In today’s fast-paced world, every dollar counts. As consumers become increasingly savvy about their spending, the quest for maximizing value through cashback and rewards programs has gained meaningful momentum. Whether you’re a seasoned shopper or just starting to navigate the complexities of personal finance, understanding how to effectively harness these programs can lead to ample savings over time. In this article, we’ll delve into the intricacies of cashback and rewards systems, exploring how they work, the various options available, and insider tips to help you optimize your earning potential. Wiht a strategic approach, you can transform everyday purchases into significant financial benefits, making the most of your hard-earned money without sacrificing your lifestyle. Let’s explore how to make the most of these powerful tools and enhance your savings efficiently.

Table of Contents

- Understanding cashback and Rewards programs

- Evaluating the Best Credit Cards for Maximum Rewards

- Strategic Spending: Tips to Boost Your Earnings

- Optimizing Redemption: making the Most of your Rewards

- The Conclusion

Understanding Cashback and Rewards Programs

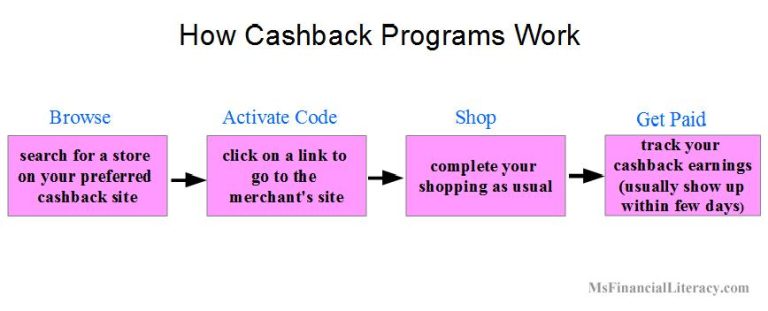

Cashback and rewards programs have become essential tools for the savvy shopper, offering a way to earn back a percentage of your spending. These programs usually fall into two categories: cashback and points or miles rewards. Cashback programs provide you with a direct return,typically a small percentage of your purchase,either as cash or credit. On the other hand,rewards programs allow you to accumulate points or miles that can later be redeemed for various benefits like discounts,travel,or merchandise. Understanding these distinctions can empower consumers to choose the program that best aligns with their spending habits.

To get the most out of these programs,consider the following tips:

- Choose the Right Card: Research which credit cards offer the best cashback or rewards rates for your typical spending categories,such as groceries,dining,or travel.

- Stay Informed: Keep an eye on seasonal promotions or bonus offers that can enhance your cashback or rewards earnings.

- Combine Offers: look for opportunities to stack cashback offers from various platforms or apps to maximize your savings even further.

| Program Type | Typical benefits | Best For |

|---|---|---|

| Cashback | Direct cash returns on purchases | Frequent shoppers |

| Points/Miles | Redeemable for travel, goods, or discounts | Travel enthusiasts |

Evaluating the Best Credit Cards for Maximum Rewards

When selecting a credit card that optimizes your rewards, it’s crucial to understand the various features and benefits each option provides. Start by identifying your spending habits; some cards excel in specific categories like groceries, gas, or travel. Here are a few key criteria to consider when evaluating options:

- Rewards Rate: look for cards offering higher cashback percentages in categories where you spend the most.

- Sign-Up Bonuses: Many cards provide attractive bonuses for new users meeting spending thresholds within the first few months.

- Annual Fees: Weigh the cost of annual fees against the rewards potential to ensure you get a net gain.

A useful way to compare different credit card options is through a straightforward comparison table. This not only highlights the rewarding aspects of each card but also makes it easier for you to visualize your choices:

| credit Card | Rewards Rate | Sign-Up Bonus | Annual Fee |

|---|---|---|---|

| Card A | 5% on groceries | $200 after spending $500 | $0 |

| Card B | 3% on gas | $300 after spending $1,000 | $95 |

| Card C | 2% on travel | $150 after spending $750 | $50 |

Exploring these features will enable you to determine which card aligns best with your financial goals. Consider not just the convenience of rewards but also the card’s overall value, including additional perks like travel insurance or no foreign transaction fees, to truly maximize your savings.

