In today’s complex financial landscape, achieving long-term wealth and security requires more than just saving diligently; it demands strategic planning and informed decision-making. Whether you’re embarking on your first investment journey, navigating the intricacies of retirement savings, or looking to grow an established portfolio, partnering with a financial planner can be a game-changer. These professionals bring expertise, personalized strategies, and a wealth of knowledge that can help you maximize your financial potential. In this article, we’ll explore the myriad benefits of collaborating with a financial planner, how to choose the right one for your needs, and the transformative impact they can have on your financial future. Get ready to take charge of your wealth and unlock new opportunities for financial success!

Table of Contents

- Understanding the Value of a Financial Planner in Wealth management

- Key Strategies for Selecting the Right Financial Planning Partner

- Building Long-Term Financial Goals Through Expert Guidance

- Measuring Success: Tracking Progress with Your Financial Planner

- Future Outlook

Understanding the Value of a Financial Planner in Wealth Management

When it comes to building and preserving wealth, the expertise of a financial planner can be a game changer. These professionals go beyond simple budgeting and investment advice; they offer a holistic approach to your financial health. by partnering with a financial planner, you gain access to tailored strategies that align with your personal goals, risk tolerance, and time horizon. Some of the key services they provide include:

- Investment Management: Crafting a diversified portfolio that suits your financial objectives.

- Tax Planning: Identifying strategies to minimize tax liabilities while maximizing returns.

- retirement Planning: Ensuring that you are on track to meet your retirement goals, with appropriate savings and investment plans.

- Estate Planning: Assisting in developing a strategy for wealth transfer that considers tax implications and family dynamics.

Moreover, a financial planner plays a crucial role in navigating market volatility and changing economic conditions. They offer valuable insights that can lead to well-informed decisions, helping you avoid emotional reactions that frequently enough derail financial plans. Below is a simple comparison of the benefits of working with a financial planner versus managing your finances independently:

| Aspect | With Financial Planner | Without Financial Planner |

|---|---|---|

| Expertise | Access to professional knowledge and experience | Self-education and research required |

| Accountability | Regular check-ins and assessments | self-driven reviews |

| Strategy Progress | Personalized financial strategy | Generic or ad-hoc planning |

| Risk Management | Proactive risk assessment and management | Reactive to market changes |

Key Strategies for Selecting the Right financial Planning Partner

Choosing the right financial planning partner is a pivotal step towards achieving your financial goals.First, consider their credentials and expertise. Look for professionals who hold recognized qualifications, such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA). This not only demonstrates their dedication to the field but also ensures they possess the necessary knowledge to guide you effectively. Experience is another crucial factor—ideally, your planner shoudl have a diverse background in areas relevant to your financial situation, whether that be retirement planning, investments, or tax strategy.

Additionally, the alignment of values is essential in your partnership. Ensure that the financial planner you choose listens to your goals and understands your risk tolerance. A good way to assess this is through preliminary meetings where you can gauge their communication style and understanding of your priorities. Fee structure is another significant aspect; understand how they charge—whether through a flat fee, commission, or hourly rate—to ensure openness and avoid potential conflicts of interest. You might consider the following table to summarize vital considerations:

| Factor | Considerations |

|---|---|

| Credentials | Certified Financial Planner, Chartered Financial Analyst |

| Experience | Diverse financial background relevant to your needs |

| Values Alignment | Understanding your goals and risk tolerance |

| Fee Structure | Flat fee, commission, hourly rate |

Building Long-Term Financial Goals Through Expert Guidance

Establishing lasting financial goals is a transformative journey that frequently enough requires insights from a knowledgeable professional. Collaborating with a skilled financial planner not only clarifies your vision but also lays down a strategic framework to achieve it. Here are a few ways expert guidance can fuel your ambition:

- Personalized Strategies: Planners tailor financial strategies to align with your life goals and risk tolerance.

- Investment Insights: Professionals analyze market trends to recommend the most beneficial investment opportunities.

- Tax Efficiency: They offer strategies to minimize tax burdens while optimizing your returns.

