In an increasingly complex financial landscape,planning for retirement is more crucial than ever.Whether you’re just starting your career or nearing retirement age, understanding the nuances of retirement accounts can significantly impact your financial future. Among the most popular and effective saving vehicles are the 401(k) and the Individual Retirement Account (IRA). Thes tools not only offer tax advantages but also pave the way for a more secure and pleasant retirement. In this guide, we will explore the ins and outs of 401(k)s and IRAs, how to choose the right accounts for your needs, and strategies to maximize your contributions. No matter your current financial situation, these insights will equip you with the knowledge to make informed decisions and help your savings grow. Let’s dive in and unlock the potential of these powerful saving options!

Table of Contents

- Understanding the Basics of 401(k)s and iras for Optimal Savings

- Key Differences Between 401(k)s and IRAs: Which is right for You

- Strategies to Maximize Contributions and Take Advantage of Employer Matches

- Navigating Tax Implications: Making Smart Choices for Your Retirement Funds

- In Retrospect

Understanding the Basics of 401(k)s and IRAs for Optimal Savings

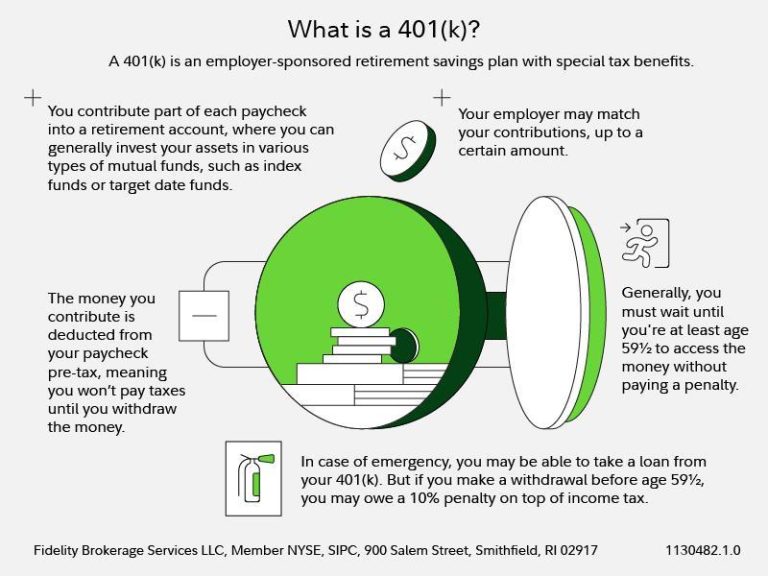

When it comes to planning for retirement, two of the most popular saving vehicles are 401(k) plans and Individual Retirement Accounts (iras). Understanding how each operates is crucial for building a robust financial future. A 401(k) is typically offered by employers, allowing employees to contribute a portion of their paycheck pre-tax. This type of account not only helps lower your taxable income but can also come with employer matching contributions, significantly boosting your retirement savings. On the other hand, IRAs come in two main forms: Customary and Roth. traditional IRAs offer tax-deferred growth,while Roth IRAs allow for tax-free withdrawals in retirement,provided certain conditions are met.

Both 401(k)s and IRAs have annual contribution limits which may change periodically. For 2023, the contribution limits for these accounts are set as follows:

| Account Type | Contribution Limit |

|---|---|

| 401(k) | $22,500 (plus $7,500 catch-up if aged 50+) |

| Individual IRA | $6,500 (plus $1,000 catch-up if aged 50+) |

Additionally, it’s essential to be aware of the tax implications, as both account types have different rules for withdrawals. Understanding these nuances helps you choose the right strategy to enhance your savings while minimizing tax liabilities. It’s advisable to regularly review your accounts, considering factors like employer matches and investment options, to ensure your retirement strategy remains aligned with your long-term financial goals.

Key Differences Between 401(k)s and IRAs: Which is Right for You

When it comes to planning for retirement, understanding the differences between a 401(k) and an IRA is crucial for making informed decisions. A 401(k) is typically an employer-sponsored plan that allows employees to save a portion of their paycheck before taxes are taken out, which reduces their taxable income. One notable advantage is that employers ofen match contributions up to a certain percentage, effectively giving you free money towards your retirement. In contrast, an IRA (Individual Retirement Account) is a personal account you set up independently, allowing for more versatility in investment choices. you can contribute after-tax dollars with a traditional IRA, or opt for a Roth IRA where your contributions are made with after-tax income but allow for tax-free withdrawals in retirement.

