In the fast-paced world of entrepreneurship, the ability to manage your finances can make or break your business. Whether you’re a seasoned entrepreneur or just starting out, having a robust budget plan is essential for steering your company towards success. A well-crafted budget not only allows you to track your income and expenses, but it also serves as a strategic tool to help you allocate resources effectively, plan for growth, and navigate unexpected challenges. in this article,we’ll explore the fundamentals of creating a comprehensive business budget plan,offering practical tips and insights to help you master your finances. By understanding the importance of budgeting and employing smart financial strategies, you can ensure that your business remains profitable, enduring, and ready to seize new opportunities. Let’s dive in and unlock the secrets to financial mastery!

Table of Contents

- Understanding the Importance of a Business Budget in Financial Management

- Key Components of an Effective business Budget Plan

- Strategies for Creating a Realistic Budget That Aligns with Business Goals

- Tools and Resources to Streamline Your Budgeting Process

- Future Outlook

Understanding the Importance of a Business Budget in Financial Management

Creating a business budget is essential for establishing a solid financial framework. It not only provides a roadmap for spending and investment but also helps in identifying potential financial pitfalls before they become critical issues. A well-organized budget allows businesses to:

- Track Expenses: Monitoring expenditures ensures that funds are allocated appropriately.

- Set Realistic Goals: A budget enables businesses to set achievable financial goals by evaluating past performance.

- Prioritize Spending: Identifying essential versus non-essential expenses can lead to more effective financial strategies.

- Ensure Liquidity: Maintaining a budget helps in managing cash flow, ensuring that there are enough resources to cover operational costs.

Additionally, a strategic budget serves as a dialog tool within the organization, fostering transparency and collaboration among departments.By involving team members in the budgeting process, businesses can harness a broader range of insights and innovations. This collaborative effort strengthens commitment and accountability across the organization. Consider using a simple table to categorize your projected income and expenses:

| Category | Projected Income/Expenses |

|---|---|

| Sales Revenue | $50,000 |

| Operating Expenses | $30,000 |

| marketing Costs | $5,000 |

| Net Profit | $15,000 |

Key Components of an Effective Business Budget Plan

Creating a successful business budget requires a thorough understanding of multiple key components that come together to form a comprehensive financial strategy. Frist and foremost, your budget should include a detailed breakdown of revenues and expenses. This involves not only understanding your projected sales but also recognizing all operating costs, fixed costs, and variable expenses. A well-organized budget will allow you to plan for seasonal fluctuations in sales and unexpected expenses, ensuring your business remains financially stable throughout the year.

Additionally, the incorporation of financial forecasting plays a crucial role in an effective budget plan.This involves estimating future financial conditions based on past data and market trends. Strategically adjust your budget periodically by including a column for actual results alongside your forecasts. This will enable you to track performance and make informed adjustments. To assist in this process, consider utilizing tables for a clear visual representation of your budget metrics:

| Category | Projected Amount | Actual Amount | Variance |

|---|---|---|---|

| Revenues | $50,000 | $48,000 | -$2,000 |

| Fixed Expenses | $20,000 | $19,500 | +$500 |

| variable Expenses | $15,000 | $16,500 | -$1,500 |

Strategies for Creating a Realistic Budget That Aligns with Business Goals

Creating a budget that accurately reflects your business goals requires a thorough understanding of both your current financial situation and future aspirations.Start by establishing clear, measurable objectives that resonate with your strategic plans. Consider factors such as was to be expected revenue growth, marketing investments, and operational costs. Utilizing tools like zero-based budgeting can help ensure that every dollar is allocated wisely, while flexible budgeting allows for adjustments as conditions change. Regularly review and adjust your budget in response to performance metrics, as this will keep your financial plan aligned with your evolving business landscape.

Incorporate predictive analytics to anticipate potential financial bottlenecks and opportunities. This proactive approach will allow you to adapt quickly if assumptions change or if market trends affect profitability. To foster an informed budget, engage key stakeholders in the budgeting process—this promotes buy-in and ensures that all departments are aligned. Utilize visual aids such as charts and graphs to communicate budgetary goals effectively. Below is a simple table to illustrate budget components that align with strategic goals:

| Budget Component | Alignment with Goals |

|---|---|

| Marketing Expenses | Increase brand awareness and market share |

| Operational Costs | Improve efficiency and reduce wastage |

| Research & Growth | Innovate products and drive growth |

| Training & Development | Enhance employee skills for better performance |

Tools and Resources to streamline Your Budgeting Process

Managing a business budget can often feel overwhelming, but utilizing the right tools and resources can considerably simplify the process. Consider platform options like QuickBooks, FreshBooks, and Mint that offer user-friendly interfaces and powerful financial tracking features. These platforms not only help in organizing expenses and revenues but also provide insightful analytics that can guide decision-making. additionally, mobile apps like YNAB (You Need A Budget) allow business owners to keep track of spending on the go, ensuring that budgeting is a seamless part of your daily routine.

