Introduction:

As educational costs continue to soar, the burden of student loan debt is a growing concern for millions of aspiring students and their families.With the average graduate entering the workforce saddled with substantial financial obligations, understanding how to navigate this complex landscape becomes paramount. However, it’s not just about surviving the debt — it’s about smart, proactive strategies that can prevent it from becoming a long-term hindrance. In this article, we will explore practical and innovative approaches to student loan debt prevention, equipping you with the knowlege and tools necessary to make informed decisions as you pursue your academic and professional goals. whether you are a prospective student, a parent, or an educational advocate, these strategies will empower you to take control of your financial future. Let’s delve into the smart choices that can help you mitigate debt from the very beginning of your educational journey.

Table of Contents

- Understanding the Landscape of Student Loan Debt and Its Implications

- Creating a Financial Blueprint: Budgeting Tips for future Students

- Maximizing Financial Aid: Scholarships, Grants, and Work-Study Opportunities

- Building credit Early: Tools for Financial Health During Your College years

- Closing Remarks

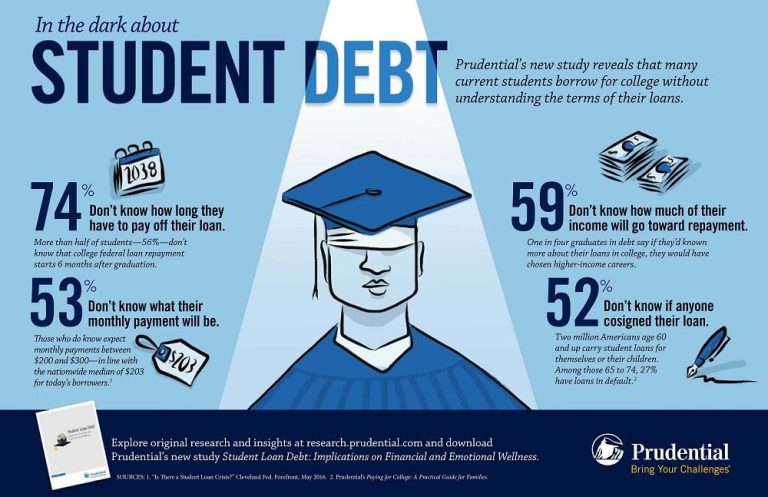

Understanding the Landscape of Student Loan Debt and Its Implications

The burden of student loan debt is increasingly becoming a important issue for manny graduates, shaping not only their financial futures but also their life choices. As tuition prices soar, the amount borrowed by students frequently enough exceeds their expectations, leading to a cycle of debt that can hinder their ability to invest in other areas of life, such as homeownership, saving for retirement, and even starting a family. To understand this landscape, one must consider various factors including the types of loans, interest rates, and repayment options available. A shift towards federal loans can provide certain protections, while private loans, though sometimes offering lower rates, may lack the same level of versatility and support.

When navigating the complexities of student loan debt, employing smart prevention strategies can make a world of difference. here are some tactical approaches to consider:

- research Scholarships and Grants: Prioritize applying for financial aid that doesn’t have to be repaid.

- Budget Wisely: Create a financial plan that includes all potential expenses to avoid borrowing more than necessary.

- Work-Study Programs: Engage in work programs that provide income while studying, easing the reliance on loans.

- Choose your Institution Wisely: Evaluate the return on investment of various schools before committing.

Creating a Financial Blueprint: Budgeting Tips for Future Students

Establishing a firm financial foundation is key for future students aiming to manage their expenses efficiently and avoid crippling debt. One of the most effective strategies is to create a meticulous budget that accounts for all anticipated costs. Here are some significant tips to help craft this blueprint:

- Track Your Income: Start by documenting all sources of income, including part-time jobs and allowances.

- List All Expenses: Categorize expenses into fixed (tuition, rent) and variable (food, entertainment) to understand where your money goes.

