As the golden years approach, many of us look forward to enjoying the fruits of decades of hard work. Though, transitioning from saving for retirement to withdrawing those savings can be a daunting task. Crafting a thoughtful retirement withdrawal strategy is not just a financial necessity; it’s the key to ensuring your golden years are indeed golden.In a world of fluctuating markets, rising costs, and unexpected medical expenses, how can you confidently navigate this pivotal phase of life? In this article, we will explore the essential principles of a smart withdrawal strategy, providing you with the tools and knowledge to manage your finances effectively and make the most of your retirement savings. whether you’re just starting to think about retirement or are already at the point of making withdrawals, mastering this aspect of your financial plan can lead to lasting security and peace of mind. Let’s dive in and build a strategy that not only sustains your lifestyle but also empowers you to savor every moment in your retirement.

Table of Contents

- Understanding the Importance of a Strategic Withdrawal Plan

- Assessing Your Retirement Income Needs and Goals

- Maximizing Your Tax Efficiency During Withdrawals

- Adapting Your Strategy to Changing financial Landscapes

- Wrapping Up

Understanding the importance of a Strategic Withdrawal Plan

Creating a strategic withdrawal plan is essential for ensuring that your retirement savings last throughout your retirement years. Such a plan not only allows you to manage your finances effectively but also minimizes the risk of depleting your resources too quickly. By establishing a clear withdrawal strategy, you can determine the optimal amounts to withdraw from various accounts, ensuring you meet both your immediate needs and longer-term financial goals. Key considerations include:

- Tax Implications: Different accounts have varying tax treatments, which can significantly affect your net income.

- Market Conditions: Withdrawals made during market downturns can erode your principal more rapidly.

- Social Security Timing: Deciding when to start collecting Social Security benefits can impact your overall retirement income.

Additionally, having a withdrawal strategy can provide peace of mind. It can help you navigate essential financial decisions and adjust for unforeseen circumstances, such as unexpected healthcare costs or market volatility. A well-constructed plan not only aligns your withdrawals with your lifestyle needs but can also include elements like:

| Strategy Component | Description |

|---|---|

| Bucket strategy | Dividing assets into groups for short-term and long-term needs. |

| systematic Withdrawals | Regularly scheduled withdrawals to maintain consistency. |

| Roth Conversions | Converting customary retirement accounts to Roth IRAs to reduce taxes. |

Assessing Your Retirement Income Needs and Goals

Understanding your financial situation is essential for creating a retirement plan that aligns with your goals and lifestyle.Start by evaluating your current expenses and estimating how they may change in retirement. Consider the following factors:

- Housing Costs: Will your mortgage be paid off, or are you planning to downsize?

- Healthcare Expenses: are you factoring in increased healthcare costs as you age?

- Leisure and Travel: how much do you wish to allocate for hobbies and adventures?

- Inflation impact: How will inflation affect your purchasing power over time?

Next, it’s crucial to set specific income goals for your retirement. This means determining how much money you will need monthly to sustain your desired lifestyle. You can use a simple formula to estimate your required income:

