As you approach retirement, the excitement of newfound freedom and leisure can frequently enough be overshadowed by concerns about financial stability. After years of diligent saving and planning,the prospect of managing your finances in retirement may feel daunting.However, mastering your retirement budget is not just about numbers—it’s about creating a lifestyle that allows you to enjoy this well-deserved phase of life. In this article, we’ll explore practical strategies for crafting a budget that suits your unique needs and goals. Whether you’re dreaming of world travel, pursuing hobbies, or simply enjoying more time with family, a well-structured budget can help you achieve financial peace of mind while making the most of your retirement years. Let’s dive in and unlock the secrets to a fulfilling and financially sound retirement!

Table of Contents

- Understanding Your Retirement Income Sources

- identifying Essential and discretionary Expenses

- Strategies for adjusting Your Budget Over Time

- Tools and Resources for Effective Budget Management

- Closing remarks

Understanding Your Retirement Income Sources

When planning for retirement,it’s essential to have a clear understanding of the various income sources that will sustain you through your golden years. Many people rely on multiple streams, which may include:

- Social Security Benefits: This is often the first source individuals think of. Understanding your entitlement age and benefit calculations can substantially impact your total income.

- Pension Plans: If you’re fortunate enough to have a pension, know the specifics—whether it’s a defined benefit or defined contribution plan.

- Investment Income: portfolio distributions from stocks,bonds,or mutual funds can provide vital income,especially if managed wisely.

- Retirement Accounts: Accounts like IRAs and 401(k)s offer additional funds, but remember to account for taxes or penalties on early withdrawals.

Each income source has unique implications on your budget. it’s crucial to assess how much you can realistically expect from each. Consider the following table to visualize potential monthly income:

| Income Source | Estimated Monthly Income |

|---|---|

| Social Security | $1,500 |

| Pension | $1,200 |

| Investment Income | $800 |

| Retirement Accounts | $1,000 |

Understanding these figures helps you paint a clearer picture of your total retirement income and allows you to set realistic expectations for your spending. Creating a budget aligned with these sources means being proactive about your financial future.

Identifying Essential and Discretionary Expenses

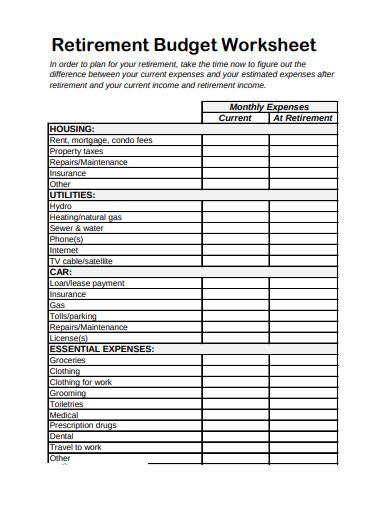

Understanding the distinction between essential and discretionary expenses is crucial for retirees looking to manage their finances effectively.Essential expenses are those that are necessary for daily living and generally include:

- housing costs (rent/mortgage)

- Utilities (electricity, water, gas)

- Groceries and household supplies

- Healthcare and insurance premiums

- Transportation (public transit, fuel)

On the other hand, discretionary expenses represent non-essential spending that enhances your lifestyle but can be adjusted or eliminated if necessary.Examples of these include:

- Dining out and entertainment

- Vacations and travel

- Luxury items and hobbies

- Subscriptions and memberships

- Gifts and charitable donations

Strategies for Adjusting Your Budget Over Time

Adjusting your budget over time is crucial for accommodating life changes and potential financial shifts. To do this effectively, consider implementing a few key strategies: start by regularly reviewing your expenses and identifying areas where you can trim costs. This can include lifestyle adjustments, such as dining out less frequently enough or seeking more affordable entertainment options. Additionally, don’t forget to factor in inflation; certain expenses may increase over time, so plan for gradual rises in your living costs. Aim to allocate a portion of your budget towards savings and investments, ensuring that your financial future remains secure.

another essential approach involves setting financial goals that evolve with your life circumstances. Whether you’re planning for a potential relocation, healthcare uncertainties, or unexpected family expenses, being proactive can save you from financial stress. To keep your budget aligned with your goals, create a flexible budget framework using the following tips:

- Track your spending: Use budgeting apps or spreadsheets to monitor your monthly expenditures.

- Review bi-annually: Set a reminder to refine your budget every six months to adjust for any significant changes.

- Consult with a financial advisor: Seek expert advice to help you navigate complexities in your financial landscape.

| Timeframe | budget Action |

|---|---|

| Monthly | Track and analyze current expenses |

| Every 3 months | Assess changes in income or expenses |

| Annually | Set new financial goals and adjust long-term strategies |

Tools and Resources for Effective Budget Management

Effective budget management is crucial in ensuring that your retirement funds last as long as you do. To simplify this process, there are a variety of tools and resources available that can help you track expenses, create and maintain budgets, and plan for future financial needs. Some popular options include:

- Budgeting software: programs like Mint and YNAB (You Need A Budget) provide extensive solutions for tracking income and expenditures.

- Spreadsheets: Customizable templates in Excel or Google Sheets allow you to tailor your budget according to your unique financial situation.

- Mobile apps: Apps such as PocketGuard and GoodBudget let you manage your finances on-the-go.

- Retirement calculators: Online tools that help estimate how much you need to save to maintain your desired lifestyle during retirement.

Along with these digital resources, consider engaging with financial advisors and local community workshops that focus on retirement planning. These professionals can provide personalized advice and help you navigate complex financial decisions. To further enhance your understanding, you might explore classes related to financial literacy. Below is a quick reference table highlighting some of the key features of a few popular budget management tools:

| Tool | Key Features | Best For |

|---|---|---|

| Mint | Expense tracking, budgeting, alerts | Overall comprehensive management |

| YNAB | Proactive budgeting, goal tracking | Behavior change and savings goals |

| GoodBudget | Envelope budgeting system, sync across devices | Cash-based budgeting enthusiasts |

| PocketGuard | Spending limits, saving goals | Simple expense management |

closing Remarks

mastering your retirement budget is not just about crunching numbers; it’s about empowering yourself to live the life you’ve envisioned during this exciting new chapter. By understanding your income sources, evaluating your expenses, and being flexible enough to adjust as needed, you’ll pave the way for financial peace of mind. Remember, creating a sustainable budget is an ongoing process that may require adjustments as your needs and circumstances evolve.

Take the time to regularly review your financial plan and be proactive in adapting it to ensure it continues to serve you well. With the right tools and mindset, you can enjoy your retirement years with confidence and freedom, knowing that your financial future is secure.

Thank you for joining us on this journey to master your retirement budgeting—hear’s to a fulfilling and financially sound retirement!