Planning a wedding is an exhilarating journey filled with joy, love, adn endless excitement. However, amid the flurry of floral arrangements, venue selections, and cake tastings, one crucial aspect often looms large: the budget. Navigating the intricate landscape of wedding expenses can feel like a daunting task, and it’s all too easy to get caught up in the romance of the occasion and overspend. In this article, we will explore essential tips and strategies for mastering your wedding budget to ensure that your special day is not only memorable but also financially responsible. Whether you’re dreaming of a grand celebration or an intimate gathering, we’ve got you covered with practical advice that will help you achieve your vision without breaking the bank. Join us as we dive into the art of budgeting, allowing you to focus on what truly matters—celebrating love and creating lasting memories.

Table of Contents

- Understanding Your Total Wedding Costs

- Essential Strategies for Creating a Realistic Budget

- Smart Prioritization: Allocating Funds Wisely

- Tips for Saving Without Sacrificing Quality

- Concluding Remarks

Understanding Your Total Wedding Costs

When planning your wedding, understanding all potential costs is critical to avoid exceeding your budget. Start by outlining the key areas where expenses typically arise. Focus on categories such as:

- Venue Rental – This often consumes a notable portion of your budget.

- Attire – Including wedding dresses, suits, and accessories for both the couple.

- catering – Food and beverage choices can vary widely in price.

- Photography & Videography – Capturing your big day is essential, but costs can add up.

- Entertainment – DJs, live bands, or other forms of entertainment are vital for guest enjoyment.

Additionally, remember to account for costs that might be overlooked during the planning process. These can include:

- Invitations & Stationery – Featuring save-the-dates, invitations, and thank-you cards.

- Flowers & Décor – Centerpieces, bouquets, and other decorative elements.

- Vendor Gratuities – Tips for those providing services on your big day.

- Wedding Insurance – A safeguard for unexpected cancellations or issues.

| Category | Estimated Cost |

|---|---|

| Venue | $3,000 – $15,000 |

| Catering | $4,000 – $10,000 |

| Photography | $1,500 – $5,000 |

| Entertainment | $1,000 – $3,000 |

| Attire | $500 – $5,000 |

Essential Strategies for Creating a Realistic budget

Creating a budget that reflects your wedding vision while still being realistic can be challenging. Start by determining your overall budget based on your financial situation and contributions from family. It’s crucial to break down this total into categories such as venue, food, attire, and entertainment. Here’s a simple example of how to distribute your budget:

| Category | percentage of Budget |

|---|---|

| Venue | 30% |

| Catering | 25% |

| Photography | 15% |

| Attire | 10% |

| Entertainment | 10% |

| miscellaneous | 10% |

Once you have your budget categories defined, it’s essential to research the typical costs associated with each category in your area. This allows you to make informed decisions and avoid underestimating expenses.Remember to consider all potential costs, including taxes and gratuities, which can easily add up. Tracking your expenses meticulously throughout the planning process will help you stay on top of your budget and avert any unexpected financial strain. Use budgeting tools or apps to keep everything organized and accessible on-the-go.

