Introduction:

Living with roommates can be one of the most rewarding experiences, providing not only companionship but also financial relief. However, managing shared expenses can quickly become a source of stress if not handled thoughtfully.from rent and utilities to groceries and household supplies, the challenge lies in finding a fair and efficient way to divide costs without straining relationships. In this article, we will explore smart strategies for splitting expenses with your roommates, ensuring that everyone feels comfortable and valued in the arrangement. By implementing practical budgeting techniques and leveraging digital tools designed for expense tracking, you can foster openness and harmony in your shared living space. LetS dive into the best practices that will transform how you navigate financial discussions and strengthen your roommate dynamic!

Table of Contents

- Understanding the Importance of Clear Communication in Expense Sharing

- Establishing a Fair Expense Tracking System for Roommates

- Creative Solutions for Managing Shared and Individual Costs

- Navigating Disputes and Maintaining Harmony Among Roommates

- Wrapping Up

Understanding the Importance of Clear communication in Expense Sharing

Effective communication is the cornerstone of successful expense sharing among roommates, ensuring that everyone is on the same page and reducing the potential for misunderstandings. When bills and contributions are involved,clarity is essential to prevent friction in living arrangements. Here are a few points that highlight the importance of transparency:

- Prevents Confusion: Clear communication about who owes what and when eliminates ambiguity.

- Builds Trust: Open discussions about finances foster a culture of trust among roommates.

- Encourages Accountability: When everyone knows their responsibilities, it promotes a sense of ownership over shared expenses.

Along with verbal communication, employing tools and systems to support your expense-sharing discussions can enhance clarity. Consider creating a shared digital spreadsheet or using a dedicated app for tracking expenses, as this allows for real-time updates and reduces the likelihood of disputes. Below is an example setup for an expense-sharing table:

| Roommate | Monthly Contribution | Paid Last Month | Amount Owed |

|---|---|---|---|

| Roommate A | $400 | $400 | $0 |

| Roommate B | $300 | $250 | $50 |

| Roommate C | $350 | $350 | $0 |

This table not only keeps everyone informed about their standing but also serves as a visual aid during discussions. Striving for clear communication in these scenarios cultivates a harmonious living surroundings and ensures that every roommate feels respected and involved in financial choices.

Establishing a Fair Expense Tracking System for Roommates

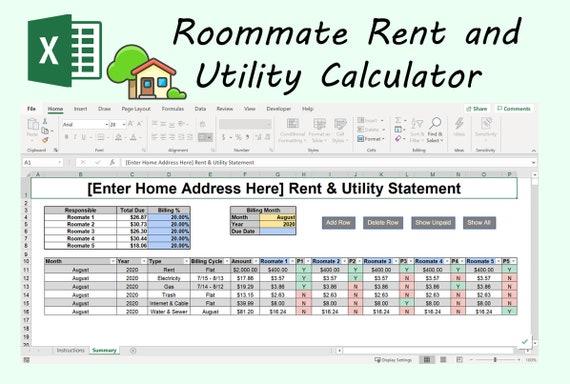

Creating an effective expense tracking system is essential to maintaining harmony in a shared living situation. To begin with, establish clear categories for all shared expenses. This can include utilities, groceries, cleaning supplies, and internet bills. Using software tools like Splitwise or even a simple spreadsheet can streamline this process, allowing everyone to see who owes what at any given time.When setting up the tracking, ensure every roommate has a say in the category allocation, fostering a sense of ownership and transparency.

Another pivotal aspect is ensuring regular updates and communication.Designate a specific day each month to review the expenses together. Keeping a shared document that is easily accessible can definitely help everyone stay informed about current balances and upcoming payments. This not only mitigates the potential for disputes but also encourages accountability. Additionally, consider organizing occasional house meetings to address any discrepancies or concerns, ensuring that every voice is heard and valued in the expense tracking journey.

Creative Solutions for Managing Shared and Individual Costs

When it comes to sharing living spaces, finding equitable ways to manage expenses can sometimes feel like navigating a minefield. Clear communication is key, so consider holding a monthly budget meeting with your roommates to discuss upcoming expenses.In addition to simply splitting rent, explore options such as:

- creating a shared spreadsheet to track shared costs like groceries, utilities, and internet.

- Setting up a joint account for communal expenses to streamline payments and reduce confusion.

- Using apps specifically designed for managing shared expenses, which allow you to easily split costs and send reminders.

Moreover, it’s essential to address individual costs thoughtfully. As an example, if one roommate frequently uses the living room for study sessions, consider adjusting the common space usage arrangements. You might also explore seasonal cost-sharing for shared items. A helpful way to visualize and manage these costs is through a simple table, where you can outline who pays what and when.Here’s an example:

| Item | Total Cost | roommate A | Roommate B | Roommate C |

|---|---|---|---|---|

| Rent | $1,200 | $400 | $400 | $400 |

| Utilities | $150 | $50 | $50 | $50 |

| Groceries | $300 | $100 | $100 | $100 |

This not only clarifies financial commitments but also fosters a collaborative approach to budgeting, leading to smoother roommate relationships.

Navigating Disputes and Maintaining Harmony Among Roommates

Finding the right balance in friendships while sharing living expenses can often lead to uncomfortable situations. to effectively navigate disputes, it’s vital to establish open communication right from the start. Regular household meetings can serve as a platform for all roommates to discuss any grievances, set household rules, and review budgetary concerns. Encourage everyone to express their views and listen actively, which can foster understanding and decrease the likelihood of resentment building up. This proactivity allows for a shared commitment to maintaining a peaceful living environment.

In addition to open dialogues, transparency about expenses can prevent misunderstandings. Consider using a shared digital spreadsheet or expense tracker app to log all shared costs in real time. This way, everyone can see where their money is going and ensure all roommates are on the same page. To make this process smoother, you might find the following table helpful in tracking recurring expenses:

| Expense | Amount | Frequency | Paid By |

|---|---|---|---|

| Rent | $1200 | Monthly | Roommate A |

| Utilities | $150 | Monthly | Roommate B |

| Groceries | $300 | biweekly | Roommate C |

| Internet | $60 | Monthly | Roommate D |

Wrapping Up

managing shared expenses with roommates can be a smooth and stress-free process when approached with the right strategies. By establishing clear communication, creating a realistic budget, and utilizing available tools and apps, you can foster a harmonious living environment while keeping financial tensions at bay. Remember, the goal is not just to split costs, but to build collaborative relationships that enhance your living situation.Whether you’re sharing an apartment for the summer or settling into a longer-term arrangement, implementing these smart strategies will ensure that everyone is on the same page, reducing misunderstandings and promoting accountability. With thoughtful planning and cooperation, you can turn what could be a burdensome chore into a seamless routine, allowing you and your roommates to focus on creating enjoyable memories together. Happy living!