In today’s economic climate, the term “inflation” ofen dominates headlines, sparking discussions that can leave even the most seasoned consumers feeling anxious. As prices rise and purchasing power fluctuates, understanding how inflation impacts your personal finances has never been more critical. Whether you’re a homeowner, a renter, or a savvy saver, the effects of inflation can ripple through every aspect of your financial landscape. In this article,we’ll delve into the complexities of inflation,unpack its implications for your day-to-day expenses,investments,and savings strategies,and provide actionable insights to help you navigate these turbulent waters with confidence. Join us as we explore ways to protect your financial well-being and make informed decisions in a world where economic uncertainties abound.

Table of Contents

- Understanding Inflation and Its Impact on Consumer Purchasing Power

- Strategies for Budgeting in an Inflating Economy

- Investment Opportunities and Risks During Inflationary Periods

- Long-Term Financial Planning: Adapting to Rising Costs

- Key Takeaways

Understanding Inflation and Its Impact on Consumer Purchasing Power

Inflation is an economic phenomenon characterized by the general increase in prices and a decline in the purchasing power of money. As inflation rises,consumers find that their dollars stretch less far,resulting in a shift in how they allocate their budgets. Understanding the nuances of inflation can help individuals make informed financial decisions.Key factors include:

- Cost of Living Adjustments: Prices for essential goods, such as food and housing, tend to increase, prompting consumers to reassess their spending habits.

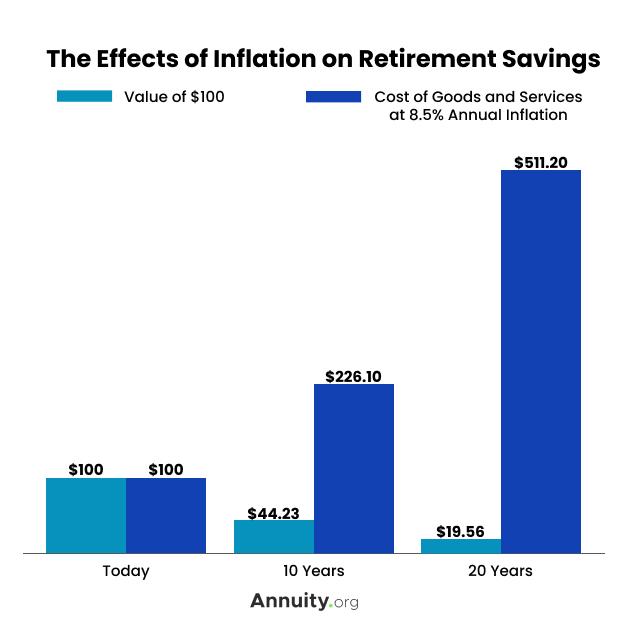

- Savings Erosion: Inflation diminishes the real value of cash savings, making it crucial to consider investment options that can outpace inflation.

- Interest Rates: Central banks often raise interest rates to combat inflation, impacting borrowing costs for consumers on loans and credit cards.

The relationship between inflation and consumer purchasing power is particularly evident when examining changes in wages versus rising prices. Although many employers offer pay raises to keep up with inflation, the reality is that these adjustments often lag behind the rate of price increases. The table below highlights a comparison between last year’s wage growth and inflation rates:

| Year | Wage Growth (Annual %) | Inflation Rate (Annual %) |

|---|---|---|

| 2022 | 3.5% | 7.0% |

| 2023 | 4.0% | 5.5% |

As you can see,even with nominal wage growth,the effects of inflation can lead to stagnant or declining real income,creating challenges for maintaining financial stability. therefore, staying informed about inflation trends and adjusting financial strategies accordingly is essential for protecting your overall purchasing power.

Strategies for budgeting in an Inflating Economy

Amid the challenges of rising prices,adjusting your budgeting strategies can make a critically important difference in managing your personal finances. First,consider revising your budget categories to reflect current economic conditions. Focus on essential spending and identify areas where you can cut back. As an example, you might prioritize your necessities—like housing, food, and healthcare—while temporarily reducing discretionary spending on luxury items or entertainment. This can help you maintain financial stability amid fluctuating prices.

