As the cost of higher education continues to rise, many students are seeking innovative ways to finance thier studies while gaining valuable experience in the workforce.enter work-study programs—an excellent possibility for students to earn money, build their resumes, and develop skills that will serve them well beyond the classroom. But how do you successfully navigate the application process and set yourself apart from the competition? In this complete guide, we will walk you through the essential steps to mastering your work-study application.From understanding eligibility requirements to crafting a standout resume and preparing for interviews, we’ll provide you with the insights and strategies you need to secure a work-study position that aligns with your academic and career aspirations.Whether you’re a first-time applicant or looking to improve your chances for the coming semester, this guide will equip you with the tools you need to thrive in the competitive landscape of work-study programs. let’s dive in and transform your educational journey into a triumphant blend of learning and professional growth.

Table of Contents

- Understanding Work-Study Programs and Their Benefits

- Navigating eligibility Requirements and Application Processes

- Maximizing your Work-Study Experience for Career Growth

- Balancing Academics and Work Responsibilities Effectively

- The Way Forward

Understanding Work-Study Programs and Their Benefits

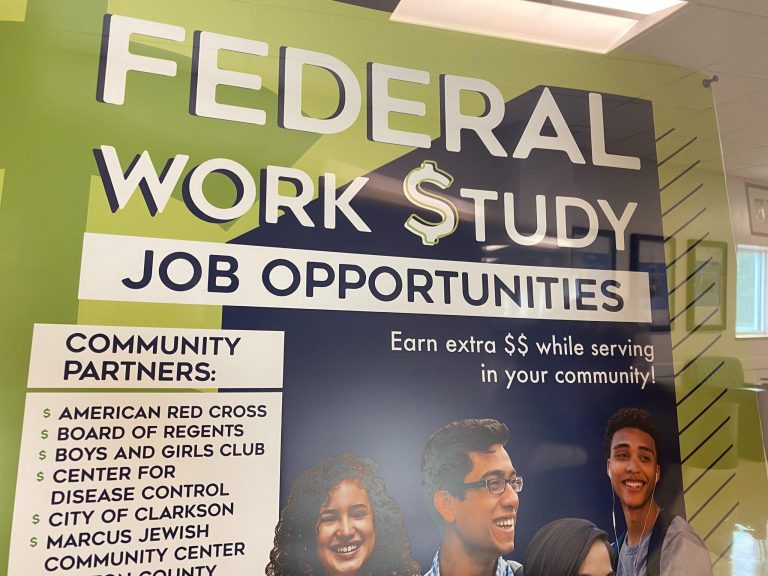

Work-study programs provide students with a unique opportunity to gain practical experience while earning money to support their education. These programs frequently enough involve part-time jobs that align with a student’s field of study, making them a valuable asset for building a resume and enhancing career prospects. By participating in work-study,students can acquire critical skills such as time management,teamwork,and problem-solving,all of which are highly sought after by future employers. The financial support from these jobs also alleviates some of the burdens of tuition and living expenses, enabling students to focus more on their studies.

Moreover, work-study programs foster a sense of community and engagement within the campus surroundings. Students who participate often develop lasting relationships with their peers and mentors, leading to networking opportunities that can benefit them long after graduation. Here are some key benefits of work-study programs:

- Financial Aid: Helps cover tuition and living costs.

- Skill Development: Provides hands-on experience specific to the student’s career path.

- Flexible Hours: Typically designed to accommodate class schedules.

- Networking Opportunities: Connects students with professionals in their field.

Navigating Eligibility requirements and Application Processes

understanding the eligibility requirements for work-study programs is vital to successfully securing your position. Most programs have specific criteria that you must meet, generally including:

- Enrollment status: You typically need to be enrolled at least half-time in a degree program.

- Financial Need: Demonstrated financial need is frequently enough assessed through the FAFSA.

- Satisfactory Academic Progress: Maintaining a good academic record is essential; this frequently enough includes a minimum GPA requirement.

Once you confirm your eligibility, the application process involves several key steps. Start by completing the Free Application for Federal Student Aid (FAFSA), which opens up doors to federal aid and work-study opportunities. Afterward, follow these important steps:

- Check with Your Financial Aid Office: They can provide specific information on available work-study positions and deadlines.

- Prepare Your Resume: Highlight any prior work experience and skills related to the positions you’re interested in.

- Attend Job Fairs: Networking can be crucial—employment opportunities are often discussed at these events.

Maximizing Your Work-Study Experience for Career Growth

To truly elevate your work-study experience, it’s essential to be proactive and intentional about the skills and connections you develop during this time. Engaging actively in your assigned role allows you to gain hands-on experience that can be instrumental in shaping your future career path. Utilize this opportunity to immerse yourself in a professional environment by:

- Networking: Build relationships with colleagues and supervisors; they can provide valuable insights and recommendations.

- Seeking Mentorship: Identify a mentor who can guide you, share industry knowledge, and help you navigate your career.

- Taking Initiative: Volunteer for projects or tasks that stretch your capabilities and expand your skill set.

Additionally, take time to reflect on your experiences and how they relate to your long-term goals. Document your achievements and the skills you’ve acquired; this information will be vital when updating your resume or preparing for interviews. Consider creating a simple table to track your progress:

| Skill/Experience | Description | Application |

|---|---|---|

| Dialog | Practiced clear messaging with colleagues and clients. | Beneficial in client-facing roles and presentations. |

| Project Management | Managed timelines and deliverables for specific projects. | Critical for future roles requiring coordination. |

| Technical Skills | Gained proficiency in software tools relevant to your field. | Enhances suitability for technical positions. |

Balancing Academics and Work Responsibilities Effectively

Successfully juggling academics and work obligations demands intentional planning and time management. To create a balanced schedule, consider the following techniques:

- Prioritization: Rank tasks based on deadlines and importance, ensuring you address what truly matters first.

- Time Blocking: Allocate specific time slots for studying, working, and personal activities to enhance focus and reduce distractions.

- Flexibility: Remain adaptable to unexpected changes, whether they stem from an increased workload or a challenging academic project.

Moreover, utilizing campus resources can help streamline your experience. Many institutions offer:

- Academic Advising: Guidance on course selection and workload management.

- Career Services: Support in finding suitable work-study positions that align with your academic goals.

- Peer Support Groups: Networking with fellow students to share insights and cope with overlapping responsibilities.

| Strategy | Description |

|---|---|

| Time Management Apps | Utilize tools like Trello or Todoist to track tasks and deadlines. |

| Study Groups | Collaborate with peers to enhance learning and maintain accountability. |

| Regular Breaks | incorporate short breaks to recharge and prevent burnout. |

The Way Forward

embarking on a work-study program can be a transformative experience, providing not just financial support but invaluable skills and connections for your future career. By mastering your application, you set the stage for success, showcasing your unique strengths and passion in a way that resonates with potential employers. Remember, the journey doesn’t end with submission; staying proactive, engaged, and open to learning will further enhance your experience.

Embrace the opportunity, invest the time in crafting a compelling application, and you’ll find that the rewards extend far beyond the paycheck. Whether it’s gaining hands-on experience, creating a professional network, or developing essential workplace skills, work-study programs can catapult you into your desired career path.

Thank you for reading, and we wish you the very best as you take the next steps in your academic and professional journey! Explore the possibilities, leverage your experiences, and most importantly, believe in yourself—you’re capable of achieving great things!