In an era where financial adaptability is often just a click away,payday loans have emerged as a tempting solution for many individuals facing unexpected expenses or temporary cash shortages. While these short-term loans promise quick access to funds, thay come wiht a unique set of risks and challenges that can leave borrowers in a precarious financial position. In this article, we delve into the world of payday loans, unraveling their mechanics, examining the potential pitfalls, and providing key insights to empower you to make informed decisions. Whether you’re considering a payday loan or simply trying to understand the landscape of choice financing options,our extensive guide will equip you with the knowledge you need to navigate these turbulent waters safely. Join us as we explore the delicate balance between urgent financial needs and the risks associated with payday lending, and discover strategies for managing your finances more effectively.

Table of Contents

- Understanding the High Stakes of Payday Loans

- evaluating the True Cost: Interest Rates and Fees

- Exploring Alternatives to Payday Loans for Financial Relief

- tips for Responsible Borrowing and Making Informed Choices

- To Conclude

Understanding the High Stakes of Payday Loans

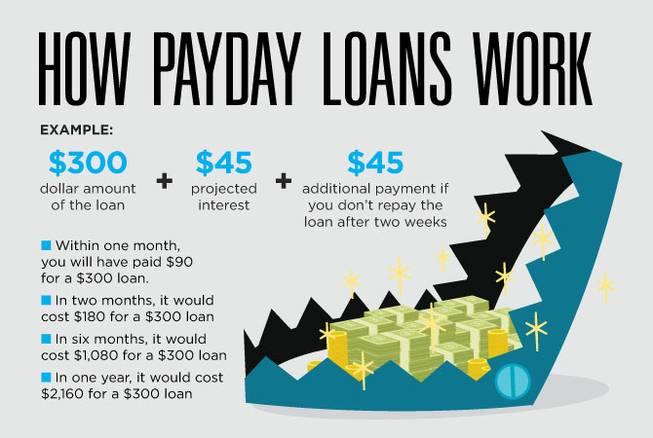

Payday loans are often marketed as quick fixes for urgent financial needs, but borrowers can find themselves facing severe consequences. The high interest rates associated with these loans frequently lead to a cycle of debt, where individuals take out new loans to pay off existing ones.In many cases, defaulting can result in hefty fees or even legal action, further complicating an already difficult financial situation.The ease of access to payday loans can create the illusion of affordability, but many borrowers do not fully understand the implications of repayment terms and the long-term costs involved.

It’s crucial for consumers to be aware of several key risks when considering payday loans:

- Debt Spiral: One loan often leads to another, trapping borrowers in a relentless loop of debt.

- Impact on Credit Score: Missed payments can severely damage credit ratings.

- Legal Repercussions: Lenders may pursue legal action for defaulted loans, leading to court fees.

- High Fees and Interest: Often, the total repayment amount far exceeds the original loan.

Understanding these risks is essential for anyone considering taking out a payday loan.

Evaluating the True Cost: Interest rates and Fees

Understanding the comprehensive expenses associated with payday loans is crucial for anyone considering this borrowing option. The interest rates on payday loans are frequently enough exorbitantly high, frequently ranging from 300% to over 1,000% APR. This means that while the initial loan amount might seem manageable, the cumulative cost can spiral out of control if the loan is not repaid promptly. Along with interest,borrowers should be aware of various fees that may accompany the loan,including application fees,late payment fees,and rollover fees if the loan is extended. It’s essential to calculate the total repayment cost before committing to a loan arrangement.

To better illustrate the potential costs,let’s take a look at a simple example in the table below,showing the implications of a $500 payday loan with a 400% APR over a two-week period:

| Loan Amount | Interest Rate | Interest for 2 Weeks | Total Repayment Amount |

|---|---|---|---|

| $500 | 400% APR | $100 | $600 |

Beyond direct costs,it’s wise to consider the impact on your finances. If you’re unable to repay on time, you may find yourself caught in a cycle of debt that can aggressively compound. To mitigate these risks,consider the following strategies:

- Read the fine print: Always review the loan agreement to fully understand all terms and conditions.

- Create a repayment plan: Before borrowing, establish a robust budget to ensure you can repay the loan on time.

- Explore alternatives: Look for other financing options, such as personal loans from credit unions or family support.

Exploring Alternatives to Payday Loans for Financial Relief

For those seeking financial relief without the burdensome terms of payday loans, several alternatives can provide a crucial lifeline. These options frequently enough come with more transparent lending practices and favorable repayment terms, making them a smarter choice for many consumers.Consider exploring the following alternatives:

- Credit Unions: Many credit unions offer small, low-interest loans tailored for members facing financial difficulties.

- Personal Installment Loans: Unlike payday loans,these loans allow consumers to repay amounts in manageable installments over time.

- Payment Plans: Some service providers, such as utility companies, may offer flexible payment plans that can ease immediate financial burdens.

- Crowdfunding: Websites that allow individuals to raise funds for personal needs through community support can be an innovative way to secure financial help.

Another promising option is to tap into assistance programs offered by non-profit organizations or government bodies. These programs often provide emergency funds or assistance for specific needs such as housing, food, or medical costs.The table below summarizes some potential resources:

| Resource type | Description | Where to Find |

|---|---|---|

| Emergency Assistance Programs | Financial help for immediate needs like housing or food. | Local non-profits or government websites |

| Community Grants | Financial aid focused on specific community needs. | Civic organizations or local foundations |

| Financial Literacy Workshops | Training on budgeting and managing finances effectively. | Community colleges or libraries |

Tips for Responsible borrowing and Making Informed Choices

When considering a payday loan, it’s essential to approach this decision with caution and a clear understanding of your financial situation. Take the time to evaluate your needs and ensure you truly require the funds. Remember to assess your budget thoroughly to avoid a cycle of debt. Here are some key considerations to keep in mind:

- Understand the total cost: Before borrowing, calculate the full repayment amount, including interest and fees.

- Shop around for rates: not all lenders offer the same terms; compare different payday loan providers.

- Check for alternatives: Explore other options, such as personal loans or assistance programs, which might have more favorable terms.

Once you’ve decided to proceed, maintain responsible borrowing practices to safeguard your financial health. Develop a repayment plan that aligns with your cash flow to prevent defaulting on the loan. Keeping track of your financial commitments is crucial. Consider creating a simple table to monitor your income and expenses:

| Income/Expense | Amount |

|---|---|

| Monthly Income | $3,000 |

| Payday Loan Payment | -$500 |

| Other Expenses | -$2,200 |

| Remaining Balance | $300 |

To Conclude

navigating the world of payday loans requires a careful balance of understanding their potential benefits and inherent risks.While these short-term financial solutions can provide immediate relief during times of need, it is crucial to approach them with caution and thorough research. By arming yourself with the insights shared in this article, you can make informed decisions that align with your financial goals and long-term stability.

Always remember to explore alternative options and seek advice before committing to any loan. Your financial well-being is paramount, and prioritizing a clear understanding of your choices will serve you well in the long run. If you find yourself in need of assistance, consider reaching out to financial advisors or exploring local resources that can provide guidance tailored to your situation.

Thank you for joining us in this exploration of payday loans. we hope this article has shed light on the complexities of these financial instruments and empowered you to navigate them more confidently. Stay informed, stay proactive, and take charge of your financial health!