Title: A

In today’s fast-paced world, managing your finances can often feel overwhelming, with an endless array of options and uncertainties lurking at every turn.Whether your just starting your financial journey or looking to refine your existing strategies, having a solid personal financial plan is an essential roadmap to achieving your goals. A well-crafted financial plan not onyl clarifies your current financial situation but also empowers you to make informed decisions and take control of your financial future.In this step-by-step guide, we’ll walk you through the process of creating a personalized financial plan tailored to your unique circumstances. From defining your financial goals and assessing your current resources to building a budget and investing wisely, this article will provide you with the tools and insights you need to navigate your finances with confidence. Let’s embark on this journey towards financial empowerment together!

Table of contents

- Understanding Your Financial Goals and Priorities

- Assessing Your Current Financial situation

- Budgeting Strategies for Effective Money Management

- Building a Sustainable Investment Plan for the Future

- to Wrap It Up

Understanding Your Financial Goals and Priorities

Identifying financial goals is a crucial first step in crafting a personalized financial plan. Start by reflecting on your present situation and envisioning what you hope to achieve in the future. Consider categorizing your goals into short-term, mid-term, and long-term objectives. Here are some examples:

- Short-term: Building an emergency fund, paying off a credit card.

- Mid-term: Saving for a wedding, purchasing a car.

- Long-term: Buying a home, planning for retirement.

Once you’ve outlined your goals,it’s essential to prioritize them. This involves assessing each goal’s importance and the timeframe for achieving it,which can help you allocate your resources effectively. You can create a simple scoring system based on factors such as urgency,feasibility,and potential impact on your life. A helpful table to visualize this priority assessment could look like this:

| Goal | Timeframe | Priority Score | Notes |

|---|---|---|---|

| Emergency Fund | 1 Year | 9 | Essential for financial security |

| Buy a Home | 5 Years | 7 | Requires significant saving |

| Retirement Planning | 25 years | 8 | Invest early for better returns |

Assessing Your Current Financial Situation

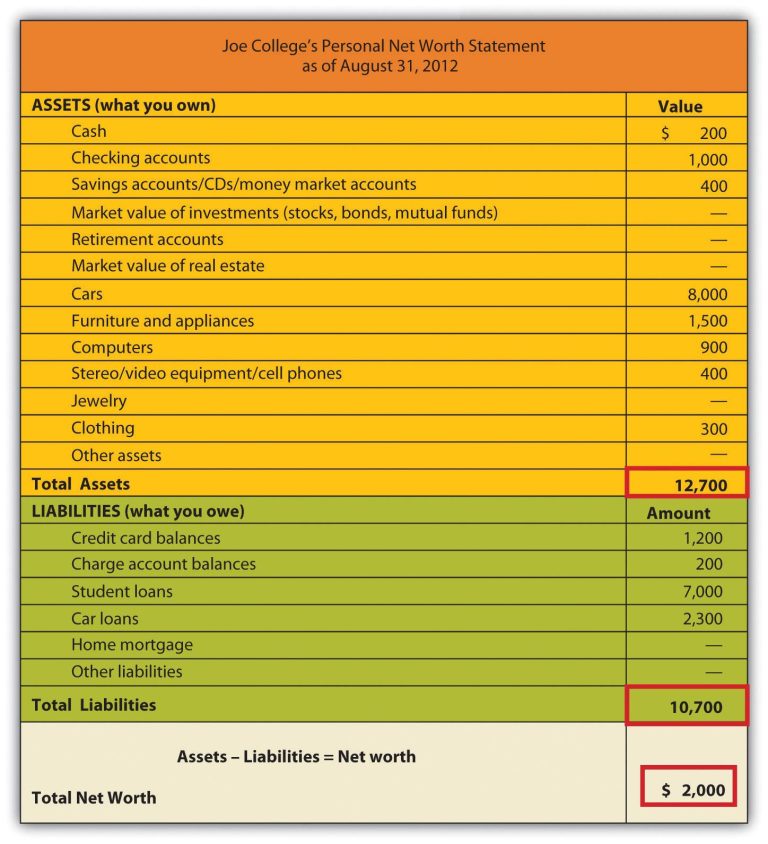

Before you dive into creating a personal financial plan, it’s crucial to take a close look at your current financial landscape. This initial assessment will provide a foundation for your planning process and help you identify areas that need improvement. Start by gathering all relevant financial documents and compiling a comprehensive overview of your assets and liabilities.consider including:

- bank Statements: Review your monthly transactions to understand your spending habits.

