In today’s fast-paced world, financial needs can arise unexpectedly, leaving many individuals searching for rapid and reliable solutions. whether it’s for consolidating debt, covering medical expenses, or funding a dream vacation, personal loans have become an increasingly popular option for managing these costs. But with a plethora of options available, understanding how personal loans work and the role banks play in providing this financial assistance is crucial for making informed decisions. In this article, we will delve into the intricacies of personal loans, exploring how banks assess borrowers, the different types of personal loans available, and the key factors to consider before committing to a loan. By gaining a clear understanding of these aspects, you can navigate the lending landscape with confidence and choose the financial support that aligns with your needs and goals.

Table of Contents

- Understanding the Fundamentals of Personal Loans and Their Purpose

- Key Factors Banks Consider When Approving Personal Loan Applications

- The impact of Credit scores on Personal Loan Terms and Interest Rates

- Strategies for Choosing the Right Personal loan for Your Financial Needs

- The Conclusion

Understanding the fundamentals of Personal Loans and Their Purpose

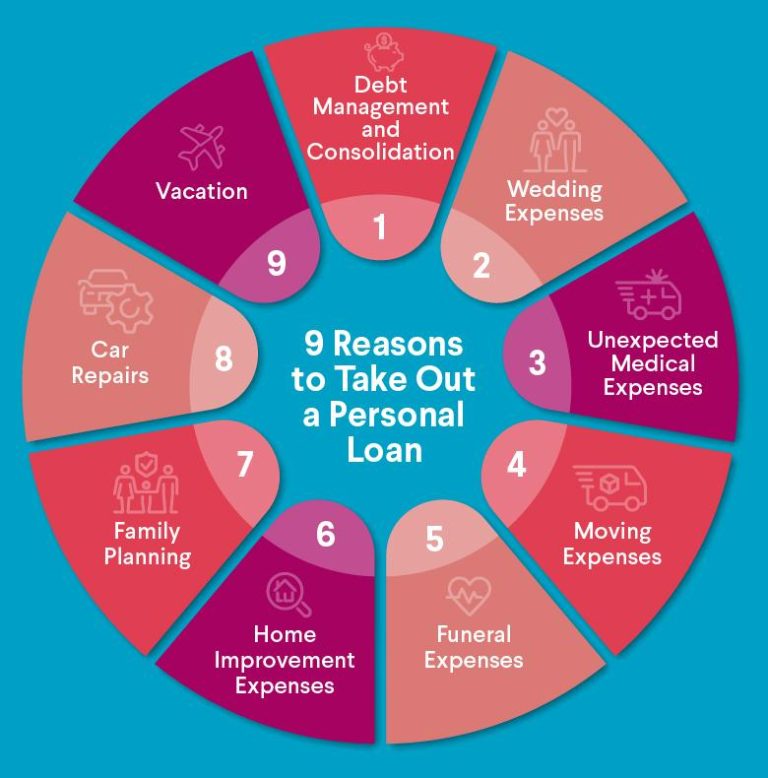

Personal loans are unsecured financial products that allow individuals to borrow money for various purposes, from consolidating debt to financing a home renovation or covering unexpected expenses. One of the key features of these loans is that they do not require collateral, making them accessible to a wide range of borrowers. The loan amount typically varies, and repayment terms can range from a few months to several years. Understanding the nuances of interest rates, fees, and repayment schedules is crucial, as they directly influence the total cost of borrowing.

When considering a personal loan, it’s essential to evaluate the potential benefits, which may include:

- Debt Consolidation: A personal loan can simplify finances by consolidating high-interest debts into a single payment.

- emergency Expenses: They provide immediate financial relief in crisis situations, such as medical emergencies or urgent home repairs.

- Flexible Use: Borrowers can use personal loans for various purposes, without having to justify the expense to the lender.

Though, potential borrowers should also be wary of the associated risks, such as accumulating debt and the impact on credit scores. To make an informed decision, individuals should compare different lenders, scrutinize terms, and assess their repayment capacity.

