: Maximizing Your Budget for Educational Success

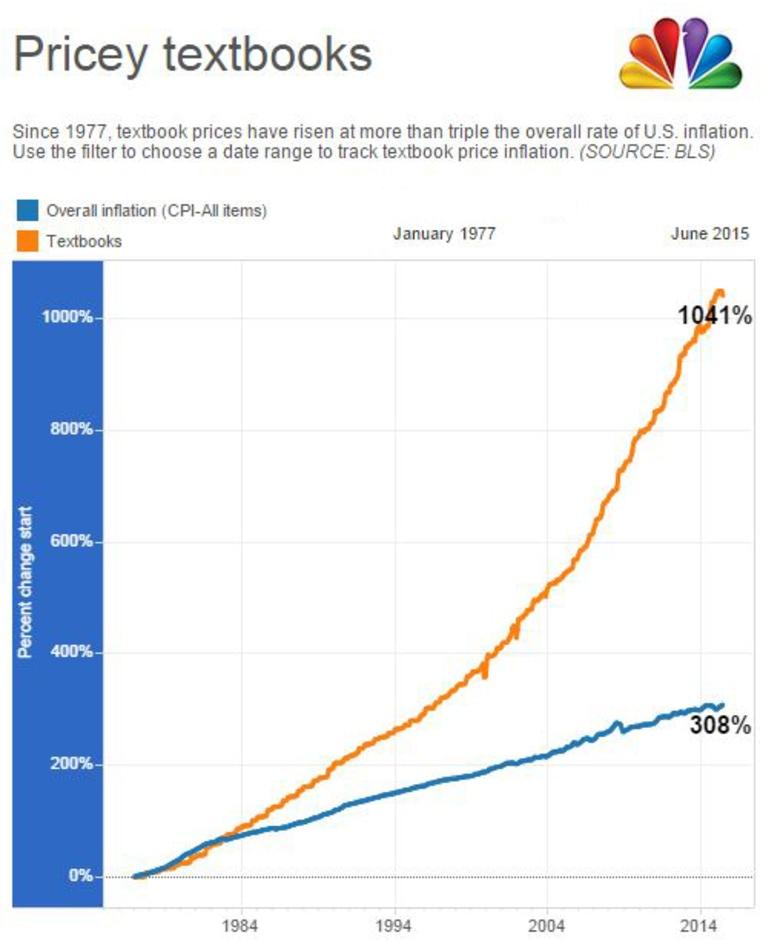

As the back-to-school season approaches, families everywhere brace themselves for the inevitable financial strain that comes with outfitting their students for a new academic year. Textbooks, notebooks, pens, and other essential supplies can quickly add up, creating a significant burden on household budgets. However, with a little creativity and strategic planning, it’s possible to ease this financial pressure without compromising on quality or learning opportunities. In this article, we will explore smart and practical strategies that can definitely help you cut textbook and school supply costs while ensuring your child is equipped for success. From leveraging technology to tapping into community resources, these tips will empower you to make informed purchasing decisions and maximize your educational budget. Let’s dive into the best practices that can help make back-to-school shopping a breeze!

Table of Contents

- effective Ways to Utilize Digital Resources for Savings

- Exploring Alternative Sources for Textbook Purchases

- Maximizing Discounts on School Supplies Through Smart Shopping

- strategies for Organizing and Sharing Resources Within Your Community

- Key Takeaways

Effective Ways to Utilize Digital Resources for Savings

In today’s digital age, leveraging online resources can considerably reduce the financial burden of textbooks and school supplies. Consider utilizing e-book platforms that offer affordable or even free versions of textbooks. Websites like <a href="https://www.project Gutenberg.org" target="blank”>Project Gutenberg provide access to thousands of free e-books, while platforms like <a href="https://www.scribd.com" target="blank”>Scribd and <a href="https://www.chegg.com" target="blank”>Chegg offer subscription-based services that can be more economical than traditional book purchases. Additionally,exploring digital textbook rentals can provide savings,especially for courses with a quick turnover of materials. Many colleges and universities have their own digital libraries, allowing students to borrow required readings for the semester at no cost.

