Navigating Your Mortgage Journey: Smart Strategies for Securing a loan with Bad Credit

Buying a home is frequently enough considered the cornerstone of the American Dream, but for many, the path to homeownership can feel like a daunting uphill battle—especially for those grappling with bad credit. While credit scores play a significant role in mortgage approvals, they’re not the sole determinant of your eligibility. Fortunately, there are smart strategies and creative solutions that can help you secure a mortgage even with a less-than-ideal credit history. In this article, we’ll explore proven techniques, resources, and tips to empower you on your journey to homeownership. Whether you’re a first-time buyer or looking to refinance, understanding the mortgage landscape and arming yourself with knowledge can make all the difference. Let’s dive in and uncover how you can turn your dream of owning a home into a reality, despite past financial challenges.

Table of Contents

- Understanding the Impact of Bad Credit on Mortgage Options

- Exploring Alternative Lenders and Financing Solutions

- Strengthening Your Financial Profile Before Applying

- Key Tips to Improve Your Mortgage Approval Chances

- To wrap It Up

Understanding the Impact of Bad Credit on Mortgage Options

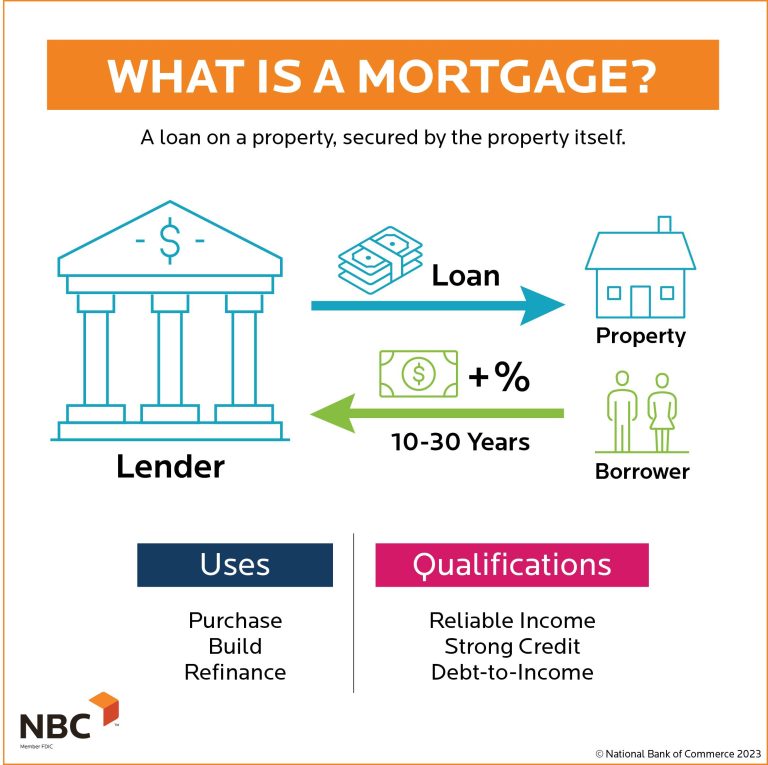

Bad credit can significantly limit your mortgage options, impacting both the type of loans you can qualify for and the terms you’ll receive. Lenders frequently enough view a low credit score as a higher risk, which can lead to higher interest rates, larger down payment requirements, or even denial of your mortgage submission. Understanding this dynamic is crucial for anyone hoping to buy a home with less-than-perfect credit. By comprehending the potential repercussions, borrowers can better prepare to address their credit history and improve their chances for approval.

Despite the challenges, there are strategies to navigate the mortgage landscape effectively. Consider the following actions to mitigate the impact of bad credit:

- Shop Around: Diffrent lenders have varying criteria. Some may offer loans to those with bad credit.

- Consider FHA Loans: These government-backed loans often accept lower credit scores.

- Document Income and Stability: Showcasing your ability to make payments can counterbalance a poor credit score.

- Get a Co-Signer: A co-signer with good credit can improve your chances of mortgage approval.

