In today’s fast-paced world, keeping your finances in check can often feel like a daunting task. With countless expenses piling up, unexpected bills looming on the horizon, and ever-evolving financial goals, it’s no wonder many people feel overwhelmed. Fortunately, technology has come to the rescue in the form of budgeting apps. These powerful tools are designed to help you take control of your finances, offering everything from expense tracking to goal setting, all at the tips of your fingers. In this article, we will explore some of the top budgeting apps available on the market today, highlighting thier key features and benefits. Whether you’re a seasoned budgeter looking to refine your approach or a novice ready to embark on a new financial journey, this guide will help you find the right app to meet your needs and achieve financial stability. Let’s dive in and empower you to take command of your financial future!

Table of Contents

- Understanding Key Features of Top Budgeting Apps

- Comparing User Friendliness and Accessibility

- Evaluating Integrations with Banking and Financial Tools

- Maximizing Your Savings with Smart Budgeting Strategies

- Closing Remarks

Understanding Key Features of Top Budgeting Apps

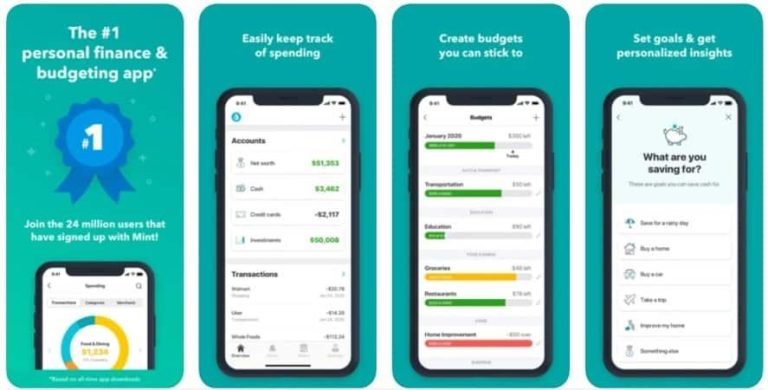

Exploring the essential features of budgeting apps can illuminate how they empower users to manage their finances effectively. User-friendly interfaces are paramount, ensuring that tracking expenses and income is intuitive, even for those new to budgeting. Additionally, many apps offer real-time syncing with bank accounts, allowing users to view their current financial status without manual entry. Integration with various financial institutions provides a seamless experience while saving time. Other critical features include goal setting capabilities, enabling users to establish savings targets for vacations, emergencies, or debt repayment, making the budgeting process more dynamic and goal-oriented.

Security and privacy are also significant concerns for individuals using budgeting apps. Most top applications implement bank-level encryption to safeguard user data, offering peace of mind while managing finances. Moreover, many apps provide customizable categories, allowing users to tailor their budgets according to personal spending habits and preferences. This versatility encourages adherence to budgets over time. To further assist users,some apps incorporate financial reports and analytics,providing insights into spending patterns and suggesting areas for advancement,making budgeting not just a task but a pathway to financial wellness.

Comparing User Friendliness and Accessibility

When exploring budgeting apps, user friendliness plays a pivotal role in how effectively individuals can manage their finances. an intuitive interface allows users to navigate through features effortlessly, enabling them to quickly input expenses, track their spending, and monitor their savings. apps that incorporate friendly design principles, such as clear icons, simple menus, and customizable dashboards, often receive higher satisfaction ratings.Additionally, helpful tutorials and responsive customer support can significantly enhance the initial user experience, making it easier for newcomers to adapt to the world of budgeting.

Conversely, accessibility ensures that budgeting tools cater to a diverse audience, including those with disabilities. This can include features such as voice commands for navigation, screen reader compatibility, and high-contrast color schemes for better visibility. More advanced apps may even offer adjustable text sizes and option input methods, ensuring that users of all abilities can effectively manage their finances without needless barriers.Prioritizing both user friendliness and accessibility not only broadens an app’s appeal but also fosters an inclusive habitat for financial management.

Evaluating Integrations with Banking and Financial Tools

When choosing a budgeting app, it’s imperative to evaluate how well it integrates with your banking and financial tools. Seamless integration can simplify tracking your finances by allowing automatic synchronization of your transactions, which saves time and minimizes errors. Look for apps that connect effortlessly with your bank accounts, credit cards, and investment platforms. Some crucial factors to consider include:

- Security Measures: Ensure the app uses bank-level encryption to protect your financial data.

- Compatibility: Check if the app supports the various financial institutions you use.

- Real-Time Updates: Apps that provide real-time syncing help you stay informed about your cash flow.

Additionally, the effectiveness of an app’s integration often hinges on user-friendly features that enhance financial management.Consider options that not only offer budgeting tools but also deeper analytical insights, enabling a comprehensive view of your financial health. A table illustrating some popular apps and their integration capabilities might help in making a decision:

| App Name | Integration Features | Supported Institutions |

|---|---|---|

| Mint | Automatic transaction syncing | Over 16,000 financial institutions |

| YNAB | Real-time updates via direct import | Most major banks |

| Personal Capital | Investment tracking and budgeting | Multiple banks and investment accounts |

Maximizing Your Savings with Smart Budgeting Strategies

Implementing smart budgeting strategies is essential to maximizing savings. With the right budgeting app, you can effortlessly track your expenses, categorize spending, and set financial goals. Many applications offer features such as automated expense tracking, bill reminders, and financial goal setting, making it easier than ever to stick to a budget. By leveraging technology, you gain insights into your spending habits, allowing for adjustments that lead to significant savings over time. Key features to look for in a budgeting app include:

- User-friendly interface for seamless navigation

- Integration with bank accounts for real-time updates

- Customizable budgeting categories tailored to your lifestyle

- Charts and graphs that visualize your financial progress

To better understand the impact of various budgeting apps, consider the following comparison of popular options:

| App | Monthly Cost | Key Feature |

|---|---|---|

| mint | Free | Credit Score Monitoring |

| YNAB | $11.99 | Goal-Oriented Budgeting |

| PocketGuard | Free / $4.99 | Spending Limits |

| EveryDollar | Free / $129/year | Simple Drag-and-Drop Budgeting |

Each of these apps offers unique functionalities catering to different financial habits and goals, enabling you to find a solution that works best for your individual needs.By combining these tools with disciplined spending and regular reviews, you can effectively enhance your financial health and optimize savings.

Closing Remarks

managing your finances doesn’t have to be overwhelming or tedious, especially with the wealth of budgeting apps available today. By carefully selecting the right app tailored to your needs and preferences, you can transform your financial habits, track your spending, and ultimately achieve your financial goals. Whether you’re looking for advanced investment tracking or simply a straightforward way to manage monthly expenses, there’s an option out there for you.

Remember, the journey to financial control begins with a single step, and using a budgeting app can be that pivotal step towards a more secure financial future. Take the time to explore these tools and find the one that resonates with you—your financial well-being is worth the investment. Happy budgeting!