Key Factors Banks Consider When approving Personal Loan Applications

When evaluating personal loan applications, banks meticulously examine a variety of factors to determine the applicant’s creditworthiness and ability to repay the loan. One of the primary considerations is the applicant’s credit score, which serves as a numeric depiction of their financial history. A higher score typically translates to more favorable loan terms. Additionally, financial institutions analyze debt-to-income ratio, which compares an applicant’s total monthly debt payments to their gross monthly income. This ratio helps banks assess how much of an applicant’s income is already allocated to existing debt and how much is available for new obligations.

Moreover, banks also take into account the length of employment and stability of income. Consistent and secure employment indicates a reliable source of income,reducing the lender’s risk.It’s equally crucial for banks to review the loan amount requested in relation to the applicant’s financial situation, including their savings and other assets. A borrower with ample savings might potentially be viewed as less risky, as they have a financial cushion to rely on in case of unforeseen circumstances.

The Impact of Credit Scores on Personal Loan Terms and Interest Rates

Credit scores play a crucial role in determining the terms and interest rates associated with personal loans. When you apply for a loan, lenders evaluate your credit history to assess the level of risk they are taking on. A higher credit score typically indicates a strong track record of financial responsibility, which can lead to more favorable loan conditions. Individuals with good to excellent credit scores may enjoy benefits such as:

- Lower Interest Rates: Borrowers with higher credit scores are often offered reduced rates, leading to significant savings over time.

- Higher Loan Amounts: A strong score can qualify borrowers for larger sums, enabling them to meet more substantial financial needs.

- Flexible Repayment Terms: Lenders may provide more options for repayment duration, offering greater flexibility.

Conversely, those with lower credit scores may face steeper interest rates and less favorable terms. in extreme cases, borrowers may struggle to secure a personal loan altogether. Understanding the ramifications of your credit score is vital, as this numerical depiction of your creditworthiness can shape your financial future. The following table outlines the potential impact of varying credit score ranges on loan offers:

| credit Score Range | Typical Interest Rate | Loan Amount |

|---|---|---|

| 300 – 579 | 15% – 25% | Up to $10,000 |

| 580 – 669 | 10% – 15% | $10,000 – $25,000 |

| 670 – 739 | 6% – 10% | $25,000 – $50,000 |

| 740 – 850 | 3% – 6% | $50,000+ |

Strategies for Choosing the Right Personal Loan for Your Financial needs

Selecting a personal loan that aligns with your financial needs is essential for effective money management. Start by clearly defining your purpose for the loan, whether it’s for debt consolidation, home renovations, or unexpected expenses. Once you know the reason, consider the following factors:

- Loan Amount: Determine how much you really need.Borrowing too much can lead to needless debt.

- Interest Rates: Shop around for competitive rates.Fixed rates provide stability,while variable rates may fluctuate.

- Loan Terms: Evaluate the length of the loan, as shorter terms may have higher payments but lower overall interest.

- Fees and Charges: Look out for origination fees, prepayment penalties, and other hidden costs that can affect your loan’s total cost.

Beyond these initial considerations, also assess your credit score. A higher score can frequently enough secure better terms and lower rates. Here’s a simplified overview of how different credit ranges might influence loan options:

| Credit Score Range | Average Interest Rate | Loan Options |

|---|---|---|

| 300-579 | 15% – 36% | Limited options,primarily lenders specialized in bad credit |

| 580-669 | 10% – 20% | Many lenders available,moderate rates |

| 670-739 | 6% – 15% | Good range of options,competitive rates |

| 740 and above | 4% – 10% | Best rates and multiple loan options available |

The Conclusion

understanding personal loans and the role banks play in providing financial assistance is crucial for making informed decisions about your financial future. Whether you’re looking to consolidate debt, finance a major purchase, or cover unexpected expenses, personal loans can be a valuable resource. However, it’s essential to assess your needs, do thorough research, and consider the terms and conditions associated with each loan option available to you.

Take the time to compare interest rates,repayment periods,and fees across different financial institutions to ensure you find a solution that best fits your situation. Remember that while a personal loan can offer a pathway to financial relief, responsible borrowing is key to maintaining your financial health.

As you navigate this journey,don’t hesitate to reach out for professional advice or utilize online resources that can further enhance your understanding of personal loans. By equipping yourself with knowledge and insights, you’ll be better prepared to make sound financial decisions that pave the way for stability and growth. Thank you for joining us on this exploration of personal loans – we hope you feel empowered to take your next step toward financial success!