In today’s fast-paced financial landscape, being able to decipher your bank statement is an essential skill that goes beyond simply tracking your spending. Whether you’re an individual trying to manage your personal finances or a business owner overseeing company expenditures,understanding bank statements can empower you to make informed financial decisions. This professional guide aims to break down the complexities of bank statements, highlighting key components, common terms, and actionable insights to enhance your financial literacy. by mastering the art of reading your bank statement,you can not only keep better tabs on your financial health but also identify discrepancies,optimize your budgeting strategy,and pave the way for more strategic financial planning. Join us as we delve into the intricacies of your bank statement and unlock the valuable facts it holds.

Table of Contents

- Key Components of Bank Statements Explained

- Decoding Transaction Details for Better Financial Management

- Identifying Fees and Charges: What You Need to Know

- Tips for Using Your Bank statement to Create a Budget

- In Retrospect

Key Components of Bank Statements explained

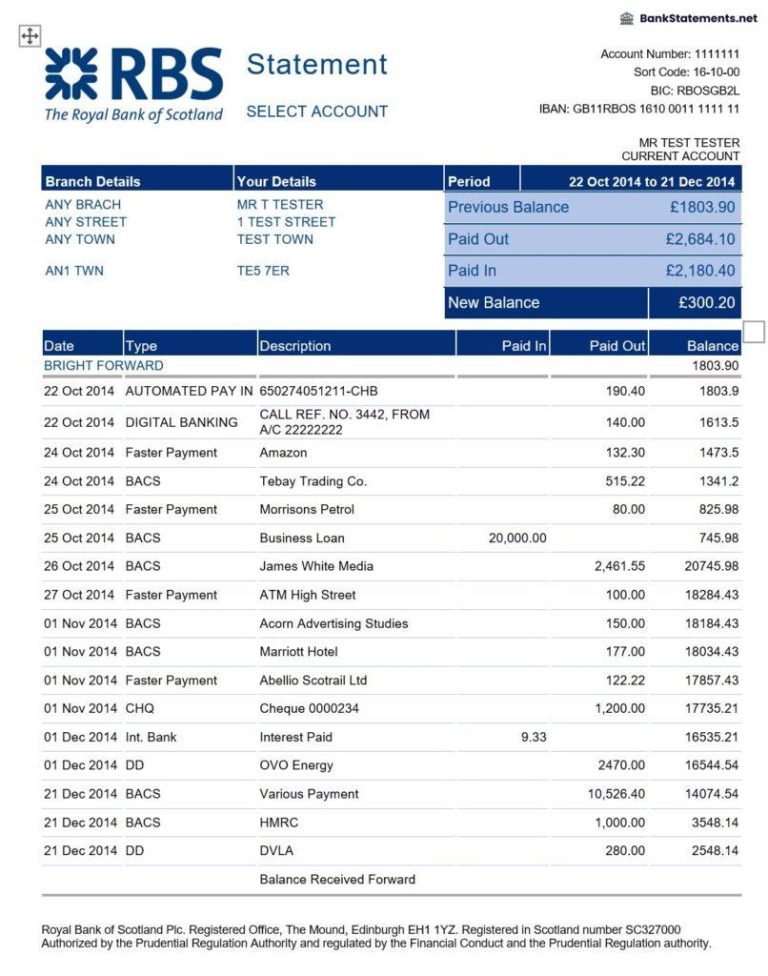

Bank statements provide a comprehensive overview of your financial activity for a specified period, typically monthly. A typical statement includes several key components that are essential for understanding your account status and transaction history. These components consist of:

- Account Holder Information: This section lists your name, account number, and address. It ensures the document is accurately associated with you.

- Statement Period: It indicates the dates for which the transactions are reported, usually from the beginning to the end of the month.

- Transaction Details: This is a detailed list of all transactions during the period, including deposits, withdrawals, and fees, often accompanied by transaction dates.

- Balance Information: Here, you’ll find your starting balance, total debits, total credits, and the closing balance, offering insight into your overall financial position.

