In today’s fast-paced world, where expenses can quickly spiral out of control, mastering your finances has never been more crucial. Whether you’re saving for a dream vacation, planning for retirement, or simply hoping to make ends meet, a well-crafted monthly budget is your roadmap to financial stability. But what exactly makes a budget effective? In this article,we’ll explore the essential steps to create a personalized budgeting plan that not only tracks your spending but also aligns with your long-term financial goals. Get ready to take charge of your financial future and transform your relationship with money, one month at a time!

Table of Contents

- Understanding Your financial Landscape

- Setting Realistic Goals for Your Monthly Budget

- Tracking Expenses and Adjusting Your Budget

- Utilizing Tools and Apps for Budgeting Success

- In Conclusion

Understanding Your Financial Landscape

To effectively manage your finances, it’s crucial to identify and understand the various components of your financial landscape. Begin by assessing your income sources, including your salary, side hustles, or any passive income. Understanding how much money comes in each month will provide a foundation for your budgeting process. Next, examine your regular living expenses and categorize them. Common areas to consider include:

- Fixed Expenses: Rent or mortgage, insurance premiums, and loan payments

- Variable expenses: Groceries, utilities, and entertainment

- Discretionary Spending: Dining out, hobbies, and luxury items

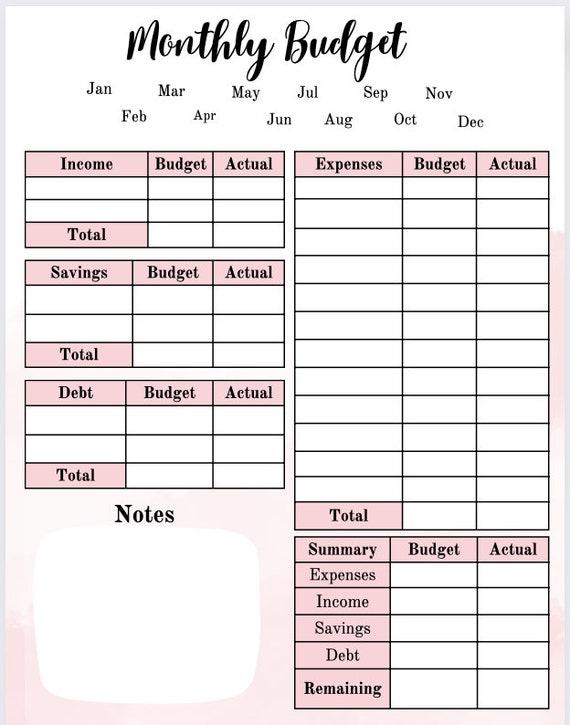

Once you’ve detailed your income and expenses, it’s time to gain a clearer perspective on your financial health. Utilize a budgeting tool or spreadsheet to create a visual representation of your financial landscape. This could look like the following:

| Category | Budgeted Amount | Actual Amount | Difference |

|---|---|---|---|

| Income | $3,500 | $3,500 | $0 |

| Rent | $1,200 | $1,200 | $0 |

| Groceries | $400 | $450 | -$50 |

| Dining out | $200 | $300 | -$100 |

| Savings | $500 | $400 | +$100 |

This table not only highlights your budgeted amounts versus actual spending but also helps identify areas where you might need to cut back or adjust your financial goals. By thoroughly understanding these elements, you’ll be better positioned to make informed decisions that align with your financial objectives.

Setting Realistic Goals for Your monthly Budget

When embarking on the journey of budgeting, it’s crucial to ensure that your goals are not only aspirational but also attainable. Start by evaluating your current financial situation, which includes assessing your income, expenses, and any debts you may have. This realistic overview allows you to set specific,measurable,and achievable targets. For instance, rather than stating a vague aim of “saving money,” specify an amount to set aside each month. Consider the following strategies to guide your goal-setting process:

- Analyze Past Spending: Review previous months’ expenses to spot trends and identify areas of advancement.

- Prioritize Needs Over Wants: Focus your budget on essentials before allocating funds for discretionary spending.

- Adjust for Life Changes: Be ready to update your goals as your circumstances evolve, such as job changes or family additions.