- Investment Accounts: List all current investments and their values to ascertain your net worth.

- Debt Obligations: Itemize any personal loans, credit cards, or mortgages to gauge your total liabilities.

Once you have a clear picture of your finances, it’s wise to calculate your net worth by subtracting your total liabilities from your total assets. This number will serve as a benchmark for your financial health. Additionally, tracking your income and expenses will highlight whether you are living within your means or overspending. Consider using the following table format for an organized view:

| Income Sources | Monthly Amount |

|---|---|

| Salary | $4,000 |

| Freelancing | $800 |

| Investment Income | $200 |

| Total Income | $5,000 |

By documenting your financial situation in a structured manner, you’ll gain valuable insights into potential areas for growth and make informed decisions as you move forward with your financial goals.

Budgeting Strategies for Effective Money Management

Creating an effective budget doesn’t have to be a daunting task. Start by assessing your current financial situation, which involves identifying all sources of income and detailing your monthly expenses.This includes fixed costs such as rent and utilities,and also variable costs like groceries and entertainment. To keep things organized, consider using spreadsheets or budgeting apps that allow for easy tracking.A simple way to categorize your spending is through the following groups:

- Essentials: Housing, Food, Utilities

- Savings: Emergency fund, Retirement Accounts

- discretionary: Dining Out, Hobbies, Shopping

Once you have a clear picture of your finances, it’s crucial to allocate funds wisely. Design a budget that aligns with your financial goals by adhering to the 50/30/20 rule, were 50% of your income goes to needs, 30% to wants, and 20% to savings. Regularly review and adjust your budget to accommodate changes in your income or expenses. A useful tool for tracking your progress is a simple table like the one below, which summarizes your budget performance each month:

| Month | Income | Total Expenses | Remaining Balance |

|---|---|---|---|

| January | $3,000 | $2,500 | $500 |

| February | $3,000 | $2,750 | $250 |

| March | $3,000 | $2,600 | $400 |

Building a Sustainable Investment Plan for the Future

Creating a sustainable investment plan begins with a clear understanding of your financial goals and values. Start by defining what sustainability means to you—whether it’s supporting green companies, investing in renewable energy, or focusing on social impact. Once you have established your priorities, consider the following aspects:

- Assessment of Risk Tolerance: understand how much risk you can comfortably take on. This can shape your investment choices away from volatile industries.

- Diverse Portfolio Construction: Build a portfolio that includes a mix of assets—stocks, bonds, and sustainable ETFs that align with your values.

- Research Sustainable Options: Look for companies and funds with ethical practices, clear sustainability reports, and a commitment to corporate responsibility.

Next, regularly evaluate and adjust your investment allocations based on performance and any changing economic factors. It’s crucial to stay informed about new sustainable opportunities and the implications of market shifts. To ensure your strategy remains on track, consider creating a brief review table for your investments:

| Investment Type | Current Value | Performance (% Change) |

|---|---|---|

| Green Energy ETF | $5,000 | +15% |

| Sustainable Agriculture Fund | $3,000 | +10% |

| Socially Responsible bonds | $2,000 | +8% |

To Wrap It Up

crafting your personal financial plan is a vital step towards achieving financial independence and security. By following the structured approach outlined in this guide, you can gain clarity on your financial goals, assess your current situation, and create a roadmap to navigate your financial future with confidence. Remember, a well-thought-out financial plan is not set in stone; it should evolve as your life circumstances change, market conditions shift, and new opportunities emerge.

As you embark on this journey, take the time to regularly review and adjust your plan, seek advice when necessary, and stay informed about financial trends that could impact your strategy. Building a solid financial foundation takes time and discipline, but the rewards of a secure and prosperous future are well worth the effort.

We hope this guide has equipped you with the knowledge and tools to take control of your finances. Don’t hesitate to share your experiences and insights in the comments below or contact us if you have any questions.Here’s to a financially savvy future!