How too Safely Close Your Bank Account: A Step-by-Step Guide

Closing a bank account may seem like a daunting task, but with a little preparation and the right approach, it can be a straightforward process.Whether you’re looking to switch to a bank with better services, lower fees, or simply want to simplify your financial management, it’s significant to ensure that the closure is handled properly to avoid any potential pitfalls. In this comprehensive guide, we’ll walk you through each step of the process, offering practical tips and best practices to ensure a smooth transition while safeguarding your financial details. from checking for outstanding transactions to exploring your new banking options, we’ve got you covered every step of the way. Let’s get started on ensuring your bank account closure is efficient and hassle-free!

Table of Contents

- Understanding the Reasons for Closing Your Bank Account

- Preparing for the Account Closure Process

- navigating Outstanding Transactions and Balances

- Ensuring a Smooth Transition to a New Banking Solution

- The Way Forward

Understanding the Reasons for Closing Your Bank Account

Closing a bank account can be a significant decision influenced by various factors.Individuals frequently enough reconsider their banking situation for reasons such as high fees, poor customer service, or dissatisfaction with the services offered. Additionally, major life changes—like relocation, a shift in financial circumstances, or the need for a more supportive banking relationship—can prompt one to seek alternatives. Understanding the specific motivations behind this decision is crucial to ensure that the next banking choice aligns with your financial goals and lifestyle needs.

Financial dissatisfaction is not the onyl reason for closure; sometimes,it’s all about seeking better opportunities. As an exmaple, if a competing bank offers superior interest rates, enticing rewards programs, or more advanced online banking features, it’s inherently beneficial to make the switch. Also, in the current digital age, many consumers are gravitating toward neobanks or credit unions that might provide fewer fees and more personalized options. Here’s a fast lookout at some common reasons for account closures:

| Reason for Closure | Description |

|---|---|

| High Fees | Over time, maintenance and transaction fees can significantly impact savings. |

| Poor Customer Service | Negative experiences can lead to a lack of trust and frustration. |

| Better Options Available | Choice banks may provide incentives that are hard to resist. |

Preparing for the Account Closure Process

Before you initiate the closure of your bank account, it’s crucial to ensure that you have taken all the necessary precautions to avoid any potential disruptions. Start by reviewing your account statements to identify any outstanding transactions, such as pending deposits or scheduled payments. Make sure to settle any pending fees or overdrafts to bring your account balance to zero.Additionally, update your payment information wherever necessary, whether for subscriptions, utilities, or any services linked to your bank account.

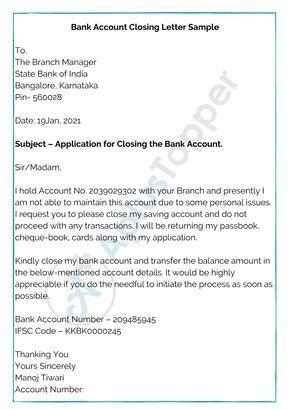

Next, gather any pertinent documentation that might be required during the account closure process. This may include your account number, identification, and possibly a closure request form, which can usually be found on your bank’s website. It’s also wise to make a list of important contacts at your bank, such as your account manager, should you encounter any issues. If needed, schedule a visit with your bank representative to discuss the closure process and confirm that all your queries are addressed. A well-prepared closure will help you transition smoothly to your new banking arrangements.

Navigating Outstanding Transactions and Balances

Before finalizing your bank account closure, it’s crucial to assess any outstanding transactions and confirm your account balances.This process ensures that you don’t leave behind any pending payments or unexpected fees. Start by reviewing your recent bank statements to identify any transactions that haven’t yet cleared, such as checks you’ve written or debit charges.Additionally, make sure you settle any remaining account balances, as an insufficient balance could lead to overdraft fees, or worse, affect your credit score.

It’s also advisable to consider the following steps:

- Check for recurring payments linked to your account.

- Notify relevant service providers of your account closure to avoid missed payments.

- Transfer any remaining funds to your new account or withdraw them in cash.

organizing the status of these transactions will pay off in avoiding potential complications. For ease of tracking, you might want to create a simple table to summarize your activities:

| Transaction Type | Status | Amount |

|---|---|---|

| pending Check | Awaiting Clearance | $150.00 |

| Utility Bill | Paid | $75.00 |

| Subscription Service | cancelled | $12.99 |

Ensuring a Smooth Transition to a New Banking Solution

Transitioning to a new banking solution can be a smooth process if you approach it with careful planning. Begin by researching your new bank to ensure that it aligns with your financial needs. look for features such as better interest rates,lower fees,and enhanced customer service. Once you’ve selected your new bank,consider opening the new account before closing your old one,allowing time for direct deposits and automatic payments to be redirected smoothly. Keep a record of all your transactions during this transition period to avoid any potential mishaps.

As you prepare for the final closure of your old account, it’s vital to communicate with your existing bank. Confirm that all pending transactions have cleared, and ensure that there are no outstanding charges. here’s a simple checklist to help you ensure you haven’t missed anything:

- Review and update your direct deposits and automatic payments.

- Transfer funds from your old account to the new one.

- Notify your account holders about the change in banking details.

- Request formal closure of your old account to avoid future fees.

by systematically addressing these aspects, you can minimize any disruptions and make your transition to a new banking solution as seamless as possible.

The Way Forward

Closing a bank account may seem like a daunting task,but with the right guidance and preparation,it can be a smooth and hassle-free process. By following the steps outlined in this article, you can ensure that all your financial matters are handled appropriately, safeguarding both your assets and your peace of mind. Whether you’re switching banks for better services or simply need to streamline your finances, taking it one step at a time will help you avoid unneeded complications.Remember, interaction is key—don’t hesitate to reach out to your bank for clarification or assistance throughout the process. And, as always, keep an eye on your accounts even after closure to ensure everything is finalized correctly. With careful planning and attention to detail, you’ll be well on your way to a more manageable banking experience. Thank you for joining us in this guide, and best of luck on your financial journey ahead!