Another effective strategy is to tap into comparison shopping websites to find the best prices on school supplies. Websites like <a href="https://www.pricegrabber.com" target="blank”>PriceGrabber and CampusSI can help you compare prices across multiple retailers in minutes. Furthermore,don’t forget to explore social media platforms and local community groups,where students often sell gently used items. Many schools host online marketplaces for students to connect and buy or sell textbooks and supplies, enabling a cost-effective way to obtain what you need while helping peers reduce their expenses too. Here’s a quick reference table showcasing some popular online resources for savings:

| Resource Type | Examples | Benefits |

|---|---|---|

| E-book Platforms | Project Gutenberg, Scribd, Chegg | Affordable/FREE Access |

| Comparison Shopping | PriceGrabber, CampusSI | Find Lowest prices |

| Online Marketplaces | Facebook Groups, School Forums | Buy/Sell Gently Used Items |

Exploring Alternative Sources for Textbook Purchases

When it comes to finding textbooks without breaking the bank, consider tapping into a variety of alternative sources. Online marketplaces like eBay and Craigslist are excellent for hunting down used books at a fraction of the retail price. You can often find previous edition texts that are still relevant, and sellers typically offer them at a significantly reduced cost. Additionally, explore social media platforms and community groups—many colleges and universities have dedicated Facebook groups where students buy and sell textbooks directly, allowing you to negotiate prices and save on shipping.

Another option is to leverage digital resources. Many publishers offer eBooks at lower prices compared to their physical counterparts, and platforms like Project Gutenberg provide access to free academic texts. Public libraries are also a treasure trove for students, with many now providing online lending services and interlibrary loans for textbooks. And don’t forget about academic sharing sites such as Chegg or BookFinder, where you can rent textbooks for a semester at a much lower cost than purchasing them outright. By diversifying your approach and exploring these various avenues, you can cut down significantly on textbook expenses.

Maximizing Discounts on School Supplies Through Smart Shopping

To achieve maximum savings on school supplies, it’s essential to adopt a strategic approach to shopping. Start by creating a extensive list of required items, focusing on both essentials and optional supplies that may enhance learning experiences. Check for local sales events, as many stores offer back-to-school discounts around this time, often in conjunction with tax-free weekends. Additionally, keep an eye out for clearance sales at the end of the season, where you can score significant savings on items that can be used for the upcoming school year.

Exploit online resources and apps to ensure you’re getting the best deals. Consider using comparison websites to assess prices across multiple retailers. Many stores provide loyalty programs that can further enhance your savings, so sign up to reap the benefits. Additionally, bulk buying can sometimes pave the way for reduced prices on frequently used supplies. Here’s a quick table for reference:

| Item | Store | Discount |

|---|---|---|

| Backpacks | Store A | 20% off |

| Notebooks | Store B | Buy 1 Get 1 Free |

| Pens & Pencils | Store C | 15% off with loyalty card |

Strategies for Organizing and Sharing Resources within Your Community

Creating a cohesive community resource-sharing plan can significantly reduce educational expenses. One effective strategy is to establish a local book exchange, where families can donate textbooks and school supplies their children have outgrown. this initiative not only fosters a sense of community but also provides access to materials that might or else be financially out of reach. You can enhance this effort by:

- setting up a community event to facilitate sharing days, encouraging families to come together to swap resources.

- Utilizing social media platforms to create group pages or events to connect those in need with available resources.

- Partnering with local businesses to sponsor supply drives or offer discounts for educational materials.

Another impactful approach involves leveraging digital tools for better interaction and collaboration. Creating a shared online repository for resources can definitely help streamline access to educational materials. You might consider using platforms like Google Drive or specialized community applications. A well-organized system can include:

- Digital lists of available resources, including materials, books, and other supplies.

- volunteer-led inventory tracking to keep the resource bank up-to-date and easily accessible.

- Feedback forums to ensure community members can voice their needs and suggestions.

Key Takeaways

as we wrap up our discussion on smart strategies to cut textbook and school supply costs,it’s clear that with a little planning and resourcefulness,you can significantly lighten your financial load while still ensuring that you and your students have everything you need for a successful school year. From embracing digital alternatives and exploring community resources to timing your purchases strategically, these tactics not only help to keep expenses in check but also promote sustainability and creativity in learning.

Remember, every dollar saved on textbooks and supplies is a dollar that can be redirected toward other enriching educational experiences. So, take these strategies to heart and make them part of your school planning process. With the right approach, you can navigate the back-to-school season with confidence and ease.

We would love to hear about your own experiences and tips for saving on school expenses. What strategies have you found most effective? Share your thoughts in the comments below, and let’s keep the conversation going. Until next time, happy saving and happy learning!