Traveling the world is a dream for many, a chance to immerse oneself in new cultures, savor diverse cuisines, and create unforgettable memories. Though, the excitement of planning an adventure can frequently enough be overshadowed by financial concerns. With rising costs in travel and living expenses, achieving that wanderlust desire while staying within budget can seem daunting. But fear not! In this article, we’ll explore effective strategies for smart travel budgeting, enabling you to embark on your journeys without the fear of overspending. From savvy planning tips to practical advice on finding the best deals, we’ll guide you through the essential steps to ensure your travels are not only enriching but financially sustainable.Get ready to discover how to travel wisely and experience the world without breaking the bank!

Table of Contents

- Understanding Your Travel Costs for Better Budgeting

- Creating a Flexible Yet Effective Travel Budget

- Maximizing Savings with Smart Booking Strategies

- Experiencing Authenticity on a Budget Without Compromise

- The conclusion

Understanding your Travel Costs for Better Budgeting

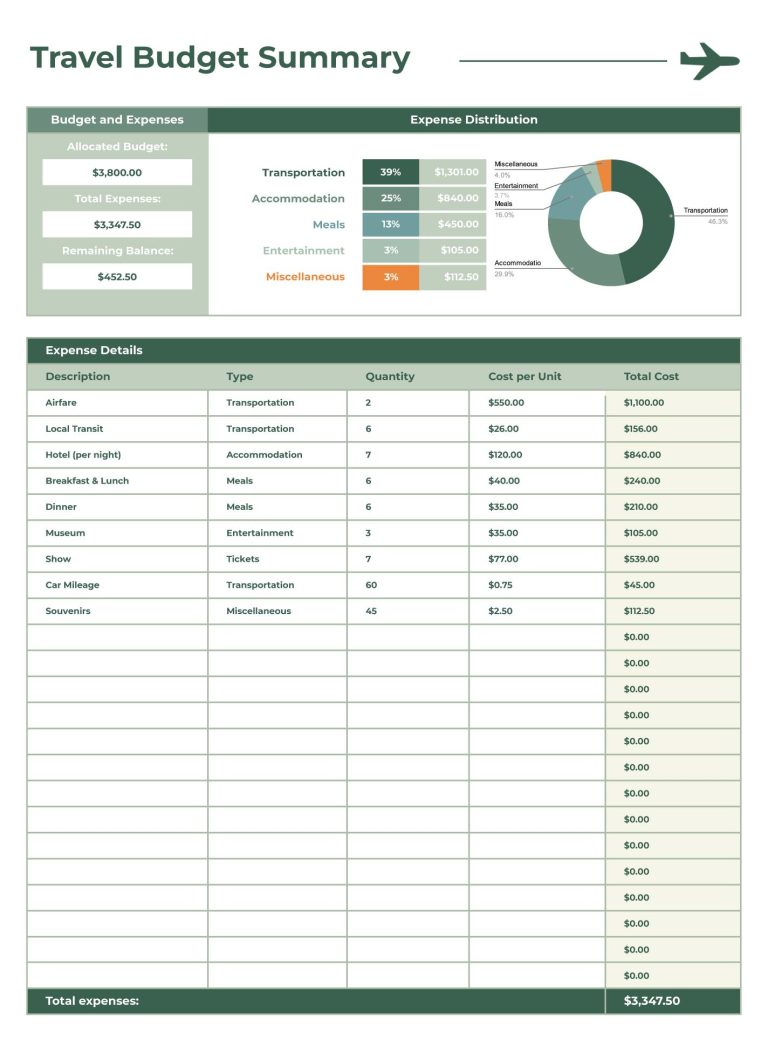

To achieve a well-rounded budget for your travels, it’s crucial to identify and analyze all potential expenses before embarking on your journey. Accommodation, transportation, and food are the three main pillars of any trip budget, but there are additional factors to consider:

- Activities and excursions: Research entry fees for attractions or guided tours you may want to experience.

- Travel insurance: Don’t overlook the importance of safeguarding your finances against unexpected events.

- Souvenirs and shopping: Set a limit to avoid overspending on impulse purchases.

Another effective way to control your travel costs is to utilize cost comparison tools and apps that allow you to track expenses as they occur. Make sure to:

- Plan for currency conversion: Keep an eye on exchange rates to ensure you get the best deal.