Strategic Spending: Tips to Boost Your Earnings

When it comes to smart spending, leveraging cashback and rewards programs can significantly enhance your financial routine. By strategically choosing where and how to spend your money,you can maximize the return on your purchases. Here are some effective tips to consider to boost your earnings:

- Research Available Programs: Explore various cashback and reward programs offered by banks, credit cards, and retailers. Each program has unique features and benefits, making it essential to find one that aligns with your spending habits.

- Align Spending with Rewards: Focus on spending in categories that provide higher cashback rates, such as groceries or gas, to increase your overall returns.

- Track Expiration Dates: Keep an eye on reward points and cashback expiry to avoid losing potential earnings from infrequent purchases.

- Combine Offers: Use cashback offers in conjunction with sales or promotions from retailers to maximize your savings even further.

Consider utilizing digital tools and apps that can help you manage and track your rewards effectively. For instance, a simple table can help you compare cashback rates across different programs:

| Program | Cashback Rate | Bonus Offers |

|---|---|---|

| Cashback Credit Card A | 1.5% on all purchases | 5% on groceries for first 6 months |

| Supermarket Rewards Program | 2% on groceries | 10% off on first purchase |

| Online Shopping Portal | Up to 10% depending on retailer | Extra 2% during holiday season |

By being deliberate in your spending choices and making use of these programs, you can improve your financial situation without compromising your quality of life. Remember, each dollar spent can be an chance to save and earn, as long as you’re strategic in your approach.

Optimizing Redemption: Making the Most of Your Rewards

When it comes to leveraging rewards programs effectively, understanding the intricacies of redemption is key. Many programs offer various options to redeem points or cashback, each with it’s own value proposition. To truly optimize your experience, consider the following tips:

- Know Your value: Familiarize yourself with the point-to-dollar conversion rates. Some rewards can be worth more when redeemed for certain categories such as travel or experiences versus cash equivalents.

- Tiered Program Benefits: Strive to reach higher tiers in reward programs, as additional benefits often accompany elevated status, such as bonus points on future purchases or exclusive redemption opportunities.

Another strategy is to combine rewards across multiple programs to maximize your savings potential. As a notable exmaple, pairing credit card cashback with loyalty programs can amplify your earning capability.Pay attention to promotional periods where bonus points or cash back are offered, as these can significantly enhance the value of your redemptions. Consider creating a simple spreadsheet to track:

| Program | Redemption Options | Value per Point |

|---|---|---|

| Cashback Card | Cash, statement credit | $0.01 |

| Travel Rewards | Flights, hotel stays | $0.02+ |

| loyalty Program | Awards, upgrades | $0.015 |

This approach ensures you’re making informed decisions tailored to your spending habits. The more strategic you are about how and when you redeem your rewards, the more savings you’ll unlock, maximizing your financial returns from these programs.

The Conclusion

maximizing your savings through cashback and rewards programs is not just a trend; it’s a savvy financial strategy that can yield impressive returns when approached thoughtfully. By understanding the nuances of various programs, selecting the ones that align with your spending habits, and employing disciplined budgeting techniques, you can turn everyday purchases into substantial savings.As you navigate the world of cashback incentives and rewards,remember that consistency is key.Each small reward contributes to your overall financial health, allowing you to invest, save, or treat yourself guilt-free.

Start today by evaluating your current spending and identifying the best programs that suit your lifestyle. Whether you’re an online shopping enthusiast or a frequent traveler, there’s likely a rewards scheme that’s perfect for you.keep an eye on new offers and updates, as the landscape of cashback and rewards is ever-evolving.

With the right approach, you’ll unlock the full potential of these programs, ensuring that every dollar spent works harder for you. Happy saving, and may your journey towards maximizing savings be both rewarding and enjoyable!