach, side hustles can turn your passions into profit, enabling you to:

- Boost Savings: every extra dollar earned can go into an emergency fund or future investments.

- Pay Down Debt: Additional income can expedite the repayment of student loans, credit cards, or other debts.

- Invest in Yourself: Use side hustle earnings to further education or professional advancement opportunities.

Furthermore, side hustles can enhance your financial literacy and entrepreneurial skills. Engaging in these ventures encourages you to manage budgets, analyze market trends, and develop a business mindset. For clarity, here’s a simple comparison of common side hustles and their potential returns:

| Side Hustle | Average Monthly Earnings | Time Investment |

|---|---|---|

| Freelancing | $500 – $3,000 | 10 – 20 hours/week |

| Online Tutoring | $300 – $2,000 | 5 – 15 hours/week |

| E-commerce | $1,000 – $10,000 | 15 – 30 hours/week |

Wrapping up

embarking on a side hustle can be a transformative journey that not only boosts your income but also enriches your personal and professional life. The advantages are manifold, from financial stability to the cultivation of new skills and the opportunity to explore your passions. Whether you’re looking to pay off debt, save for a big purchase, or simply indulge in a new interest, a side hustle can be the key to unlocking extra income and expanding your horizons.

As you consider your options, remember that the right side hustle aligns with your interests, skills, and available time. Take the leap—invest in yourself and your future by starting a venture that excites you. The road might potentially be challenging at times, but the rewards of creativity, flexibility, and increased financial freedom are well worth the effort.So why wait? Start exploring your potential today and discover the powerful benefits that a side hustle can bring to your life. Your future self will thank you!