- Set Limitations: Allocate specific amounts for each category and stick to them diligently.

- Review Regularly: Regularly reassess your budget to adjust for any changes in income or expenses.

Additionally, consider utilizing resources available for students that can offer financial assistance or discounts. Making use of these can alleviate some financial pressures. Here’s a brief overview of potential avenues for cost-saving:

| Resource | Benefit |

|---|---|

| Student Discounts | Reduced prices on software, travel, and local events. |

| Scholarships and Grants | Financial aid that doesn’t require repayment. |

| Peer-to-Peer Tutoring | A cost-effective way to enhance learning while saving money. |

Maximizing Financial Aid: Scholarships, Grants, and Work-Study Opportunities

To effectively reduce your dependency on student loans, consider tapping into the abundant resources available, such as scholarships, grants, and work-study programs. These opportunities can considerably alleviate your financial burden while allowing you to focus on your studies. Scholarships are often merit-based and available from various organizations, including schools, nonprofits, and businesses. Grants, on the other hand, are typically need-based and provided by the federal government or state agencies. engaging in a work-study program not only helps you earn money to pay for your expenses but also enhances your resume with valuable work experiance.

When exploring these financial aid options, it’s crucial to conduct thorough research and be proactive. Here are some strategies to discover and apply for these financial resources:

- utilize online databases: Websites like Fastweb and Cappex can help you find scholarships tailored to your qualifications.

- Check with your school: Most colleges have financial aid offices that can guide you toward grants and scholarships specific to your institution.

- Network: Speak with faculty, alumni, and community members to uncover unique scholarship opportunities not widely advertised.

- Stay organized: Keep track of deadlines and required documents for each submission to maximize your chances of success.

Building Credit Early: Tools for Financial Health During Your College Years

Establishing a solid credit history while in college can significantly enhance your financial health and set you on a path toward future success. One of the most effective tools for building credit is a student credit card. These cards are specifically tailored for those with limited credit history and frequently enough come with lower limits and easier approval processes. to maximize the benefits, consider these strategies:

- Pay your balance in full: Avoid interest charges by paying off your balance every month, which helps build a positive credit history.

- Make timely payments: Consistency in making monthly payments on time is crucial for maintaining a strong credit score.

- Keep unused credit accounts open: The length of your credit history factors into your credit score; therefore, keeping older accounts open can be beneficial.

Another fantastic way to build credit is through student loans. While these are primarily a form of debt, responsibly managing them can enhance your credit profile. Before you take out loans, research your options thoroughly. Here’s a fast comparison of federal and private student loans:

| loan Type | Interest Rates | Repayment Options |

|---|---|---|

| Federal Student Loans | Fixed, typically lower | Flexible, income-driven |

| Private Student Loans | Variable or fixed, potentially higher | Less flexibility |

Understanding the differences helps you make more informed choices. You can also benefit from credit monitoring services during your college years; these services can provide insights into your credit score, helping you keep track of your progress and alerting you to any significant changes. Additionally,educating yourself on the nuances of credit reporting can empower you to make smarter financial decisions now and in the future.

Closing Remarks

As we conclude our exploration of smart strategies for navigating student loan debt prevention,it’s clear that proactive planning and informed decision-making can significantly ease the financial burdens frequently enough associated with higher education. From understanding the true cost of college to exploring scholarships, grants, and option funding options, each approach plays a critical role in paving the way toward a debt-free future.

Remember, the journey to managing student loans begins long before graduation. Equip yourself with knowledge,seek guidance,and leverage the resources available to you. By prioritizing financial literacy and making mindful choices,you can position yourself for success—not only in your educational endeavors but also in your overall financial health.

Thank you for joining us on this journey towards mastering student loan debt prevention. We hope you’re inspired to take actionable steps and share this information with others who may benefit. Together, we can create a community that empowers individuals to pursue their educational goals without the looming shadow of overwhelming debt.Until next time, keep learning and planning for a brighter financial future!