Setting up direct deposit with your bank can be one of the most convenient financial decisions you make. Whether you’re receiving your paycheck, government benefits, or investment income, direct deposit offers a secure and efficient way to ensure your funds reach you without the hassle of paper checks. Not only does this method streamline your financial transactions, but it also helps you avoid trips to the bank, giving you more time to focus on what truly matters. In this extensive step-by-step guide, we’ll walk you through the process of establishing direct deposit with your bank, addressing common questions and concerns along the way. By the end of this article, you’ll be equipped with all the knowledge you need to make the transition to direct deposit smooth and straightforward. Let’s get started on simplifying your financial life with this essential banking feature!

Table of Contents

- Understanding the Benefits of Direct Deposit for Your Finances

- Gathering Necessary Information for a Seamless Setup

- Navigating Your Banks Direct Deposit Process with Ease

- Troubleshooting Common Issues and Ensuring Successful Transactions

- Key Takeaways

Understanding the Benefits of Direct Deposit for Your Finances

Direct deposit is a financial game-changer that offers multiple advantages for those seeking to streamline their money management. With this method, you can enjoy the convenience of having your paycheck, government benefits, or other recurring payments automatically deposited into your bank account. This process eliminates the need for physical checks, thus reducing the risk of lost or stolen payments. Moreover, direct deposit ensures that your funds are accessible more quickly, often on the same day your payment is issued, allowing you to manage your expenses without delay.

Additionally, utilizing direct deposit can simplify your record-keeping and budgeting. Many financial institutions provide notifications when a deposit is made, helping you stay informed about your account balance. Here are some benefits worth considering:

- Time-saving: No need to visit the bank to deposit checks.

- Safety: Reduced risk of check fraud or loss.

- Automated savings: You can often allocate a portion of your deposit directly into savings, promoting good financial habits.

- Environmentally amiable: Reduces paper usage and waste.

Gathering Necessary Information for a Seamless Setup

Before diving into setting up your direct deposit, it’s crucial to gather all necessary information to ensure a smooth process. Start by collecting your bank account details, which include your account number, routing number, and the type of account (checking or savings). Additionally, having your employer’s information on hand can save time, as you’ll likely need to provide details about where your direct deposit requests should be submitted. A simple checklist might include:

- Bank account number

- Bank routing number

- type of account (checking/savings)

- Employer’s name and contact information

- Any required forms from your employer

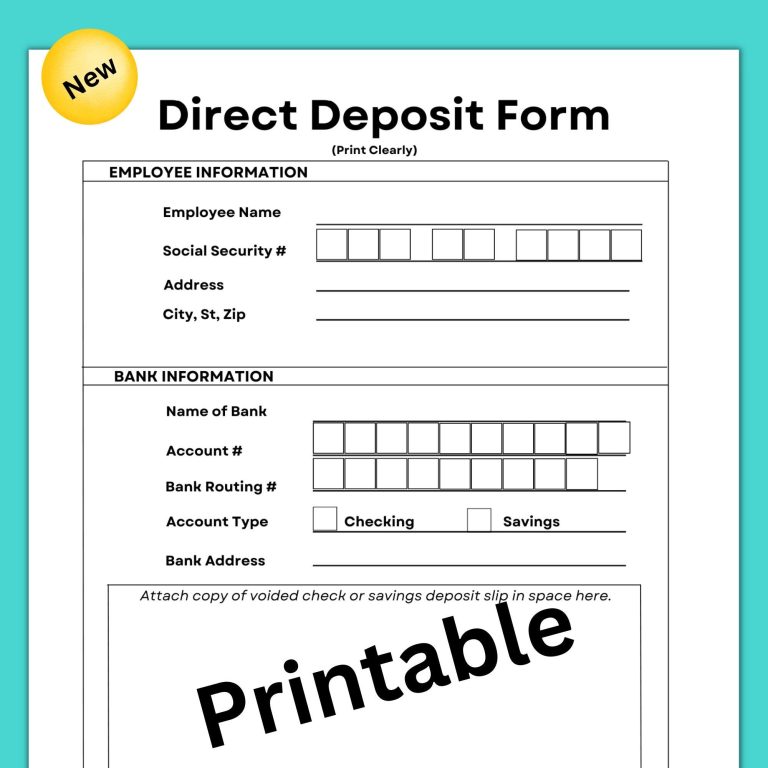

In certain specific cases, you may also need to complete a direct deposit authorization form. This form typically requests the above details and might require your signature to authorize the setup. To make things easier, consider organizing this information in a clear format, such as the table below:

| Information Type | Details |

|---|---|

| account Number | 123456789 |

| Routing Number | 987654321 |

| Account type | Checking |

Once you’ve compiled this information, you’ll be well-prepared to initiate the setup process, eliminating potential delays or complications in your direct deposit arrangement.

Navigating Your Banks Direct Deposit Process with Ease

Setting up direct deposit with your bank can streamline your finances, ensuring your paycheck lands directly in your account without the hassle of checks. To begin, gather all necessary information, such as your bank account number, routing number, and personal identification. Most employers will require you to fill out a direct deposit authorization form. This form is essential for communicating with your bank and employer, serving as the bridge for automatic transfers. Ensure that your information is precise to avoid delays in receiving your funds.

After submitting the authorization form, it’s prudent to track your payments for the first few cycles. Keep an eye out for notifications or alerts that confirm your deposit has been processed. Many banks offer online tools or mobile apps that allow you to monitor your account activity. Here’s a speedy checklist to assist you on this journey:

- Confirm your bank details: Double-check routing and account numbers.

- Inform HR or payroll: Make sure they have the correct information.

- monitor your deposits: Look for confirmation notices or statements.

- Stay updated: Watch for any bank communications regarding changes in your account.

Troubleshooting Common Issues and Ensuring Successful Transactions

When setting up direct deposit, it’s common to encounter a few hurdles that can delay your transactions. Here are some frequent issues that you might encounter and how to navigate them:

- Incorrect Account Information: Double-check that you have entered your banking routing and account numbers correctly. Any typo can result in delays or failed deposits.

- Employer Processing Times: Understand that some employers may take a few pay cycles to implement direct deposit. Confirm with your HR department about their processing schedule.

- Bank Restrictions: Consult with your bank to ensure they support direct deposit services. Some accounts may have specific requirements or restrictions.

If your direct deposit transaction does not go through as expected, here are steps to rectify the situation:

| Step | Action |

|---|---|

| 1 | Contact your employer to verify if the deposit was initiated. |

| 2 | Check your bank statement for any unusual activity or fees. |

| 3 | Reach out to your bank’s customer service to check on potential errors. |

Taking these proactive steps can definitely help ensure that your direct deposits are processed smoothly, allowing you to enjoy a hassle-free banking experience.

Key Takeaways

setting up direct deposit with your bank is a straightforward process that not only streamlines your financial management but also enhances your convenience and security. By following the steps outlined in this guide, you can ensure that your funds reach your account promptly and without the hassle of manual deposits.Remember, maintaining an open line of communication with your employer and understanding the specific requirements of your bank will make the transition seamless.Whether you’re receiving your paycheck, government benefits, or any other type of income, direct deposit is a reliable method that saves you time and offers peace of mind.

We hope this guide has provided you with the clarity and confidence to take the next steps towards setting up direct deposit. If you have any questions or need further assistance, don’t hesitate to reach out to your bank’s customer service or consult their online resources. Here’s to a more efficient and organized way to manage your finances!