In an era where financial literacy is more crucial than ever, mastering the art of budgeting can be the key to unlocking your financial potential. Zero-Based Budgeting (ZBB) stands out as a powerful strategy that enables individuals and businesses alike to take control of their finances by prioritizing spending based on current needs rather than past expenses. Unlike traditional budgeting methods, which frequently enough rely on previous spending patterns, zero-based budgeting requires you to start each budgeting period from a “zero base,” allocating every dollar purposefully.This method not only cultivates a mindset of intentionality in financial decisions but also promotes smart savings by empowering you to identify and eliminate needless expenditures. In this article, we will explore the basic principles of zero-based budgeting, its benefits, and step-by-step guidance to help you implement this effective approach in your own financial journey. Join us as we delve into how you can master zero-based budgeting and pave the way for a smarter, more secure financial future.

table of Contents

- Understanding the Fundamentals of Zero-Based Budgeting

- implementing Zero-Based Budgeting Effectively for Your Finances

- Common Pitfalls to avoid in Zero-Based Budgeting

- Strategies for Sustaining Long-Term Success with Zero-Based Budgeting

- in Summary

Understanding the Fundamentals of Zero-Based Budgeting

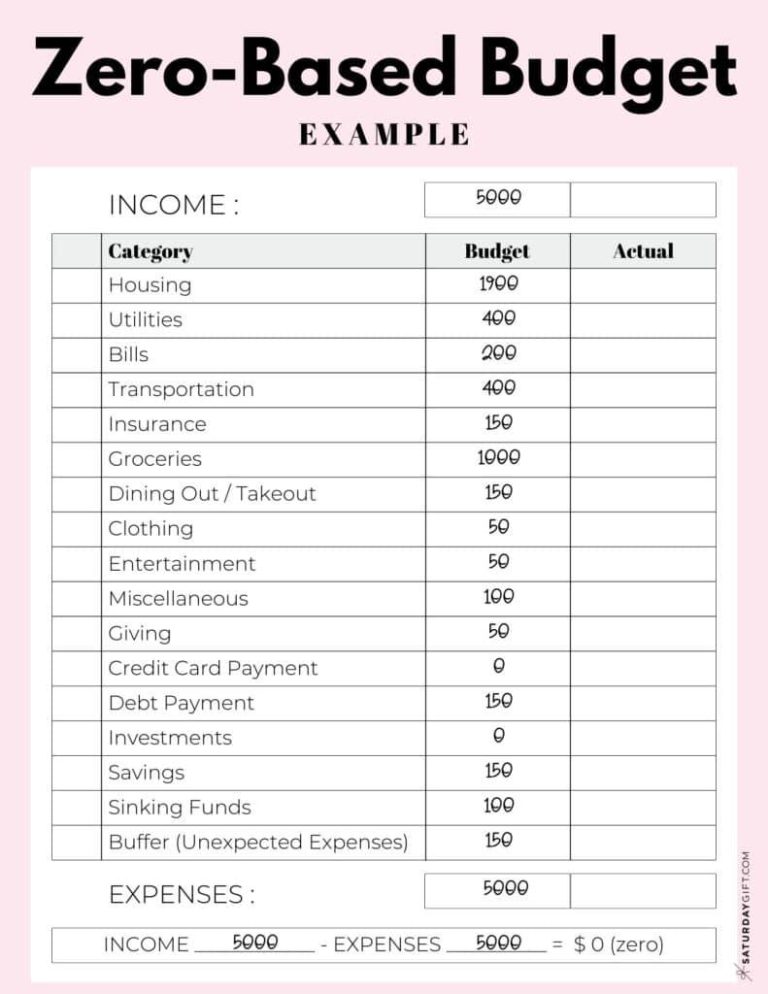

Zero-based budgeting (ZBB) is a financial management approach where every expense must be justified for each new period, rather than basing the budget on previous periods. This method encourages a thorough examination of all expenditures, compelling you to scrutinize whether each budget item is essential for achieving your financial goals. By starting from a “zero base,” individuals and organizations can identify and eliminate wasteful spending, ensuring that funds are allocated only to activities that add value. This can lead to more conscious spending habits and a stronger alignment between goals and resource allocation.

to implement zero-based budgeting effectively,consider the following steps:

- Identify Goals: Clearly outline your short-term and long-term financial objectives.

- List All Expenses: Create a complete list of all potential expenditures, categorizing them into fixed and variable budgets.

- Justify Each Expense: For each item, ask whether it is necessary and how it contributes to your goals.

- Allocate Resources: Allocate funds based on priority, ensuring that every dollar has a purpose.

