Navigating the world of college finances can often feel like traversing a maze, with unexpected expenses lurking around every corner.While tuition may dominate the conversation about college costs,the reality is that students and families are often caught off guard by a host of hidden fees and expenses that can add thousands of dollars to the final price tag. From mandatory activity fees to textbooks and supplies, understanding these additional costs is crucial for effective budgeting and financial planning. In this article, we’ll explore essential prep strategies to uncover these hidden expenses, empowering you to make informed decisions about your college education and helping you to avoid the financial pitfalls many face. Whether you’re a prospective student, a current college attendee, or a concerned parent, arming yourself with this knowlege is the first step towards achieving a balanced budget and a triumphant college experience. Join us as we delve into the intricacies of hidden college costs and share actionable insights to prepare you for a financially savvy academic journey.

Table of Contents

- Understanding the True Cost of College beyond Tuition

- Identifying Common Hidden Fees and Expenses

- Strategies for effective Budgeting and Financial Planning

- Leveraging Resources and tools for Cost Reduction

- wrapping Up

Understanding the true Cost of College Beyond Tuition

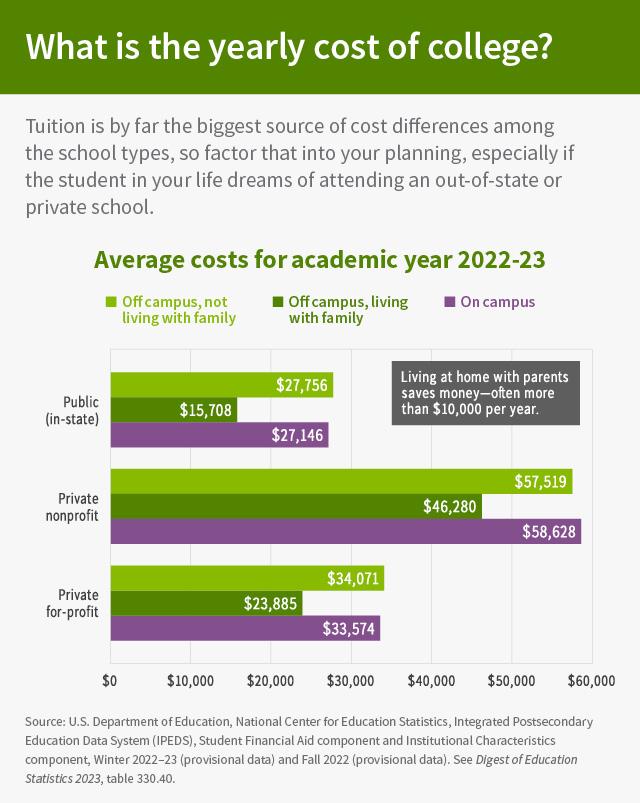

When planning for college, many students and families focus primarily on tuition—often overlooking a host of unavoidable expenses that can add up substantially over time. room and board, textbooks, and supplies are just the start. In reality, students might face additional costs such as transportation, personal expenses, and technology fees. Understanding these hidden expenses can be crucial for effective budgeting and ensuring a smoother college experience.

To give you a clearer picture, here’s a breakdown of potential costs beyond tuition that students might encounter:

| expense Category | Average Cost (per year) |

|---|---|

| Room and Board | $10,000 – $15,000 |

| Textbooks and Supplies | $500 – $1,200 |

| Transportation | $600 – $1,000 |

| Personal Expenses | $1,000 – $2,000 |

| Technology Fees | $200 – $600 |

By acknowledging these costs early on, students can devise comprehensive strategies to minimize expense-related stress. Consider options such as buying used textbooks, utilizing campus transportation, or applying for financial aid targeted at covering these expenses. Not only can smart financial planning help students avoid needless debt,but it can also enable them to focus on academics and fully enjoy the college experience without worrying about hidden financial burdens.