- Monitor your daily spending: Utilize a travel budgeting app to stay on track.

- Prioritize experiences over material goods: Opt for unique, local activities that create lasting memories instead of splurging on high-end restaurants.

Creating a Flexible Yet effective Travel Budget

Crafting a travel budget that balances flexibility with efficiency opens the door to exploring the world without the financial strain. start by setting a baseline budget that encompasses your main expenses, such as transportation, accommodation, meals, and activities. To give yourself some leeway, consider using a tiered approach to your budget, where you allocate different amounts for each category based on your travel priorities. As an example, if you’re keen on cuisine, you might prioritize dining experiences over lodging quality. Make sure to include a contingency fund for unexpected expenses, allowing for spontaneity in your plans.

Monitoring and adjusting your budget can be as crucial as the initial planning. Use travel budget apps or spreadsheets to track your real-time spending against your projected costs. Here are some key strategies to keep in mind:

- Prioritize Experiences: Allocate more funds to activities that align with your interests.

- Monitor Exchange Rates: Use tools to stay updated on currency fluctuations.

- Embrace Off-Peak Travel: Consider traveling during less busy seasons to capitalize on lower prices.

By remaining adaptable and regularly reviewing your expenditures,you can harmonize your travel aspirations with your financial reality,ensuring that you enjoy your adventures without the dread of overspending.

Maximizing Savings with Smart Booking Strategies

Traveling doesn’t have to break the bank if you employ effective booking strategies.Consider using flexible travel dates; often, flying mid-week can yield cheaper fares then weekend departures.Additionally, leverage the power of price comparison websites to ensure you’re not missing out on potential deals. Setting up price alerts can notify you when fares drop, allowing you to seize opportunities as they arise. You might also want to check for off-peak travel to save on both airfare and accommodation, as prices tend to soar during peak seasons.

Another way to maximize your savings is by bundling services. Many airlines and travel websites offer discounts when you book a flight, hotel, and car rental together. if you’re a frequent traveler, consider joining membership programs for airlines or hotels. These frequently enough come with benefits like priority boarding,free upgrades,or additional discounts. To illustrate these strategies effectively, take a look at this sample comparison table of potential savings:

| Booking Method | Potential Savings |

|---|---|

| Flexible Dates | Up to 30% off |

| Price Alerts | 10-20% off |

| Bundled Packages | 15-25% off |

| Membership Discounts | 5-15% off |

Experiencing Authenticity on a Budget Without Compromise

Traveling authentically doesn’t have to come with a hefty price tag. To immerse yourself in the local culture while maintaining a budget, consider staying with locals through home-sharing platforms or hostels that emphasize community experiences. By opting for these accommodations, you not only save money but also gain insights and stories from your hosts, enriching your travel experience. here are some practical tips:

- Cook your meals: Visit local markets to buy fresh ingredients and prepare your own dishes.

- Use public transportation: It’s an affordable way to navigate cities and frequently enough provides a glimpse into daily local life.

- Participate in free walking tours: Many cities offer guided tours based on tips, allowing you to pay what you can afford.

Additionally,explore local attractions that are either free or low-cost. Museums often have free entry days, and parks and beaches can be perfect spots for relaxation without the cost. Consider seeking out community events and festivals that showcase local heritage, and frequently enough come at little to no expense. Below is a quick guide to help you identify potential savings in your travel expenses:

| Expense Category | Budget-Friendly Tips |

|---|---|

| Food | Eat at food stalls and local cafes rather than touristy restaurants. |

| Attractions | Look for city passes that offer discounts on multiple sites. |

| Transport | rent a bike to explore the city, which is both economical and eco-friendly. |

The Conclusion

mastering smart travel budgeting is not just about saving money—it’s about maximizing your travel experiences while keeping your finances in check. By implementing the strategies outlined in this article, you can embark on unforgettable journeys without the weight of financial stress. From meticulously planning your itinerary to leveraging cost-effective tools and local resources, every small decision contributes to a larger financial picture that allows you to explore the world on your own terms.

Remember, the joy of travel lies not in how much you spend, but in the memories you create and the cultures you immerse yourself in. So, take charge of your travel budget, explore creatively, and enjoy the incredible adventures awaiting you. With the right planning and foresight, you can turn your dream trips into reality—without overspending.Safe travels, and may your next adventure be both enriching and economically savvy!