smart Prioritization: Allocating Funds Wisely

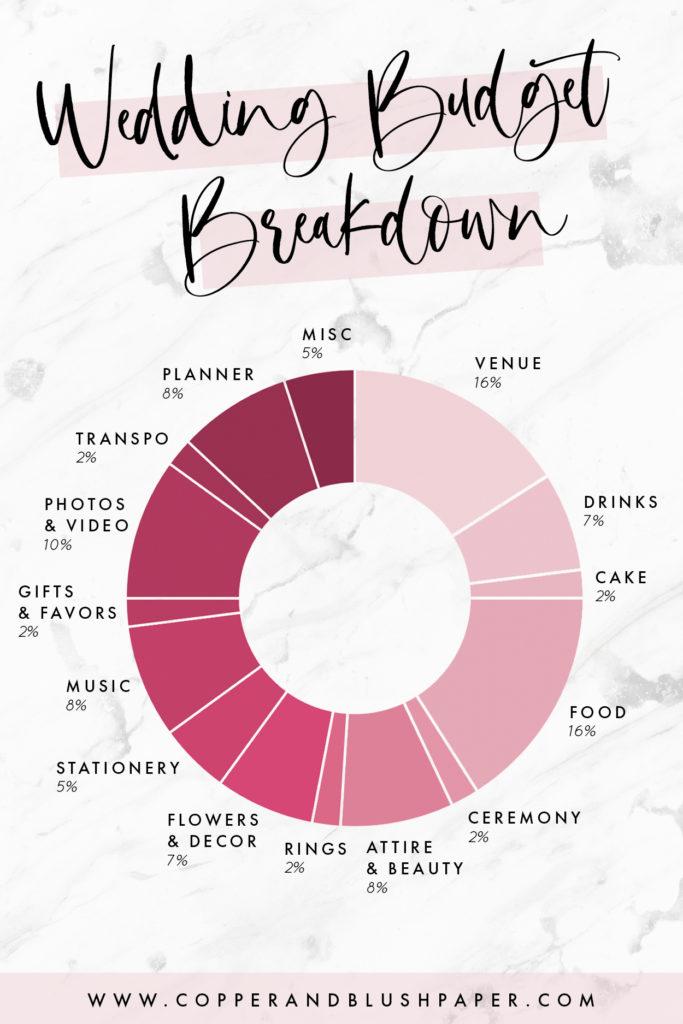

When it comes to managing your wedding budget, effective fund allocation is key to making the most of your financial resources. Start by identifying your top priorities—the elements of the wedding that matter most to you. This could include your venue, catering, photography, or entertainment. Once you’ve established these priorities, consider creating a visual breakdown to help clarify where your funds will be best spent. A common approach is to use a simple pie chart or a bar graph to represent how much of your budget each category will consume, allocating more to what’s significant to you both.

Next, it’s essential to set a realistic budget that reflects both your priorities and the overall wedding experience you wish to create. to achieve this, you can implement a fund allocation table to keep everything organized. By comparing costs of different vendors and services,you can make informed decisions that will ultimately reflect your vision without breaking the bank. As you evaluate options, categorize them into must-haves and nice-to-haves to ensure that your essential items receive the funding they deserve.

| Category | Prioritized Spend (%) | Notes |

|---|---|---|

| Venue | 30% | Book early for discounts |

| Catering | 25% | Consider buffet or family-style |

| Photography | 20% | Check for bundled services |

| Entertainment | 15% | Mix bands with DJs for flexibility |

| Decor | 10% | DIY options to save costs |

Tips for Saving Without Sacrificing Quality

When planning your wedding, it’s possible to stick to your budget while still obtaining the quality you desire. One effective way to achieve this is by researching vendors thoroughly. Look for local suppliers who have great reviews but may not have the same price tags as more popular,well-known brands. Additionally, consider creating a wish list of your must-haves versus nice-to-haves. this prioritization allows you to allocate funds more wisely and focusedly, ensuring that you’re investing in the elements that truly enhance your day.

Another savvy approach is to be flexible with your wedding timeline. opting for an off-peak season can lead to considerable savings without compromising on quality. Not only will vendors be more willing to negotiate prices, but you may also snag better deals on venues. Consider this breakdown of potential savings:

| Time of Year | Estimated Savings |

|---|---|

| Peak Season (June – September) | Higher prices 20-40% increase |

| Shoulder Season (April – May, October) | Moderate savings 10-20% decrease |

| Off-Peak Season (November – March) | Significant savings 30-50% decrease |

In addition, explore the option of DIY elements for your wedding decor. Handcrafted items can imbue your day with a personal touch while saving money. For example, creating your centerpieces or invitations can not only cut costs but also serve as meaningful activities to enjoy with family and friends. By blending a mix of DIY projects with a few professional services, you can maintain high quality without overspending.

Concluding Remarks

mastering your wedding budget is crucial for creating the celebration of your dreams without falling into financial stress. By setting a realistic budget, prioritizing your spending, and leveraging available resources, you can navigate the frequently enough overwhelming world of wedding planning with confidence. Remember, communication with your partner and vendors is key to making informed decisions and staying on track. As you embark on this exciting journey, keep in mind that your wedding day is about celebrating love and partnership, not just the price tag.With these tips in hand, you’re well on your way to planning a gorgeous event that reflects your unique style and stays within budget. Happy planning,and may your special day be everything you’ve dreamed of!