In today’s fast-paced financial landscape, unexpected expenses can arise at any moment. For many, payday loans have emerged as a rapid solution to bridge the gap between paychecks. While these loans can provide immediate relief,they come with a unique set of risks that can quickly spiral into a financial dilemma. In this article, we will explore the complexities of payday loans, offering practical insights to help you navigate this often-misunderstood financial tool. From understanding the high costs associated with these loans to exploring safer alternatives, our goal is to equip you with the knowledge you need to make informed decisions. Join us as we delve into the world of payday loans and uncover strategies to protect your financial well-being.

Table of Contents

- Understanding the True Cost of Payday Loans

- Identifying the Risks Associated with Short-Term Borrowing

- Strategies for Responsible Borrowing and repayment

- Alternatives to Payday Loans: Exploring Better Financial Options

- The conclusion

Understanding the True Cost of Payday Loans

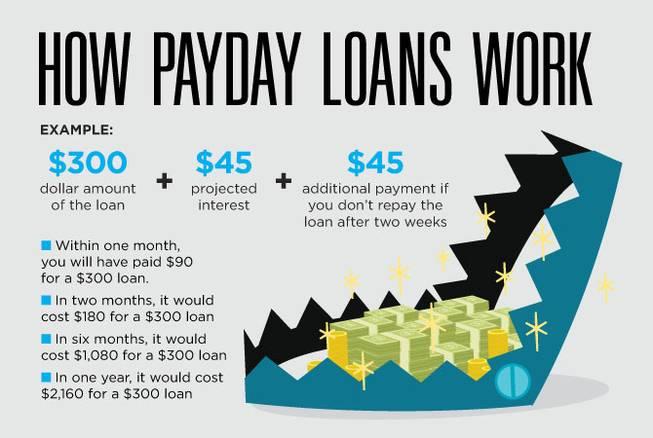

Payday loans, while often marketed as quick solutions for financial emergencies, come with hidden costs that can be staggering.Borrowers frequently overlook the cumulative interest rates that can exceed 400% annually, making a loan of just a few hundred dollars become a financial burden well beyond what was initially anticipated. Additionally, due to their short repayment terms, these loans can create a cycle of debt, where individuals find themselves continuously borrowing just to pay off previous loans. This cycle can result in missed payments, which not only incurs additional fees but can also damage one’s credit score, complicating future borrowing options.

When assessing payday loans, it’s crucial to consider the entire cost structure beyond just the principal amount borrowed. Key factors include:

- Origination fees

- Late payment penalties

- Potential bounce fees from your bank

- Collection fees if the loan goes unpaid

Understanding these elements can help you make a clearer comparison against other borrowing options, such as personal loans or credit unions that offer more favorable terms. Below is a simplified comparison of costs associated with payday loans versus traditional lending options:

| Loan type | Average APR | Typical Repayment Period |

|---|---|---|

| Payday Loan | 400%+ | 2-4 weeks |

| Personal Loan | 10%-36% | 1-5 years |

| Credit Union Loan | 8%-20% | 6 months – 5 years |

this comparison underscores the critical need to evaluate the true cost of payday loans and consider alternatives that offer better financial health and sustainability in the long term.

Identifying the Risks Associated with Short-Term Borrowing

Short-term borrowing options, such as payday loans, can present a range of potential risks that borrowers must be fully aware of before proceeding. One of the primary concerns is the high interest rates associated with these loans, which can lead to a debt cycle that is difficult to escape. The fast-paced approval process often leads to hasty decisions without a thorough understanding of the terms and conditions, putting borrowers in precarious financial situations. Additionally, borrowers may face hidden fees that can significantly inflate the total repayment amount, further complicating their ability to repay the loan on time.

Another noteworthy risk is the pervasive reliance on payday loans, which can hinder an individual’s credit score if payments are missed or defaults occur. This can create long-term financial repercussions that extend well beyond the initial loan period.Furthermore, borrowers may encounter legal actions from lenders in case of nonpayment, leading to potential wage garnishment or lawsuits.To mitigate these risks, individuals should carefully assess their personal financial situations, consider alternative options, and ensure they have a clear repayment strategy in place.

strategies for Responsible Borrowing and Repayment

Responsible borrowing begins with a clear understanding of your financial situation. Before taking out a payday loan, take time to assess your current income and expenses. Create a detailed budget that highlights your essential costs—such as housing,food,and utilities—and identifies areas where you can cut back if necessary. This exercise will help ensure that any borrowed amount will be manageable and that you can commit to timely repayment without causing financial strain. Consider these additional tips:

- Only borrow what you need to cover immediate expenses.

- Prioritize loans with lower interest rates and fees.

- Explore alternatives to payday loans, such as credit unions or community support programs.

Once you have secured a payday loan, establish a repayment strategy that aligns with your budget.It’s essential to plan for repayment ahead of time to avoid getting trapped in a cycle of debt. You might consider setting aside a portion of your income each payday specifically for loan repayment. Here’s a simple table to help you visualize your repayment plan:

| Pay Period | Amount Allocated to Repayment | Remaining Post-Repayment |

|---|---|---|

| Week 1 | $150 | $850 |

| Week 2 | $150 | $700 |

| week 3 | $150 | $550 |

| week 4 | $150 | $400 |

By documenting and regularly checking your progress, you can maintain control over your debt and protect your financial health. Embrace open communication with lenders if you find yourself struggling with repayment; they may offer flexibility or alternative solutions.

Alternatives to Payday Loans: Exploring Better Financial Options

When faced with financial emergencies, there are several alternatives to consider that can help you avoid the pitfalls of payday loans. Credit unions frequently enough offer lower interest rates and more favorable repayment terms on small personal loans. Additionally, they typically require membership, which may include a small fee or joining a local community. Another viable option is borrowing from family or friends, as they might provide interest-free loans or more flexible repayment schedules that are more accommodating to your financial situation.

For those looking to manage unexpected expenses without the burden of high-interest loans, budgeting and savings strategies are essential. Consider exploring personal installment loans from reputable lenders, which feature fixed payments and longer repayment periods. Further options include negotiating payment plans or seeking assistance from local charities or non-profit organizations that provide financial aid.Below is a simple comparison of these alternatives:

| Option | Interest Rates | repayment Terms |

|---|---|---|

| credit Union Loans | 5% – 15% | Varies (up to 3 years) |

| Family/Friends | 0% – 5% | Flexible |

| Personal installment Loans | 6% – 36% | 1-5 years |

| Charity Assistance | 0% | Varies |

The Conclusion

navigating the complex landscape of payday loans requires a careful understanding of both the potential risks and the practical strategies for managing them. while these short-term financial solutions may seem appealing in times of urgent need, they come with significant costs that can lead to a cycle of debt if not approached with caution. Equipping yourself with knowledge is essential—by assessing your financial situation, exploring alternatives, and understanding the terms and conditions of any loan agreement, you can make informed decisions that align with your long-term financial health.

Remember, it’s crucial to weigh your options and consider resources like credit counseling or personal loans before resorting to payday loans. the key is to empower yourself with insights and strategies that will help you navigate the financial landscape more effectively. By doing so, you can avoid the pitfalls and make responsible choices that lead to a more secure financial future. Thank you for reading, and take the next step towards financial empowerment today!