Additionally, improving your credit score before applying can open doors to more favorable mortgage terms. A simple table outlining some speedy credit boost tactics can be a helpful reference for prospective homeowners:

| Action | Estimated time frame |

|---|---|

| Pay Down Debt | 1-3 Months |

| Make Payments on Time | 1 Month and ongoing |

| Review and Correct credit Report Errors | 1-2 Months |

| Limit New Credit Applications | Ongoing |

Exploring Alternative Lenders and Financing Solutions

When customary lenders turn you down, it may be time to consider alternative financing options. Many borrowers with bad credit are unaware of the opportunities available through alternative lenders, who often employ more flexible criteria. These lenders include credit unions, peer-to-peer lending platforms, and online mortgage providers. By leveraging these resources, borrowers can gain access to loans tailored to their specific circumstances, even with a less-than-stellar credit history. Exploring these options can open doors, so it’s essential to conduct thorough research and compare interest rates, fees, and repayment terms.

Another potential solution is seeking out specialized mortgage programs designed for individuals with credit challenges. Frequently enough supported by state or federal initiatives, these programs may offer benefits such as lower down payments and reduced interest rates. It’s also worthwhile to connect with non-profit credit counseling services, who can guide you through improving your financial profile and may provide lists of reputable alternative lenders. Below is a table that outlines key features of various financing options:

| Financing Option | pros | Cons |

|---|---|---|

| Credit Unions | Lower interest rates,personalized service | Membership requirements |

| Peer-to-Peer Lending | flexible terms,speed of approval | May require higher interest rates |

| Online Mortgage Lenders | Convenience,competitive rates | Limited personal interaction |

Strengthening Your Financial Profile Before Applying

Before embarking on the journey to secure a mortgage,especially with a less-than-stellar credit score,it’s essential to undertake measures that enhance your financial standing. Start by assessing your current credit report.You can access your report for free annually from various services. Make sure to dispute any inaccuracies you find, as corrections can lead to an enhancement in your credit score. Additionally, it’s wise to focus on paying down existing debts. High credit utilization ratios can negatively impact your score; thus, aim to reduce your balances below 30% of your available credit limit. Consistently paying your bills before their due dates can also signal to lenders that you’re reliable and financially responsible.

Furthermore, building a solid savings history can significantly influence lenders’ perceptions. Show them you’re capable of managing finances effectively by maintaining a separate fund for emergencies. A healthy savings account demonstrates your ability to handle unforeseen circumstances. Consider listing your assets and income as well to provide a extensive picture of your financial health. Below is a simple table that outlines key components of your financial profile that lenders may evaluate:

| Financial Component | Importance |

|---|---|

| Credit Score | Indicates your creditworthiness |

| Debt-to-income Ratio | Measures your ability to manage monthly payments |

| Emergency Savings | Shows financial stability |

| Employment History | Assesses job stability |

Key tips to Improve Your Mortgage Approval Chances

Improving your odds of getting a mortgage with less-than-stellar credit involves several proactive steps. First, ensure that all your financial documents are organized and accurate. Lenders will review your income, assets, and debts, so keeping your paperwork in check lays a strong foundation. Additionally, address any discrepancies on your credit report prior to applying; errors can have a significant impact on your credit score. an organized financial profile will not only speed up the approval process but can also reinforce your credibility with lenders.

Moreover,consider seeking out 合作贷款者,or co-signers,who have better credit. This can greatly enhance your chances of approval, as lenders feel more secure when a qualified individual is backing your loan. Don’t hesitate to explore different financing options, including government-backed loans, which may have more lenient qualification criteria. Another essential tip is to maintain a steady employment history, as stability in your job can reassure lenders of your ability to repay the mortgage.

To Wrap It Up

securing a mortgage with bad credit may seem daunting, but with the right strategies and a proactive mindset, it is indeed absolutely achievable. By understanding your financial landscape, exploring various lending options, and demonstrating your commitment to improving your credit score, you can pave the way for a triumphant home purchase. Remember, every journey begins with a single step, and arming yourself with knowledge is the most powerful tool you have.

Whether you’re considering a government-backed loan, seeking out specialized lenders, or looking to leverage a co-signer, know that there are paths available to help you fulfill your dream of homeownership. Stay informed, keep a pulse on your financial health, and don’t hesitate to seek guidance from financial professionals who can provide tailored advice for your situation.

Your credit history doesn’t have to define your future. With persistence and smart planning,you can turn your homeownership aspirations into reality. Thank you for joining us on this journey to navigate the path of securing a mortgage with bad credit. Here’s to your future in your new home!