| Source of Income | Estimated Monthly Amount |

|---|---|

| Social Security | $1,500 |

| Pension | $800 |

| Retirement Accounts (Withdrawals) | $2,000 |

| Other Investments | $700 |

| Total Estimated Monthly Income | $5,000 |

Maximizing Your Tax Efficiency During Withdrawals

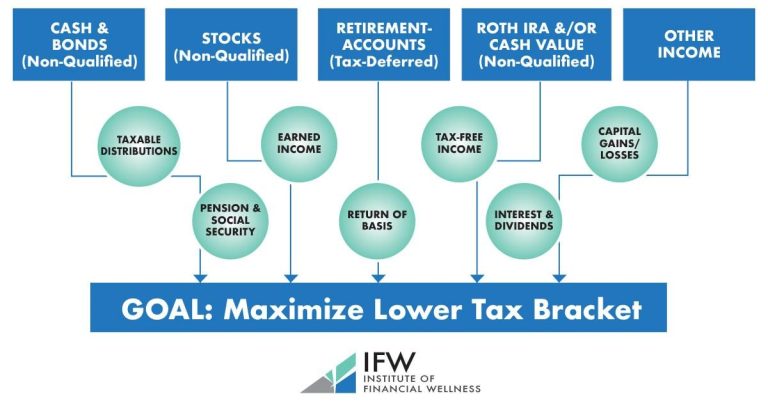

When planning your withdrawals, it’s essential to consider the tax implications of each account from which you withdraw funds. Different types of retirement accounts are taxed differently, which can either enhance or hinder your overall tax efficiency. focus on a strategy that utilizes the order of withdrawals to minimize your taxable income over the years. Here’s a common strategy:

- Taxable Accounts: Withdraw from these first to allow tax-advantaged accounts to continue growing.

- Tax-deferred Accounts: Such as Traditional IRAs or 401(k)s, these should be tapped into later to avoid increased taxation sooner.

- roth IRAs: Since withdrawals from Roths are typically tax-free,consider these last unless you face specific financial needs.

In addition, utilizing tax deductions and credits can further enhance your efficiency. As an example, if your income fluctuates, aim to withdraw larger amounts in lower-income years when you’re in a lower tax bracket. This approach can significantly reduce your overall tax burden. To visualize potential outcomes, consider the following table which outlines optimal withdrawal strategies and potential tax impacts:

| Withdrawal Type | Impact on Taxable Income | Best Timing |

|---|---|---|

| Taxable Accounts | Increases income | First 5-10 years of retirement |

| Tax-deferred Accounts | Moderately increases income | Late in retirement |

| Roth Accounts | No increase | As a last resort |

Adapting Your Strategy to Changing Financial Landscapes

As financial markets ebb and flow, it’s essential to remain agile in your approach to retirement withdrawals. Adapting your strategy may involve assessing factors such as changing interest rates, inflation, and stock market volatility. By staying informed and ready to pivot, you can protect your assets while ensuring a sustainable income stream.Consider these strategies:

- regularly Review Portfolio Allocation: Adjust your investment mix between stocks, bonds, and cash based on market performance and your risk tolerance.

- Embrace Dynamic Withdrawal Strategies: Instead of a fixed withdrawal rate, adjust your withdrawals based on market conditions and your spending needs.

- Keep an Eye on Inflation: Factor in the cost of living increases to ensure your withdrawals remain adequate over time.

Utilizing a flexible approach to withdrawals can significantly strengthen your financial security. For instance, if the market experiences a downturn, it may be wise to temporarily limit your withdrawals or tap into other income sources like Social Security or pension plans. Here’s a swift reference table to illustrate how varying strategies can impact your long-term financial health:

| Withdrawal Strategy | Market Condition | Recommended Action |

|---|---|---|

| Fixed Percentage | Stable | Continue as planned |

| Bucket Strategy | Downturn | Limit withdrawals from stocks |

| Dynamic Withdrawal | Inflation Spike | Increase withdrawals to keep up |

Wrapping Up

mastering your finances and building a smart retirement withdrawal strategy is not just about crunching numbers; it’s about creating a sustainable lifestyle that aligns with your personal goals and circumstances.As you navigate this critical phase of your financial journey, remember that flexibility and adaptability are key components. Circumstances change, and so too can your approach to withdrawals.

by taking the time to assess your needs,understanding the nuances of your portfolio,and possibly consulting a financial advisor,you can craft a strategy that minimizes tax burdens,preserves your assets,and maximizes your enjoyment in retirement.

Armed with the insights and strategies discussed in this article,you are now better equipped to make informed decisions that will carry you through your golden years with confidence and peace of mind.Here’s to a well-planned retirement, where financial security allows you to focus on what truly matters: enjoying life to the fullest!

Thank you for reading, and be sure to check back for more tips and insights on achieving financial wellness at every stage of life.