In addition to the above, some bank statements include a summary that can help you spot trends in your spending. To clarify the information presented, the transactions section may be displayed in a tabular format, making it easier to scan for specific entries. A typical format might look like this:

| Date | Description | Debit | Credit | Balance |

|---|---|---|---|---|

| 2023-10-01 | Paycheck Deposit | $0.00 | $2,500.00 | $2,500.00 |

| 2023-10-05 | ATM Withdrawal | $150.00 | $0.00 | $2,350.00 |

| 2023-10-10 | Monthly Subscription | $15.00 | $0.00 | $2,335.00 |

decoding Transaction Details for better Financial Management

Understanding the nuances of your bank statement is key to effective financial management. Each transaction line holds notable information that, when decoded, can reveal spending patterns, alert you to fees, and highlight areas for potential savings. Here are essential components to review:

- Date: When the transaction took place, helping you track spending over specific periods.

- Description: The merchant or service provider, which aids in identifying recurring charges.

- Amount: The monetary value of each transaction, allowing for easy comparison against your budget.

- balance: Your account’s status after each transaction, giving a snapshot of your financial health.

Another useful practice is categorizing your transactions into distinct areas of spending, such as groceries, utilities, and entertainment. Creating a simple table to visualize these categories can enhance your understanding:

| Category | Monthly Total |

|---|---|

| Groceries | $450 |

| Utilities | $200 |

| Entertainment | $150 |

| Transportation | $100 |

This approach not only simplifies the analysis of your spending but also empowers you to make informed decisions to optimize your finances in the long run.

Identifying Fees and charges: What You Need to Know

When analyzing your bank statement, it’s crucial to pinpoint any fees and charges that might potentially be affecting your finances. These costs can often accumulate unnoticed, leading to a significant dent in your budget. Start by examining transactions for entries labeled as service fees, ATM usage charges, or overdraft penalties. Pay special attention to monthly maintenance fees, which are commonly charged by many banks, especially if your account balance falls below a specific threshold. By identifying these charges, you can take proactive steps to reduce or eliminate them, such as switching to a different account type or negotiating with your bank.

below are common types of fees you might encounter:

- ATM Fees: Costs incurred when using non-network ATMs.

- Overdraft Fees: Fees applied when you spend more than your balance.

- Monthly Maintenance Fees: charges for account upkeep or minimal balances.

- Wire Transfer Fees: Costs associated with moving money between banks.

| Fee Type | Typical Amount |

|---|---|

| ATM Fee | $2.50 – $5.00 |

| Overdraft Fee | $30.00 – $35.00 |

| Monthly Maintenance Fee | $10.00 – $20.00 |

| Wire Transfer fee | $15.00 – $30.00 |

Understanding these fees can empower you to make more informed financial decisions. If you notice a charge you don’t recognize or believe is erroneous, don’t hesitate to contact your bank’s customer service for clarification. They can provide the rationale for the fee and may offer solutions to prevent similar charges in the future.

Tips for Using Your Bank Statement to create a Budget

Analyzing your bank statement is a practical way to gain insights into your spending habits, and using this information to create a budget can set you on the path to financial wellness.Start by identifying your income sources listed in your statement. This can definitely help you establish a clear understanding of your total monthly cash flow.Next, look for recurring expenses such as rent, utilities, and subscriptions. Categorizing these costs will provide clarity on non-negotiable expenditures as well as areas where you might reduce spending.

Onc you have sorted your income and fixed expenses, turn your attention to discretionary spending. Highlight areas where you might potentially be overspending, such as dining out or entertainment. This is where small adjustments can lead to significant savings. Consider creating a monthly budget template to outline your spending limits based on your analysis. Here’s a simple table that might help you visualize your categories:

| Category | Budgeted Amount | Actual Spending |

|---|---|---|

| Income | $3,000 | $3,000 |

| Fixed Expenses | $1,500 | $1,450 |

| Discretionary Spending | $500 | $700 |

| Savings | $800 | $850 |

In Retrospect

mastering the art of reading and understanding your bank statement is an invaluable skill that can greatly enhance your financial literacy and overall money management. By familiarizing yourself with the various components of your statement—from transaction details to account balances—you empower yourself to make informed decisions and spot any discrepancies with ease.

As you continue to refine your understanding of financial documents, remember that diligence and awareness are key to maintaining a healthy financial landscape. Regularly reviewing your bank statements not only helps you stay in-tune with your spending habits but also aids in budgeting, preparing for future expenses, and ultimately achieving your financial goals.

We hope this professional guide has provided you with the insights needed to navigate your bank statements confidently. If you have any questions or need further clarification, feel free to reach out in the comments below. Happy banking!