In today’s ever-evolving financial landscape, savvy investors are continually seeking ways to grow their portfolios while mitigating risks. Diversification, frequently enough hailed as a cornerstone of sound investment strategy, plays a crucial role in achieving enhanced returns. But as the markets shift and new opportunities arise, simply spreading yoru investments across a few asset classes may no longer suffice. In this article, we will explore smart, innovative strategies to diversify your investments effectively. From understanding emerging sectors to harnessing alternative assets, we’ll equip you with actionable insights that can help you not only safeguard your capital but also tap into new streams of growth. Whether you are a seasoned investor or just beginning your journey, these strategic approaches will empower you to navigate the complexities of today’s market with confidence. Let’s dive in and uncover the tactics that can take your investment strategy to the next level.

Table of Contents

- Strategic Asset Allocation for a Balanced Portfolio

- Exploring Alternative investments Beyond Traditional Markets

- Utilizing Dollar-Cost Averaging for Risk Mitigation

- Harnessing Technology and Analytics to Enhance Investment Decisions

- The Way Forward

Strategic Asset Allocation for a Balanced Portfolio

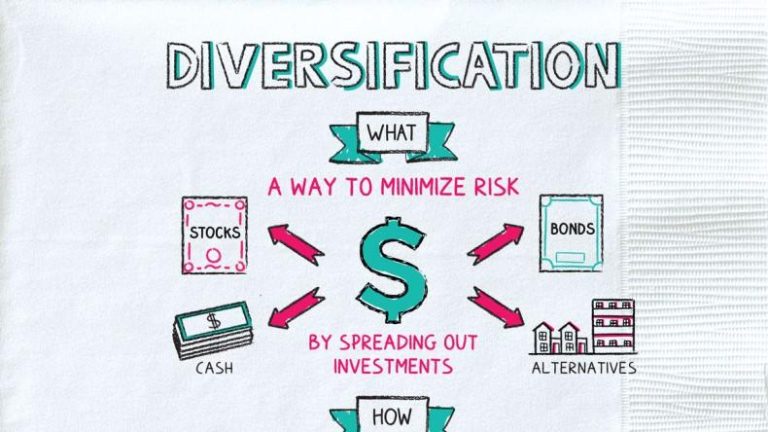

Strategic asset allocation is pivotal in building a balanced portfolio that can withstand the volatility of financial markets. By spreading investments across a variety of asset classes, investors can not only mitigate risk but also enhance the potential for returns. Here are key components to consider:

- equities: Investing in stocks can provide capital growth over time, but it comes with higher risks.Aim for a mix of large-cap, mid-cap, and international stocks.

- fixed Income: Bonds can serve as a stabilizing force in your portfolio, offering predictable returns and lower risk.

- Real Estate: Real estate investments can offer diversification and can act as a hedge against inflation.

- Cash or Cash Equivalents: Maintaining a portion of your portfolio in liquid assets can provide flexibility and safety during market downturns.

To illustrate a basic strategic allocation approach, consider the following asset allocation table:

| Asset Class | Percentage Allocation |

|---|---|

| Equities | 50% |

| Fixed Income | 30% |

| Real Estate | 15% |

| Cash Equivalents | 5% |

This model can be adjusted based on individual risk tolerance and investment goals, ensuring that your strategy remains aligned with economic conditions and personal financial aspirations.

Exploring Alternative Investments Beyond Traditional Markets

In a world where traditional stock and bond markets often fall short of delivering ample returns, savvy investors are turning their attention to alternative investments. These assets not only provide a hedge against market volatility but also open new avenues for appreciation. Consider the following options for diversifying your portfolio:

- Real Estate Crowdfunding: participating in real estate projects through crowdfunding platforms allows you to invest in properties without the complexities of direct ownership.

- Peer-to-Peer Lending: This involves lending money directly to individuals or businesses, often resulting in higher interest rates compared to traditional banks.

- Cryptocurrencies: While highly volatile, cryptocurrencies can yield impressive returns if timed correctly.

- Commodities: Investing in gold, silver, and other commodities can serve as a safeguard against inflation.