Understanding the contribution limits is another critical distinction. For the year 2023, the contribution limit for a 401(k) is set at $22,500 for individuals under 50, with a catch-up option of an additional $7,500 for those over 50. Conversely, an IRA caps contributions at $6,500 (with a $1,000 catch-up for those aged 50 and above). Here’s a quick comparison of features that highlight their key differences:

| Feature | 401(k) | IRA |

|---|---|---|

| Contribution Limits | $22,500 + $7,500 (Catch-up) | $6,500 + $1,000 (Catch-up) |

| Tax Treatment | Pre-Tax or Roth | Traditional or Roth |

| Employer Match | Yes | No |

| Withdrawal Rules | Penalties for early withdrawal | Better flexibility |

Strategies to Maximize Contributions and Take Advantage of Employer matches

To maximize your savings, it’s crucial to take full advantage of employer matching contributions. Many companies offer to match a percentage of your 401(k) contributions, effectively providing you with “free money” for your retirement. Start by contributing enough to meet the employer match—typically, this means aiming for at least 3-6% of your salary. To ensure you don’t leave any money on the table,familiarize yourself with your company’s match structure. This can frequently enough resemble:

| Employee Contribution | Employer Match |

|---|---|

| 3% or more | 100% match for the first 3% |

| 4-5% | 50% match for the next 2% |

| 6%+ | None |

Additionally, regularly review and adjust your contribution rate as your salary increases or when you receive bonuses.Consider automating your contributions to make the process effortless. Set your contributions to increase each year; many plans offer a feature that raises your contribution by a small percentage annually, aligning with salary raises. This strategy not only helps to grow your savings but also comfortably accommodates life changes without overwhelming your budget. Remember,it’s never too late to boost your retirement savings; even small,consistent increments can significantly compound over time.

Navigating Tax Implications: Making smart Choices for Your Retirement Funds

Understanding the tax implications of your retirement accounts, such as 401(k)s and iras, is crucial for making informed decisions that will impact your savings in the long run. Each account type comes with it’s own rules concerning contributions, withdrawals, and taxation, which means that a strategic approach is essential. some of the key factors to consider include:

- Contribution Limits: Familiarize yourself with annual contribution limits for each account. For 401(k)s, the limit is $22,500 for 2023, while IRAs allow a maximum of $6,500.

- Tax Treatment: Contributions to traditional accounts are tax-deductible, reducing your taxable income now, while withdrawals in retirement are taxable.with Roth accounts, tax is paid upfront, allowing you to withdraw funds tax-free in retirement.

- early Withdrawal Penalties: Understand potential penalties for early withdrawals, which can significantly affect your savings strategy.

To illustrate the potential growth of retirement funds under different tax scenarios, consider the following table that compares growth rates based on annual contributions:

| Account Type | Annual Contribution | Potential growth Over 30 Years (5% Return) |

|---|---|---|

| 401(k) | $22,500 | $2,034,172 |

| Traditional IRA | $6,500 | $573,472 |

| Roth IRA | $6,500 | $573,472 (tax-free) |

By being aware of these factors and carefully selecting the right account for your retirement goals, you can enhance your financial future and reduce the tax burden on your savings.

In Retrospect

maximizing your savings through 401(k)s and IRAs is not just a financial strategy; it’s an essential step towards securing your future. By understanding the nuances of these retirement accounts and tailoring them to your unique financial situation, you can harness the power of compounding interest and tax advantages to build a comfortable nest egg.Remember, the earlier you start contributing and the more you educate yourself about these investment vehicles, the greater your potential for growth. Take the time to evaluate your options,consult with financial advisors when necessary,and regularly review your portfolio to adapt to any changes in your life or the market.

Your retirement should be a time to enjoy the fruits of your labor, and with a solid strategy in place, you can rest easy knowing you’ve taken the right steps to ensure it. So, start today—your future self will thank you for the decisions you make now. Happy saving!