in today’s dynamic job market, salary changes can be both an exciting opportunity and a potential source of financial strain. Weather you’re celebrating a well-deserved raise or grappling with a pay cut, effectively managing your budget is crucial to maintaining financial stability and achieving your long-term goals. Smart budgeting goes beyond simple expense tracking; it involves strategic planning and adaptability to navigate the uncertainties that come with changes in income.In this article, we will explore practical tips and techniques for adjusting your budget in response to salary fluctuations, ensuring that you not only weather the transition with confidence but also position yourself for future success. Join us as we delve into the principles of smart budgeting, empowering you to take control of your finances and embrace every twist and turn in your career journey.

Table of Contents

- Understanding Salary Changes and Their Impact on Financial Health

- Key Strategies for Adjusting Your Budget During Salary fluctuations

- Maximizing Savings and Investments Amid Salary Variability

- Tools and Resources for Effective Budget Management in Transitioning Times

- To Wrap It Up

Understanding Salary Changes and Their Impact on Financial Health

Salary changes can have a profound impact on your overall financial health, making it essential to understand how these adjustments affect your budgeting strategy. Whether you receive a pay raise or experience a salary cut, what matters most is how you respond. A pay increase presents an opportunity to enhance your savings or bolster your investment portfolio, whereas a decrease may necessitate urgent reassessment of your spending habits. Here are some strategies to consider:

- Evaluate Your Current Budget: review your existing expenses to identify areas for potential cuts.

- Prioritize Savings: Aim to allocate a portion of any increased income to savings or retirement funds.

- Consider Lifestyle Adjustments: If faced with a salary reduction, explore ways to maintain your lifestyle while spending less.

to illustrate the financial impact of salary changes, the table below offers a simple comparison of budget adjustments based on a hypothetical salary increase and decrease:

| Scenario | New Salary | Potential Savings | Adjusted Spending |

|---|---|---|---|

| Salary Increase | $70,000 | $10,000 | $42,000 |

| Salary Decrease | $50,000 | $5,000 | $40,000 |

Understanding these dynamic factors will empower you to make informed decisions regarding financial planning, ensuring you remain resilient in the face of salary fluctuations.

Key Strategies for Adjusting Your Budget During Salary Fluctuations

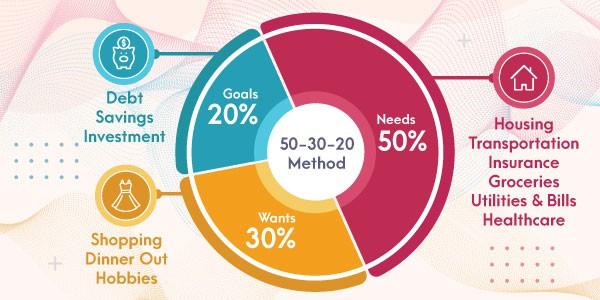

When facing fluctuations in your salary, it’s crucial to rethink your financial strategy to maintain control over your expenses. Begin by categorizing your spending into essential and non-essential items. This will allow you to identify areas where cuts can easily be made if necessary. Consider implementing the following strategies:

- Establish a flexible budget: Adjust your budget monthly based on your income fluctuations. This ensures you’re only allocating funds to essential expenses when finances are tight.

- Build an emergency fund: Aim to save at least three to six months’ worth of expenses to buffer against income instability.

- Prioritize debt repayment: Focus on paying down high-interest debts first to free up cash flow for other necessities.

To visualize your financial position, consider using a simple budget table that highlights your income versus expenses. This can help track where your money goes and where adjustments can be made:

| Category | Monthly Budget | Actual Spending |

|---|---|---|

| housing | $1,200 | $1,200 |

| Groceries | $400 | $350 |

| Utilities | $250 | $275 |

| Entertainment | $150 | $80 |

| Savings | $300 | $200 |

By maintaining visibility over your financial commitments and practicing conscious spending, you can better navigate through times of salary uncertainty without overwhelming stress.

Maximizing Savings and Investments Amid Salary Variability

To navigate the uncertainties of salary fluctuations, it’s essential to adopt a proactive approach to savings and investments. Creating an emergency fund should be your top priority, ensuring you have three to six months’ worth of living expenses set aside. This fund acts as a financial buffer, allowing you to weather any storms without derailing your long-term financial goals. Consider allocating a percentage of your income into a high-yield savings account, which offers both liquidity and interest accumulation. In addition, setting up automatic transfers to this account can definitely help enforce discipline and consistency in building your savings.

For those experiencing irregular income, prioritizing investments can feel challenging, yet it’s crucial for wealth building. Establish a diversified investment strategy that remains flexible enough to accommodate your financial circumstances. This may involve:

- Index funds or ETFs for low-cost, broad market exposure

- Robo-advisors that tailor investment portfolios based on risk tolerance

- Retirement accounts like IRAs or 401(k)s, ideally maximizing any employer match

To manage your investments effectively, consider creating a simple overview table:

| Investment Type | Benefits | Considerations |

|---|---|---|

| Index Funds | Diversification, low fees | Market risk, long-term horizon |

| Robo-Advisors | Automated management, low effort | Less control, potential fees |

| Retirement Accounts | Tax advantages, compounding growth | Withdrawal limits, early penalties |

Tools and Resources for Effective Budget Management in Transitioning Times

Managing your budget effectively during transitional periods, such as changes in salary, requires the right set of tools and resources. Start by exploring budgeting apps that simplify tracking your income and expenses.Popular options include:

- You Need a Budget (YNAB) – Encourages proactive budgeting and helps you allocate every dollar.

- Mint – Offers a extensive overview of your financial health and spending patterns.

- everydollar – A user-kind tool for zero-based budgeting.

Along with apps, utilizing financial education resources can significantly enhance your budgeting skills. Consider the following:

- Online Courses – Websites like Coursera and Udemy offer courses on personal finance and budgeting.

- Podcasts – Tune into financial podcasts that focus on budget management strategies.

- Books – Read influential books such as “The Total Money Makeover” by Dave Ramsey.

| Resource Type | Recommended Tools/Resources | Key Benefit |

|---|---|---|

| Budgeting Apps | You Need a Budget, Mint, EveryDollar | Real-time tracking and easy expense management |

| Financial Education | Online Courses, Podcasts, Books | Increased knowledge for better financial decisions |

To Wrap It Up

navigating salary changes with smart budgeting is not just about adapting to a new financial landscape; it’s about seizing the opportunity to reassess our priorities and goals. As we’ve explored, a strategic approach to budgeting can empower you to not only manage your finances during times of change but also to thrive in them. Whether you’re welcoming a raise, coping with a pay cut, or transitioning to a different income level, the key lies in versatility, foresight, and informed decision-making.

Remember, effective budgeting is an ongoing process that requires regular reflection and adjustment. By staying proactive and embracing a growth mindset, you can turn salary fluctuations into a stepping stone for achieving your long-term financial aspirations. Be sure to revisit your budget often, track your progress, and don’t hesitate to seek professional advice when needed. Ultimately,with the right tools and mindset,you can master the art of smart budgeting and navigate your financial journey with confidence.

Thank you for reading, and here’s to your success in making every dollar count!