In today’s fast-paced financial landscape,understanding loans and credit is more crucial than ever. Whether you’re looking to buy your first home,finance a new car,or simply manage your day-to-day expenses,the choices you make regarding loans and credit can have a lasting impact on your financial health. With a myriad of options available—from personal loans to credit cards—navigating this complex territory can feel overwhelming.That’s why we’ve created this complete guide to help demystify the world of loans and credit. We’ll walk you through the essentials, from understanding interest rates and credit scores to uncovering the best practices for responsible borrowing. Armed with this knowledge, you’ll be better prepared to make informed decisions that align with your financial goals, ensuring a more secure and prosperous future. Join us as we delve deeper into the intricacies of loans and credit, equipping you with the tools you need to succeed.

Table of Contents

- Understanding Different Types of Loans and Their uses

- Building and Maintaining a Strong Credit Score

- Strategies for Smart Borrowing and Debt Management

- Navigating Loan Applications and Approval Processes

- To Wrap It Up

understanding Different Types of Loans and Their Uses

When it comes to financing personal or professional needs, understanding the various types of loans available can make a significant difference. These loans can be broadly categorized based on their purpose and the terms associated with them. Some common types include:

- Personal Loans: Unsecured loans used for a variety of expenses, such as consolidating debt or funding home improvements.

- Mortgage Loans: Secured loans specifically for purchasing real estate, typically involving long repayment terms and interest rates.

- Auto Loans: Loans used to purchase vehicles, often secured by the vehicle itself.

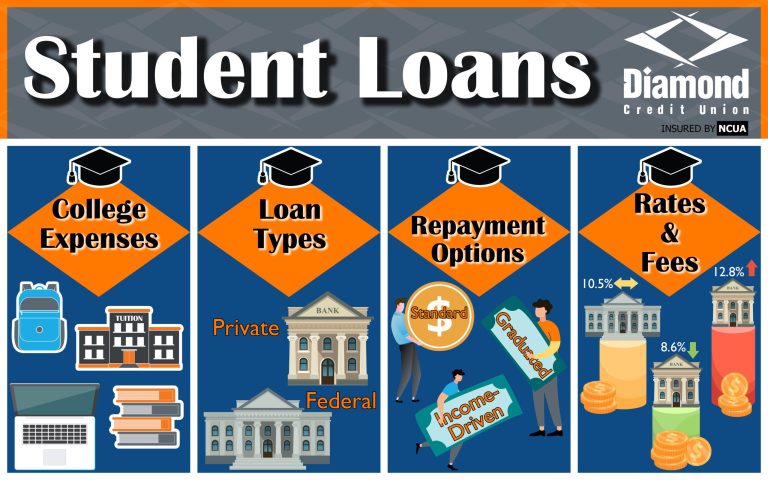

- Student Loans: Designed to help students cover the costs of higher education, these loans can be federal or private.

- Business Loans: Funding for business purposes, which can range from starting a new company to expanding an existing one.

Each type of loan comes with its unique terms and conditions. For instance, personal loans often have higher interest rates due to their unsecured nature, while mortgages generally have lower interest rates spread across longer terms. When evaluating different loan options, consider the following factors:

| Loan Type | Typical Interest Rates | Repayment Term |

|---|---|---|

| Personal loan | 6% - 36% | 1 – 7 years |

| Mortgage Loan | 3% – 6% | 15 – 30 years |

| Auto Loan | 3% – 10% | 2 – 7 years |

| Student Loan | 3% - 7% | 10 – 25 years |

| Business Loan | 4% – 13% | 1 – 10 years |

Building and Maintaining a Strong Credit Score

Establishing a strong credit score is essential not only for securing loans but also for ensuring favorable interest rates and terms. The foundation of a healthy credit profile lies in a few core principles. Focus on the following factors to enhance and maintain your credit standing:

- Timely Payments: Always pay your bills on time to demonstrate reliability.

- Credit Utilization: Aim to keep your credit utilization ratio below 30% to show that you’re not overly reliant on borrowed funds.

- Diverse Credit Mix: Having a variety of credit accounts, such as credit cards and installment loans, can positively impact your score.

- Regular Monitoring: Check your credit report periodically for accuracy and address any discrepancies quickly.

Along with these tips, consider creating a budget that allows you to plan for larger expenses, thereby minimizing the need for high-interest loans. If necessary, seek assistance from a credit counseling service to devise a personalized strategy to improve your score. Below is a summary of how long various factors can affect your credit score recovery:

| Factor | Effect Duration |

|---|---|

| Late Payments | Up to 7 years |

| Credit Inquiries | 2 years |

| Bankruptcies | Up to 10 years |

Strategies for Smart Borrowing and Debt Management

Borrowing money can be a smart move when done strategically, so it’s crucial to approach loans with a clear plan in mind. Start by assessing your financial health; know your income, expenses, and credit score before taking on any new debt. This knowledge will empower you to make informed decisions about the type and amount of credit you need. It’s also vital to compare loan options diligently. Look for the best interest rates and repayment terms, and consider choice sources like credit unions or community banks, which may offer more favorable terms than traditional banks.

Once you’ve secured a loan, effective debt management is essential to maintaining your financial wellbeing. Create a budget that incorporates all your loan payments and stick to it to avoid overspending. Consider setting up automatic payments to ensure you never miss a due date, helping you maintain a positive credit history. Additionally, prioritize high-interest debts first, as they can accumulate quickly, leading to deeper financial issues.Track your progress and celebrate small wins along the way to motivate yourself in managing your overall debt responsibly.

Navigating Loan Applications and approval Processes

Applying for a loan can frequently enough feel like navigating a maze; though, understanding the application process can significantly streamline your experience. First, gather the necessary documentation, which typically includes proof of income, credit history, and identification. Different lenders may have specific requirements, so make sure to research and prepare accordingly. Once you’ve organized your information, consider the following steps:

- compare lenders: Assess the interest rates, fees, and customer service.

- Pre-approval: Seek pre-approval to understand how much you can borrow, which strengthens your position as a borrower.

- Complete the application: Fill out the application form accurately, ensuring all information is up-to-date.

After submission, the lender will evaluate your application using several factors, primarily focusing on your credit score, debt-to-income ratio, and employment history. To provide a clearer understanding of potential approval timelines, refer to the table below, highlighting typical processing times based on loan type:

| Loan Type | typical Processing Time |

|---|---|

| Personal Loan | 1-3 days |

| Mortgage | 30-60 days |

| Auto loan | 1 week |

To Wrap It up

navigating the world of loans and credit can seem daunting, but armed with the right knowledge and strategies, you can take control of your financial future.Understanding the intricacies of different loan types, credit scores, and interest rates is essential for making informed decisions that align with your goals. Remember, it’s not just about borrowing money—it’s about building a solid foundation for your financial health.

As you embark on this journey, take the time to assess your personal situation, compare options, and seek advice when needed. Whether you’re planning to buy a home, finance your education, or simply manage your day-to-day expenses, a well-planned approach to loans and credit can pave the way for lasting success.

Thank you for joining us on this exploration of loans and credit. We hope this comprehensive guide has provided valuable insights and practical tips to help you navigate your financial landscape with confidence. Stay informed, stay proactive, and remember: the choices you make today can lead to a brighter tomorrow. happy financial planning!