as a college student,the thrill of newfound independence often comes hand-in-hand with the daunting responsibility of managing your finances. Juggling tuition,textbooks,living expenses,and social life can feel overwhelming at times. However,mastering the art of budgeting can not only alleviate financial stress but also empower you to make informed decisions that lay the groundwork for your future. In this guide, we’ll explore practical budgeting strategies designed specifically for college students. From tracking your expenses to identifying essential costs versus discretionary spending, we’ll provide you with the tools you need to take control of your finances, ensuring that you can focus on what truly matters: your education and personal growth. So, let’s dive into the steps you can take to create a lasting budget that reflects your lifestyle and aspirations, paving the way for financial stability both now and in the years to come.

Table of Contents

- Understanding Your Financial Landscape as a College Student

- Creating a Realistic Budget: essential Steps for Smart Spending

- Effective saving Strategies for Students on a Tight Budget

- Navigating Debt: Tips for Managing Student Loans and Credit Responsibly

- To Wrap It Up

Understanding Your financial Landscape as a College Student

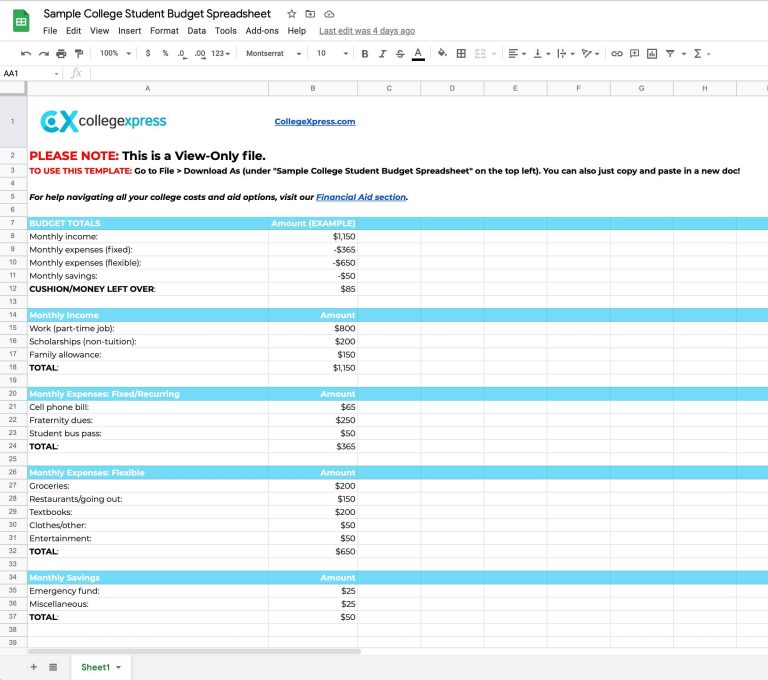

As a college student, navigating your finances can be overwhelming, but understanding the variables at play can set the stage for smart financial decisions. Start by assessing your income sources, which may include part-time jobs, internships, or allowances from family. Next, create a complete list of your regular expenses such as tuition, rent, utilities, groceries, and transportation. Having a clear view of where your money comes from and where it goes allows you to identify areas where adjustments might be necessary. Consider utilizing financial apps to track your spending habits easily, ensuring you stay within your limits and avoid the dreaded overdraft.

When budgeting,adopting the 50/30/20 rule can be an effective strategy.This method suggests allocating 50% of your income to needs (like rent and groceries), 30% to wants (such as entertainment and dining out), and 20% to savings or debt repayment. To aid your planning, here’s a simple table outlining a sample monthly budget based on this approach:

| Category | Monthly Amount |

|---|---|

| Needs | $500 |

| Wants | $300 |

| Savings/Debt | $200 |

By regularly reviewing your budget and adjusting it as necessary, you will develop a stronger sense of financial responsibility. don’t forget to factor in irregular expenses that can arise throughout the semester, such as textbooks or materials for courses. Keeping a buffer for these unexpected costs can save you from scrambling later on. Embrace this opportunity to create a solid financial foundation—it’s a skill that will not only help you in college but will also be invaluable throughout your life.