As you set out to build and enhance your wealth,the importance of continuous monitoring and adjustment cannot be overstated. Your financial plan should evolve alongside changes in your life circumstances and market conditions. By engaging regularly with your financial planner, you ensure that your strategies remain relevant.Consider the following key aspects to maintain a robust financial outlook:

| Aspect | Frequency of Review |

|---|---|

| Investment Portfolio | Quarterly |

| budget & spending | Monthly |

| Retirement Goals | Annually |

Measuring Success: Tracking Progress with Your Financial Planner

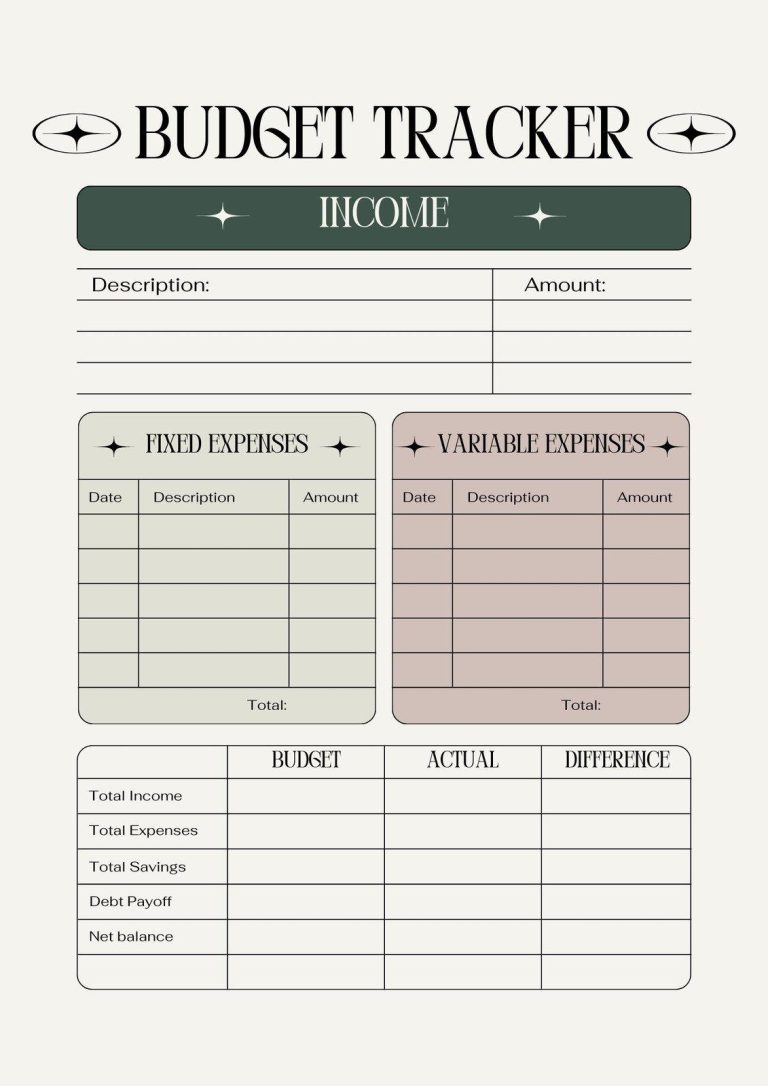

Establishing measurable financial goals is crucial for assessing your journey toward wealth maximization. Collaborating with your financial planner, create a framework of objectives that can be easily tracked and evaluated. Some key aspects to consider include:

- Net Worth Growth: Regular assessments of your net worth can provide a clear picture of your financial health.

- Investment Performance: Monitoring the returns on your investments against benchmarks helps gauge strategy effectiveness.

- Budget Adherence: Tracking expenses allows you to see where your money is going and make necessary adjustments.

By employing tools and strategies set forth by your planner,you’ll be able to visualize progress effectively. As an example, using tables or graphs to represent your budget performance can offer significant insights. Below is a simple table outlining potential budget categories for clarity in your tracking process:

| Category | Monthly Allocation | Actual Spend |

|---|---|---|

| Housing | $1,500 | $1,450 |

| Groceries | $600 | $550 |

| investments | $800 | $750 |

| Entertainment | $300 | $350 |

| Emergency Fund | $200 | $200 |

This ongoing evaluation not only helps optimize your current financial strategies but also allows for timely adjustments that are essential for achieving long-term wealth. Working hand-in-hand with your financial planner ensures that every decision aligns with your overarching financial goals, empowering you to stay on track while maximizing your wealth.

Future Outlook

partnering with a financial planner can be one of the most strategic decisions you make on your journey to financial success. Their expertise not only helps you navigate the complexities of wealth management but also empowers you to make informed decisions that align with your long-term objectives. Whether you’re planning for retirement, investing in opportunities, or simply looking to optimize your financial portfolio, a skilled planner can provide invaluable insights and personalized strategies tailored to your unique situation.As you embark on this journey, take the time to research and choose a financial planner who resonates with your goals and values. Remember, the right partnership can pave the way for not just financial security, but also peace of mind in knowing that you have a knowledgeable ally by your side.

Maximizing your wealth is not just about accumulating assets; it’s about creating a lasting financial future.So, start the conversation today, and take the first step towards a prosperous tomorrow. Your financial well-being deserves it!