Identifying Common Hidden Fees and Expenses

As college expenses continue to rise, it’s crucial to be vigilant about hidden fees that can significantly impact your budget. Many institutions impose charges that are not explicitly listed in their tuition fees, leading to unexpected financial strain. Common areas where you might encounter these fees include:

- Student Activity Fees: These are often mandatory and cover various campus activities and amenities,which can add up quickly.

- Lab and course Fees: Certain courses,notably science or art classes,may have additional fees for materials and equipment.

- Technology Fees: Many schools impose fees for maintaining technology resources, including internet services and software.

- Parking Permits: If you plan to drive to campus, be aware that parking permits often come with a hefty price tag.

- Document Fees: Charges for transcripts, diplomas, and other crucial documents can surprise many students.

To navigate these potential costs effectively, it’s essential to conduct thorough research before committing to a college. Utilize online resources or forums where current students share their experiences and insights on hidden fees. You can also request detailed breakdowns of costs directly from the financial aid office. Consider the following table to illustrate how these fees can stack up:

| Fee Type | Estimated Cost |

|---|---|

| Student Activity Fee | $100 – $400/year |

| Lab and Course Fees | $50 – $300/semester |

| Technology Fee | $100 – $200/year |

| Parking permit | $50 – $600/year |

| Document Fees | $5 – $50/request |

strategies for Effective Budgeting and Financial Planning

Understanding the full scope of college expenses goes beyond just tuition fees. To create a realistic budget, it’s essential to consider additional costs that can quickly add up. Start by itemizing all potential expenses. This includes not only tuition and room and board but also books, supplies, transportation, and personal expenses such as food and entertainment. By listing these costs, students can gauge their overall financial need and identify any funding gaps they may need to cover.Additionally, using tools like budgeting apps or spreadsheets can help keep all financial information in one place, making adjustments easier as costs fluctuate.

Another effective tactic is to actively seek out scholarships,grants,and work-study opportunities. This not only alleviates financial strain but also fosters a proactive approach to managing educational costs. Create a comprehensive list of available resources, complete with deadlines and requirements, to streamline the application process.Moreover, it’s wise to establish a monthly savings plan to build a financial cushion. A simple approach is to allocate a set percentage of any income—whether from a part-time job, family support, or financial aid—directly into a savings account. This strategy can contribute to long-term financial stability and prepare students for the unexpected costs that often arise during their college years.

Leveraging Resources and Tools for Cost Reduction

To effectively manage college expenses, tapping into available resources and tools can significantly ease financial burdens. Start by exploring scholarship opportunities through your school’s financial aid office and reputable online platforms. Resources such as Fastweb, Cappex, and College Board offer databases of scholarships tailored to your specific criteria.Additionally, don’t overlook your community; local organizations and businesses frequently enough have scholarships that are less competitive but equally beneficial. Combining multiple funding opportunities helps create a more manageable cost structure, transforming the daunting tuition into a series of more digestible payments.

Another essential strategy is to leverage budgeting tools and apps that allow you to track spending and identify saving areas. Utilize platforms like Mint or GoodBudget to categorize expenses, ensuring that you remain aware of where your money is going. moreover, consider engaging with student discount programs, such as Student beans, which offer exclusive deals on everything from textbooks to technology.Below is a simple reference table summarizing key resources:

| Resource Type | Examples | Purpose |

|---|---|---|

| Scholarship Platforms | Fastweb, Cappex, College Board | Find scholarships |

| Budgeting Apps | Mint, GoodBudget | Track expenses |

| Student Discounts | Student beans | Exclusive savings |

Wrapping Up

navigating the labyrinth of college expenses can be daunting, but with the right knowledge and proactive strategies, you can uncover the hidden costs that often catch many families off guard. By taking the initiative to explore all potential fees, from textbooks to technology, and by utilizing budgeting tools and resources available to you, you can better prepare for the financial realities of higher education. Remember, the journey to a college degree is not just about tuition; it’s about understanding the complete picture and making informed decisions that will set you up for success. As you embark on this exciting chapter, stay vigilant, ask questions, and plan ahead—your financial future will thank you! Let’s approach this endeavor wisely and make the most of every resource available. Happy prepping!