The simplicity of ZBB lies in its clarity and direct approach, encouraging active engagement with your finances. It transforms budgeting from a passive, historical practice into a proactive strategy that aligns spending with your personal or organizational vision. Below is a simple table summarizing the advantages and challenges of zero-based budgeting:

| Advantages | Challenges |

|---|---|

| Promotes mindful spending | Requires notable time and effort |

| Enhances financial clarity | Can be complex to implement |

| Improves resource allocation | May lead to short-term cuts impacting long-term growth |

Implementing Zero-Based Budgeting Effectively for Your Finances

Implementing zero-based budgeting (ZBB) hinges on creating a financial plan that begins at zero rather than relying on previous budgets.Each month, you start from scratch, evaluating your income and allocating expenses based on necessity and priorities. To do this effectively, consider the following steps:

- Identify all sources of income: Document every dollar you expect to receive throughout the month.

- List fixed and variable expenses: Categorize your expenses as essential (rent, utilities) and discretionary (entertainment, eating out).

- Prioritize your needs: Rank expenses based on urgency and importance, ensuring the essentials are covered first.

- Allocate every dollar: Assign all of your income to expenses untill you reach zero,which creates accountability and discipline in spending.

Another crucial aspect of ZBB is regularly reviewing and adjusting your budget. As your financial situation changes, revisit your income and expense categories to reflect new priorities or shifts in needs.Consider using a simple table to track your allocations, which can make adjustments more manageable:

| Category | Amount ($) | Notes |

|---|---|---|

| Income | 3,000 | Salaries, side gigs |

| Rent | 1,200 | Essential housing expense |

| Groceries | 400 | Essential for survival |

| Utilities | 300 | Electricity, water, internet |

| Entertainment | 150 | Dining, movies, outings |

| Saving for Goals | 200 | Vacation, emergency fund |

| Total Expense | 2,400 | Target is 3,000 |

Implementing ZBB not only cultivates financial awareness but also empowers you to take control of your spending habits in alignment with your financial goals. Embracing this budgeting method can pave the way to smarter savings and ultimately help secure your financial future.

Common Pitfalls to Avoid in Zero-Based Budgeting

When diving into zero-based budgeting,many individuals and businesses fall into common traps that can hinder their financial goals. One significant pitfall is inadequate goal setting. Without clear financial objectives, it becomes challenging to determine which expenses are necessary and which can be eliminated. Establishing specific, measurable, achievable, relevant, and time-bound (SMART) goals is crucial for guiding your budgeting process. Additionally, failing to regularly revisit and adjust these goals can lead to stagnation and misallocation of resources.

Another frequent misstep is neglecting to account for variable expenses, which can lead to budget inaccuracies. zero-based budgeting encourages a fresh start each period,but many overlook the fluctuation of costs like utilities,groceries,and maintenance. Creating a comprehensive list of potential variable expenses and averaging them out over time can mitigate this issue. Moreover, not involving all stakeholders in the budgeting process can result in a lack of buy-in and accountability, undermining the effectiveness of your budget. Engaging team members or family members ensures that everyone is on the same page and dedicated to achieving the set financial objectives.

Strategies for Sustaining Long-Term Success with Zero-Based Budgeting

To effectively implement zero-based budgeting (ZBB) in the long run, it’s critically important to establish a culture of accountability across all departments. This means encouraging team members to rigorously justify their expenditures regularly, rather than relying on historical budgets. Create a collaborative surroundings where employees feel empowered to contribute to the budgeting process, and ensure that key stakeholders are involved in decision-making. You can facilitate this by:

- Conducting regular training sessions on ZBB principles.

- Setting clear performance metrics that align with organizational goals.

- Providing ongoing support and resources for teams as they adjust to this budgeting model.

In addition, adopting cutting-edge technology can streamline the budgeting process significantly. Utilizing budgeting software that supports ZBB can enhance visibility and control over financial planning while making it easier to track performance versus budget. It’s also beneficial to establish regular review intervals to evaluate performance, address budget variances, and refine budgeting strategies. Consider implementing a budget review table to visually represent key areas:

| Category | Budgeted Amount | Actual Amount | Variance |

|---|---|---|---|

| Marketing | $50,000 | $45,000 | -$5,000 |

| Operations | $100,000 | $120,000 | +$20,000 |

| R&D | $75,000 | $70,000 | -$5,000 |

In Summary

As we wrap up our exploration of zero-based budgeting, it’s clear that this financial strategy offers a powerful framework for anyone looking to take control of their finances and maximize their savings. By starting each budgeting period from a “zero base,” you’re encouraged to reassess priorities, eliminate unnecessary expenses, and allocate every dollar with intention.Implementing zero-based budgeting may require diligent planning and a willingness to adapt, but the rewards—greater financial awareness, reduced waste, and ultimately, smarter savings—are well worth the effort. Remember, mastering this technique not only empowers you to make informed decisions today but also paves the way for a more secure financial future.

So, whether you’re looking to escape the paycheck-to-paycheck cycle or simply wish to optimize your financial health, give zero-based budgeting a try. take those first steps today, and watch as your savings begin to grow while your financial confidence flourishes. Here’s to your journey towards smart savings and financial mastery!