Moreover, incorporating a budgeting tool or app can help enforce these realistic goals, providing structure and accountability. Consider establishing a simple table within your budget to track your progress. This visualization can motivate you to stick to your plans while enabling regular adjustments as needed:

| Category | Budgeted Amount | Actual Amount | Difference |

|---|---|---|---|

| Housing | $1,200 | $1,150 | $50 |

| Groceries | $400 | $450 | -$50 |

| Utilities | $300 | $280 | $20 |

| Entertainment | $200 | $250 | -$50 |

This simple framework not only clarifies where your money is going but also facilitates a proactive approach to meet your monthly goals.By setting realistic expectations and utilizing tools to monitor your progress, you take significant strides towards financial mastery.

tracking Expenses and Adjusting Your Budget

Keeping a close eye on your expenditures is crucial in ensuring you stay within the confines of your financial plan. Begin by recording every expense, no matter how small; this will create a complete picture of where your money is going. Utilize spreadsheets or expense-tracking apps to categorize your spending, which can definitely help identify patterns and highlight areas where adjustments are necessary. Key categories to monitor include:

- Essentials: Rent,utilities,groceries

- Discretionary: Dining out,entertainment,hobbies

- Savings: Emergency funds,retirement contributions

After tracking your expenses for a month,you’ll likely spot opportunities for savings or overspending. Adjust your budget by reallocating funds to ensure essential needs are prioritized while still allowing for personal enjoyment. consider creating a comparison table to reflect your planned versus actual expenses, which could be formatted as follows:

| Category | Planned Amount | Actual Amount | Difference |

|---|---|---|---|

| essentials | $1,500 | $1,600 | -$100 |

| Discretionary | $300 | $200 | +$100 |

| Savings | $200 | $200 | $0 |

This comparison will reveal not only how closely you adhered to your budget but also where you can tighten your spending for the future.Self-awareness in your financial habits fosters better decision-making for lasting financial health.

Utilizing Tools and Apps for Budgeting Success

In the digital age, achieving financial organization has never been more attainable thanks to the myriad of tools and apps available. These innovative solutions simplify the budgeting process,allowing you to track your expenses,set goals,and create a financial plan that works for you. By utilizing personal finance apps, you can gain insights into your spending habits and uncover areas for improvement. key features to look for include:

- Expense Tracking: Automatically categorize your transactions for easy oversight.

- Goal Setting: Establish savings targets for specific purchases or investments.

- Custom Alerts: Receive notifications for bills and critically important due dates to avoid late fees.

Moreover, many budgeting tools provide a user-kind interface that caters to both novices and experienced budgeters alike. Among the most popular are spreadsheet templates that allow for tailored budget management. consider a simple comparison of a few popular options:

| Tool/App | Cost | Features |

|---|---|---|

| Mint | Free | Budget tracking, credit score monitoring, bill reminders |

| YNAB | $11.99/month | Proactive budgeting,goal setting,educational resources |

| Excel/Google Sheets | Free (with basic account) | Customizable templates,manual tracking,formulas |

integrating these tools into your financial routine can empower you to stay on track and adapt your strategy as your financial landscape shifts. Embrace the technology available to enhance your budgeting experience and optimize your financial future.

In Conclusion

As we conclude our exploration of mastering your finances through effective budgeting, it’s important to remember that crafting a monthly budget is not just about tracking numbers—it’s about taking control of your financial future. By setting clear goals, being mindful of your spending, and regularly reviewing your budget, you can create a roadmap that leads you toward financial security and peace of mind.Implementing the strategies we’ve discussed will empower you to make informed decisions and adjust to life’s unpredictable twists and turns. Remember, budgeting is a dynamic process; it evolves with your financial situation and personal goals. Don’t hesitate to revisit and refine your budget regularly to ensure it aligns with your lifestyle.Now that you have the tools to begin or enhance your budgeting journey, take that first step today. Embrace the challenge, stay disciplined, and celebrate your progress—no matter how small. Your financial wellness is within reach, and with the right plan in place, you can navigate your way toward a brighter, more secure future. thank you for reading, and here’s to your success in mastering your finances!