In an age where financial freedom feels increasingly elusive, mastering your budget is not just a skill; it’s a necessity. Many individuals find themselves entangled in a web of debt, struggling to make ends meet while trying to juggle everyday expenses and financial obligations. Whether you’re dealing wiht student loans, credit card debt, or personal loans, the path to financial stability can often seem overwhelming.Though, with the right strategies and a proactive approach to budgeting, it is indeed possible to take control of your finances and pave the way for a debt-free future. in this article, we will explore effective methods for debt repayment that empower you to regain control over your financial landscape, enabling you to not only meet your obligations but also to build a stronger foundation for long-term financial success. Let’s dive into the essential strategies that can transform your budgeting skills and set you on the path to financial liberation.

Table of Contents

- Understanding Your Financial Landscape: Assessing Income and Expenses

- Creating a Realistic Budget: Essential Steps for Effective planning

- Debt Repayment Strategies: Choosing the Right Approach for Your Needs

- Staying on Track: Tools and Techniques for Maintaining Your Financial Discipline

- In Conclusion

Understanding Your Financial Landscape: Assessing Income and Expenses

To effectively navigate your financial landscape, start by gaining a thorough understanding of your income and expenses. This involves not just tallying up what you earn but categorizing your income sources,which may include:

- Employment Income: Salaries,bonuses,or commissions

- Side Hustles: Freelancing or part-time jobs

- Passive Income: Rental income,dividends,or interest

next,dissect your expenses into fixed and variable categories to identify where your money flows. Fixed expenses are those that remain constant each month, while variable expenses can fluctuate. Consider the following typical expenses:

- Fixed expenses: rent/mortgage, insurance, and subscriptions

- Variable Expenses: Groceries, entertainment, and dining out

Building a clear picture of these components will empower you to create a balanced budget, allowing for effective debt repayment strategies. One useful tool is the following table,which encourages a visual portrayal of monthly income versus expenses:

| Category | Amount ($) |

|---|---|

| Total Income | 3,500 |

| Fixed Expenses | 1,200 |

| Variable Expenses | 800 |

| total Expenses | 2,000 |

| Net Income | 1,500 |

Creating a Realistic Budget: Essential Steps for Effective Planning

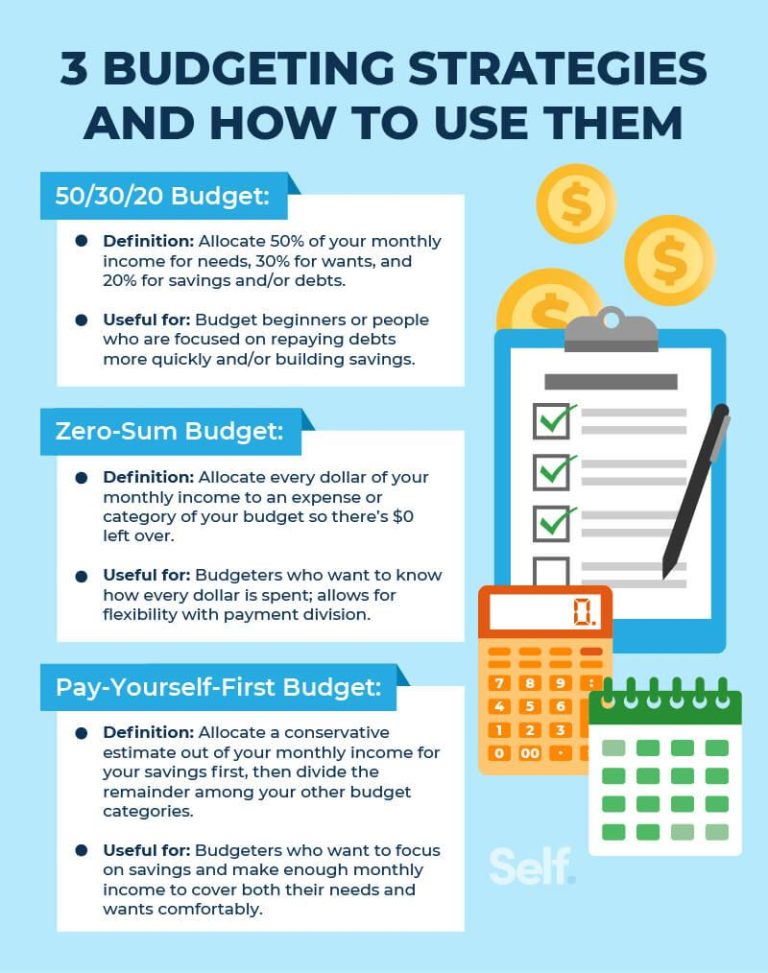

Establishing a budget is a essential step toward financial stability,and it requires a thoughtful approach to ensure it reflects your true spending habits and financial goals. Start by gathering all financial information, including your income, fixed expenses (like rent and utilities), and variable costs (such as groceries and entertainment). This will give you a comprehensive view of your finances. Next, utilize budgeting tools or apps to help streamline your process and make tracking easier. By categorizing your expenses, you can identify areas where you might be overspending and adjust accordingly.

Once you have a clear overview of your financial landscape, the next step is to set realistic financial goals. Establish both short-term objectives, like paying down specific debts, and long-term aspirations, such as saving for a home or retirement. To keep your budget on track, consider creating an envelope system for variable expenses, where you allocate a specific amount of cash for each category. This can prevent overspending and encourage discipline. Remember to review and adjust your budget regularly to accommodate life changes and ensure it remains aligned with your financial goals.

Debt Repayment Strategies: Choosing the Right Approach for Your Needs

When tackling debt, assessing your financial situation is paramount to choosing the ideal repayment strategy. Snowball and Avalanche methods are two popular approaches that cater to different psychological and financial needs. The Snowball Method suggests paying off your smallest debts first, creating momentum and motivation as you see rapid results. Conversely, the Avalanche Method focuses on paying off debts with the highest interest rates first, ultimately saving you money on interest in the long run. Selecting the right approach depends on your personality: if you thrive on quick wins and motivation, go for the Snowball; if you prefer maximizing savings, the Avalanche is your ticket.

It can be beneficial to create a visual representation of your debt repayment schedule. Utilizing a simple table can help clarify your plan and keep you organized.For instance,record your debts along with their interest rates and remaining balances,which can streamline your focus on what needs attention:

| Debt Type | Balance | Interest Rate |

|---|---|---|

| Credit Card A | $2,500 | 18% |

| Student Loan | $5,000 | 6% |

| Personal Loan | $3,000 | 10% |

By keeping track of these details visually,you can easily adapt your strategy to prioritize payments and maintain accountability. Regularly reviewing and adjusting your debt repayment plan is crucial for long-term success. Stay committed and remember that every small step towards debt freedom counts!

Staying on Track: Tools and Techniques for Maintaining your Financial Discipline

To effectively maintain financial discipline, integrating a mix of traditional and digital tools can be incredibly beneficial. Consider creating a budget using a spreadsheet or budgeting software that allows you to track your income and expenses in real time. You can also incorporate mobile apps to keep your finances organized on-the-go. For instance, apps like Mint and YNAB (You Need A Budget) offer features that help you see where your money is going and identify areas for advancement. Some additional techniques to bolster your financial discipline include:

- Setting specific financial goals

- Creating a visual progress tracker

- Establishing a dedicated savings account

Another powerful method for staying the course is cultivating healthy financial habits through regular reviews and accountability. Schedule weekly or monthly check-ins to assess your budget against actual spending and adjust where necessary.Bringing a partner or friend into this process can provide additional motivation and support. Additionally, consider utilizing a debt repayment calculator to understand how different payment strategies can affect your timeline to debt freedom. below is a simple example of what such a comparison table could look like:

| Payment Strategy | Monthly payment | Time to Pay Off |

|---|---|---|

| Snowball Method | $200 | 24 months |

| avalanche Method | $300 | 18 months |

| Minimum Payments | $100 | 60+ months |

In Conclusion

mastering your budget and effectively managing your debt is not just an aspiration; it’s a practical necessity in today’s financial landscape. By implementing the strategies outlined in this article—such as the snowball and avalanche methods, tracking your spending, and prioritizing your expenses—you can take control of your financial future. Remember, every small step counts and consistency is key.

As you embark on this journey toward financial freedom, be patient and stay committed.celebrate your milestones, no matter how small, and use them as motivation to keep pushing forward. With the right mindset and a solid plan, you can break free from the burdens of debt and lay the foundation for a healthier financial life.

Thank you for joining us on this exploration of budgeting and debt repayment. We wish you the best in your financial endeavors and encourage you to share your progress and questions in the comments below—let’s support each other on this journey toward financial wellness!