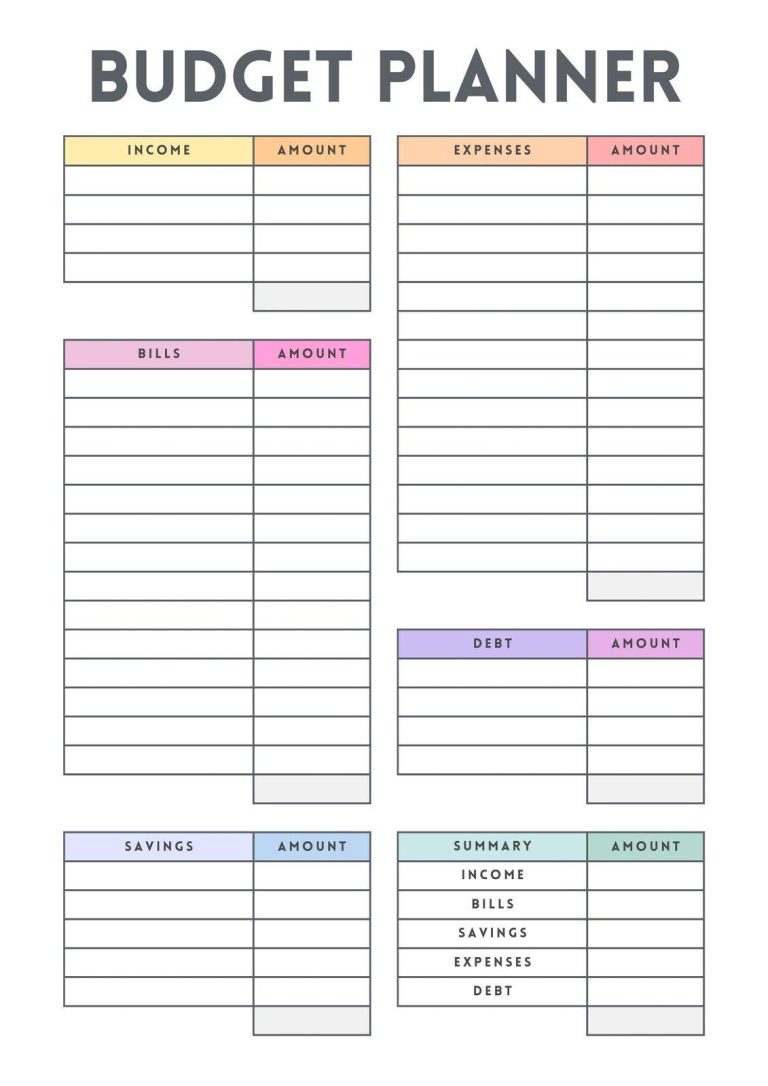

An effective budgeting process also relies on utilizing templates and worksheets to facilitate planning.Here are some resources to consider:

- Google Sheets Templates: Easily customizable and shareable for team collaboration.

- Excel Budgeting Templates: Comprehensive and detailed for a more traditional approach.

- Canva: For visually appealing and engaging budget presentations.

If you’re interested in a quick insights comparison,refer to the table below:

| Tool/Resource | Best For | Cost |

|---|---|---|

| QuickBooks | Accounting and financial reporting | starts at $25/month |

| YNAB | Personal budgeting | Free for the first month,then $14/month |

| Mint | Expense tracking and budgeting | Free |

Future Outlook

Conclusion: Taking Control of Your financial Future

mastering your finances thru a well-crafted business budget plan is not just a necessity—it’s a cornerstone of sustainable growth and success. by taking the time to systematically analyze your income, expenses, and financial goals, you empower yourself to make informed decisions that drive your business forward.

Remember, budgeting is not a one-time endeavor but an ongoing process that requires regular review and adjustment. As your business evolves, so too should your financial strategies. Embrace the discipline of tracking your performance, adapting to changes, and anticipating future needs.

investing time in understanding and implementing these budgeting principles can significantly impact your overall business health. Whether you’re a seasoned entrepreneur or just starting out, an organized budget acts as your financial roadmap, guiding you toward your aspirations while mitigating risks along the way.

So, roll up your sleeves, dive into your numbers, and start crafting your business budget plan today. your financial future awaits, and with it comes the opportunity for greater control, clarity, and success in your entrepreneurial journey. If you’ve found this article helpful,feel free to share your experiences or tips in the comments below—let’s foster a community of informed and empowered business owners!