Creating a Realistic Budget: Essential Steps for Smart Spending

Understanding your financial situation is the first step to creating a realistic budget. Start by tracking your income sources,such as part-time jobs,allowances,or financial aid.Be sure to take note of your monthly fixed expenses, including:

- Rent: How much do you pay for housing?

- Utilities: What are your average monthly bills for electricity, gas, and water?

- Groceries: Estimate your monthly food expenses.

- Transportation: Include costs for public transit or fuel if you own a vehicle.

Next, categorize your discretionary spending. This includes entertainment, dining out, and shopping for clothes or supplies. To visualize your budget better, consider creating a simple table. Here’s a basic example:

| Category | Monthly Budget | Actual Spending |

|---|---|---|

| Fixed Expenses | $800 | $750 |

| Discretionary | $200 | $220 |

| Emergency Savings | $100 | $100 |

By regularly updating this table,you’ll be able to spot trends in your spending and adjust accordingly.Always aim to save a portion of your income, no matter how small, to build a financial cushion for unexpected expenses.

Effective Saving Strategies for Students on a tight Budget

Saving money in college can be a challenge, but it’s certainly achievable with the right mindset and strategies. Start by creating a budget that outlines your income and expenses. Track your spending, categorize it into essential and non-essential items, and identify areas where you can cut back. As a notable example, consider limiting how frequently enough you eat out or opting for student meal plans. You can also set a goal to save a specific percentage of your monthly income, which will not only prepare you for unforeseen expenses but also instill a habit of saving.

Additionally, explore ways to maximize your savings through various tactics. Utilize discount apps for shopping and dining to ensure you’re always getting the best deals possible. You should also take advantage of student discounts offered at many retailers and online services. Consider opening a high-yield savings account to earn interest on the money you put aside. don’t forget to participate in campus activities that offer free services or events, like workshops and movie nights, which can provide entertainment without breaking the bank.

Navigating debt: Tips for Managing Student Loans and Credit Responsibly

Managing student loans and credit can feel overwhelming, but taking a proactive approach can make the process smoother. Start by understanding your loans; know the difference between federal and private loans, including interest rates and repayment terms. This knowledge is important for developing an effective repayment strategy. Create a monthly budget that accounts for both your necessary expenses and debt repayments. Consider leveraging tools like budgeting apps to track your spending and identify areas where you can cut back, allowing you to allocate more funds toward your loans.

With credit cards, it’s essential to build your credit responsibly. Try to only use credit when necessary and aim to pay off your balance in full each month to avoid accruing interest.Here are some quick tips to help you navigate this territory:

- Make payments on time: Late payments can hurt your credit score significantly.

- Keep credit utilization low: Aim to use less than 30% of your total credit limit.

- Consider student loan forgiveness options: Research programs that can definitely help reduce your debt burden.

To help visualize your potential repayments, consider this simple repayment comparison:

| Loan Type | Average Interest Rate | Monthly payment (10 years) |

|---|---|---|

| Federal Direct Loan | 4.53% | $1,035 |

| Private Loan | 6.0% | $1,107 |

| Credit Card Debt | 16.0% | $1,200 |

By adhering to these practices and actively monitoring your finances, you can take charge of your debt and make smarter financial decisions that pave the way toward a stable future.

To Wrap It Up

As we conclude our exploration of mastering your finances as a college student, remember that effective budgeting is more than just balancing numbers—it’s about empowering yourself to make informed financial decisions that align with your goals. The strategies and tips we’ve discussed in this guide are not just tools; they’re stepping stones towards building a secure financial future.

College can be a crucial time for developing habits that will serve you well beyond graduation. By taking control of your budget now, you’re not only minimizing stress during your academic years but also laying a strong foundation for your financial well-being in the years to come.

So, take a moment to reflect on your current spending habits, set realistic goals, and create a plan that works for you. Remember, it’s not about perfection but progress. Equip yourself with the knowledge and skills to navigate the complexities of personal finance, and you will find that financial independence is not just a dream—it’s an achievable reality.

Thank you for joining us on this journey toward financial mastery. Stay informed, stay committed, and watch as your budgeting efforts pave the way for a future filled with opportunities. Here’s to your financial success!