Moreover, it’s crucial to keep a close eye on your savings and investment strategies.To combat inflation, you may want to allocate a portion of your budget towards inflation-resistant assets, such as inflation-linked bonds or certain commodities. Consider reworking your savings plans by taking advantage of high-interest savings accounts or certificates of deposit (CDs) that offer better returns in an inflating environment. Keep in mind these effective practices that may aid you:

- Track your expenses: Regularly review your spending to ensure accountability.

- Emergency fund: Build or maintain a cash reserve for unexpected costs.

- Negotiate bills: Don’t hesitate to contact service providers for better rates.

- Use budgeting apps: Leverage technology to help streamline your tracking.

Investment Opportunities and risks During Inflationary Periods

Inflation can present a mix of opportunities and challenges for investors looking to build wealth. Equities often act as a hedge against inflation, as companies may pass increased costs onto consumers, maintaining their profit margins. Real estate also tends to retain value and generate rental income during inflationary periods, providing both capital appreciation and cash flow. Investors might consider diversifying their portfolios with:

- Commodities: Gold and natural resources can hold their value and appreciate.

- Inflation-Protected Securities: TIPS (Treasury Inflation-Protected Securities) adjust with inflation rates, preserving purchasing power.

- Dividend-Paying Stocks: Companies that consistently increase dividends can provide a hedge as payouts frequently enough grow with inflation.

However,with opportunities come risks that necessitate careful evaluation. High inflation can lead to increased interest rates, which might negatively impact bond prices and borrowing costs. Consumer behavior also shifts, which can affect sectors differently; for example, luxury goods may see reduced demand. Potential risks include:

- Stock Volatility: Prices can fluctuate wildly as market sentiments shift with inflation news.

- Increased Costs: Businesses might face squeezed margins due to rising input costs, impacting profitability.

- Reduced Consumer Spending: As households allocate more of their budget to necessities, discretionary spending sectors could suffer.

| Investment Type | Pros | Cons |

|---|---|---|

| Equities | Potential for growth | Market volatility |

| Real Estate | Income generation | Illiquidity |

| TIPS | Inflation protection | Lower yields compared to regular bonds |

Long-Term Financial Planning: adapting to Rising Costs

As inflation continues to rise, it’s crucial to rethink your long-term financial strategies. Budgeting plays an essential role in this process. Start by evaluating your current spending habits and identifying areas where you can cut back without sacrificing quality of life.Adjusting your spending to accommodate increasing prices can help maintain your financial health. Consider allocating a portion of your budget specifically for essential expenses, and keep a close eye on discretionary spending. This proactive approach can protect your finances from the unpredictable nature of inflation.

Investing wisely is another key aspect of adapting to a changing financial landscape.Explore various options to ensure your money grows at a pace that outstrips inflation. Here’s a speedy overview of some investment avenues:

- Stocks: Consider diversifying your portfolio with companies known for price resilience.

- Real Estate: Invest in properties that can provide rental income, which often adjusts with inflation.

- Commodities: Think about allocating funds to gold or other commodities as a hedge against inflation.

Additionally, it’s wise to revisit your retirement plan. Creating a robust strategy that includes inflation-adjusted returns can improve your financial security over time:

| Financial Goal | Inflation-Adjusted Strategy |

|---|---|

| Emergency Fund | Increase contributions regularly to keep pace with inflation. |

| Retirement Savings | Utilize tax-advantaged accounts that compound growth over time. |

| Debt Management | Focus on paying down high-interest debt,which can erode financial health. |

Key Takeaways

As we conclude our exploration of inflation and its multifaceted effects on personal finances,it’s clear that staying informed and proactive is key to navigating these economic shifts.While inflation presents challenges—ranging from rising costs of living to the potential erosion of savings—there are also opportunities to adapt and strengthen your financial strategy.

By understanding the nuances of inflation and implementing smart budgeting practices, exploring investment options, and monitoring your spending habits, you empower yourself to weather economic fluctuations more effectively. Remember, financial resilience isn’t just about weathering the storm; it’s about being prepared to thrive amidst the uncertainties that may come your way.

Continue to educate yourself, seek professional advice when needed, and adjust your financial approaches as circumstances change. With the right tools and a forward-thinking mindset, you can not only navigate inflationary pressures but also position yourself for long-term stability and growth. Thank you for joining us on this journey through inflation’s impact on our lives—stay financially savvy, and we look forward to providing you with more insights in the future!