Additionally, investing in art and collectibles has gained traction. As these assets can appreciate over time and are often less correlated with stock market performance, they can offer a unique alternative. Here’s a fast comparison of these alternative investments:

| Investment Type | Potential Returns | Risk Level |

|---|---|---|

| Real Estate Crowdfunding | 8-12% | Moderate |

| Peer-to-Peer Lending | 6-15% | High |

| Cryptocurrencies | Varies widely | Very High |

| Commodities | 4-10% | Moderate |

| Art and Collectibles | 5-20% | Variable |

Utilizing Dollar-Cost Averaging for Risk Mitigation

Dollar-cost averaging (DCA) is a powerful investment strategy that helps mitigate risk by spreading out the investment process over time. By consistently allocating a fixed amount of capital to an asset, regardless of its price fluctuations, investors are able to reduce the impact of volatility. This approach allows individuals to acquire more shares when prices are low and fewer shares when prices are high, leading to a more balanced investment portfolio in the long run.Consider the following benefits of DCA:

- Reduced emotional stress: By committing to a regular investment schedule, investors can avoid the emotional highs and lows linked with market timing.

- Consistency: Establishing a routine makes it easier to stick to a long-term plan and stay focused on the investment strategy.

- Lower average costs: DCA leads to an average purchase price that can be lower than the market price, especially in volatile markets.

When integrating dollar-cost averaging into a diversified investment strategy, it’s essential to track performance across different asset classes. This can provide insight into how your investments are behaving over time, while allowing for adjustments as necessary. Below is an example of how DCA can be applied to various asset classes:

| Asset Class | Monthly Investment | Investment Period (Months) |

|---|---|---|

| Equities | $500 | 12 |

| Bonds | $300 | 12 |

| Real Estate | $200 | 12 |

By applying a systematic approach like dollar-cost averaging across different investments, you can enhance your overall portfolio stability and perhaps achieve greater long-term returns. This strategy not only complements diversification efforts but also reinforces the importance of disciplined investing, ultimately leading to a more resilient financial future.

Harnessing Technology and Analytics to Enhance Investment Decisions

In today’s rapidly evolving financial landscape, integrating technology and analytics into investment strategies has become essential for optimizing asset allocation and enhancing returns. By leveraging advanced analytical tools, investors can sift through vast amounts of data to uncover trends and patterns that traditional methods might overlook. Utilizing machine learning algorithms and predictive modeling, analysts can identify potential opportunities and risks much earlier, enabling proactive decision-making that solidifies a diversified investment portfolio. The following techniques illustrate how technology can be harnessed:

- Data visualization: Platforms that provide dynamic data visualization help investors clearly interpret complex data sets.

- Sentiment Analysis: Monitoring social media and news outlets can provide insights into market sentiments, influencing investment choices.

- Robo-Advisors: Automated investment platforms use algorithms to tailor portfolios based on individual risk profiles and market conditions.

Moreover,the integration of real-time analytics can significantly enhance the management of multi-asset portfolios. By implementing systems that permit continuous monitoring of asset performance against market benchmarks,investors can make informed adjustments without delay. Below is a simple overview of how different analytics tools can impact investment strategies:

| Analytics Tool | Impact on Investment Decisions |

|---|---|

| Predictive Analytics | Forecast future market movements and trends. |

| Risk Assessment Models | Quantify risk and assess potential returns. |

| Portfolio Optimization Software | Maximize return for a specified level of risk. |

The Way Forward

diversifying your investment portfolio is not just a savvy strategy; it’s a necessity in today’s ever-shifting financial landscape. By thoughtfully incorporating a mix of assets—from stocks and bonds to real estate and alternative investments—you can not only mitigate risk but also pave the way for enhanced returns over time. Remember, diversification is not merely about quantity; it’s about quality and strategic alignment with your financial goals.

As you embark on your journey to diversify your investments,keep in mind the importance of continuous research,staying abreast of market trends,and,when needed,consulting with a financial advisor. The right strategies tailored to your unique situation can help you navigate uncertainties,seize opportunities,and ultimately build a robust financial future.

Thank you for joining us on this exploration of smart investment diversification. We hope these insights empower you to take proactive steps towards a more resilient portfolio. Until next time, happy investing!