Navigating the world of credit cards can often feel like walking through a maze—one misstep and you could find yourself lost in fees and interest charges.One of the moast crucial yet frequently enough misunderstood concepts in credit card usage is the grace period. What exactly is a grace period? How does it affect your payments, interest rates, and overall financial health? In this comprehensive guide, we’ll demystify credit card grace periods, exploring how they work, their benefits, and the best strategies for taking full advantage of them. Whether you’re a seasoned credit card user or just starting your financial journey, understanding grace periods can empower you to make informed decisions and manage your credit effectively. Join us as we break down everything you need to know about this critically important component of responsible credit card use.

Table of Contents

- Exploring the Basics of Credit Card Grace Periods

- The Importance of Timing: How Grace Periods Impact Your payments

- Navigating the Fine Print: Key Terms and Conditions to Watch For

- Maximizing Your Benefits: Strategies for Effective Use of Grace Periods

- Closing Remarks

exploring the Basics of Credit Card Grace Periods

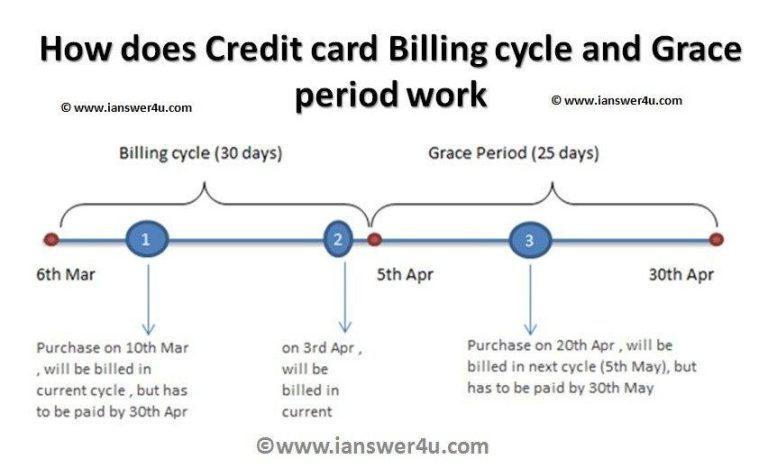

The concept of a grace period is crucial for anyone using a credit card, as it determines how long you can avoid interest charges on new purchases. Typically, this period lasts between 21 to 25 days after the end of your billing cycle.To ensure you benefit from this timeframe, consider the following aspects:

- Payment Timing: Paying your balance in full by the due date is essential to taking advantage of the grace period.

- Billing Cycle awareness: familiarize yourself with your billing cycle start and end dates to effectively manage your payments.

- New purchases: Understand that grace periods typically apply only to new purchases if your previous balance is paid in full.

Moreover, it’s critically important to note that not all transactions qualify for the grace period. Balances carried over from a previous statement promptly incur interest, negating any grace periods. Here’s a fast comparison of how various transaction types interact with grace periods:

| Transaction Type | Interest Charges |

|---|---|

| New Purchases (Paid in Full) | No Interest During Grace Period |

| New Purchases (Not Paid in Full) | Interest Accrues Immediately |

| Cash Advances | Interest Accrues Immediately |

| Balance transfers | Interest May Apply Depending on Terms |

The Importance of Timing: How Grace Periods Impact Your Payments

The grace period for credit card payments serves as a crucial buffer that many cardholders may overlook. During this time, typically lasting between 21 to 25 days after the billing cycle closes, you can pay off your balance without incurring interest charges. This period not only fosters financial discipline but also allows you to manage your cash flow more effectively. to maximize the benefits of this timeframe, consider these strategies:

- pay off your full balance: Make it a habit to clear your balance within the grace period to take full advantage of interest-free financing.

- Budget your expenses: Plan your expenses to align with your billing cycle, ensuring you have funds available to cover your purchases before the due date.

- Track due dates: Mark your calendar with payment due dates and set reminders to avoid late payments.

Understanding how grace periods work can substantially impact your overall financial health. When you miss a payment or carry a balance, you not only incur interest charges but potentially damage your credit score. Additionally, the risk of late fees can add up quickly. Here’s a comparison of how payment timing affects charges:

| Scenario | Payment Timing | Possible Charges |

|---|---|---|

| On-time Full Payment | Within Grace Period | No Interest |

| Partial Payment | After Grace Period | interest on Remaining Balance |

| Missed Payment | After Due Date | Late Fees & Interest |

Navigating the Fine print: Key Terms and Conditions to Watch For

Understanding the nuances of credit card agreements is vital for effective financial management. When reviewing a credit cardS terms and conditions, pay particular attention to the grace period details. This is the time frame during which you can pay off your balance without incurring interest. It’s essential to note the duration of this period, as it varies by issuer and can significantly affect your overall cost. Additionally, watch for the cut-off date for transactions that fall within this grace period to avoid unexpected interest charges on your next statement.

It’s also important to be aware of other related terms, including minimum payment requirements, and how they work in conjunction with the grace period. Many credit cards may offer enticing grace periods, but they frequently enough come with certain conditions that could lead to financial repercussions. Look out for the following key points:

- Billing Cycle Duration: Understand the length of your billing cycle to maximize your grace period.

- Transaction Timing: Be mindful of when purchases are made in relation to your statement cut-off date.

- Balance Transfers: Check if these are included in your grace period; some may start accruing interest immediately.

Maximizing Your Benefits: Strategies for Effective Use of Grace Periods

To fully leverage the benefits of grace periods, it is indeed essential to stay organized and proactive. First, consider setting up a payment reminder system. This could be through calendar alerts, task management apps, or straightforward sticky notes in your workspace. By keeping payment due dates front and center, you avoid late payments and ensure you can take advantage of the interest-free period. Additionally, make it a habit to review your statements monthly. This not only helps in tracking your spending but also allows you to see how close you are to the grace period cutoff date.

Another effective strategy involves maximizing your available credit wisely. When you know a significant expense is coming up, plan your charges accordingly. Aim to make purchases within the same billing cycle as your due date to benefit from the grace period. Utilize the following tactics to stay financially savvy:

- Pay your balance in full: Avoid interest charges entirely by clearing your total debt before the grace period ends.

- Know your cycle: Familiarize yourself with your billing cycle dates and plan purchases to align with them.

- Use rewards wisely: If your card offers rewards, try to maximize them within the grace period.

Closing Remarks

understanding credit card grace periods is crucial for managing your finances effectively. By knowing how these periods work, you can make informed decisions that help you avoid needless interest charges and optimize your credit usage. Always remember to review your credit card terms and conditions, as they can vary significantly between issuers. Whether you’re a beginner navigating your first credit card or a seasoned user looking to enhance your financial strategy, leveraging the grace period to your advantage can lead to more efficient budgeting and a healthier credit score.

We hope this complete guide has shed some light on the nuances of grace periods and empowered you to take control of your credit card management. For more tips on managing your financial wellness, be sure to check out our other articles, and feel free to share your experiences or questions in the comments below! Your journey to financial savvy starts with informed choices, and we’re here to support you every step of the way. Thank you for reading!