Navigating the world of bank financing can feel like embarking on a complex journey, fraught with jargon, paperwork, and a myriad of options. Whether your seeking a mortgage for your dream home, a personal loan for a big purchase, or business financing to fuel your entrepreneurial aspirations, understanding the loan process is essential for achieving your financial goals. In this comprehensive guide, we will demystify the steps involved in securing a bank loan, providing you with the knowledge and confidence to master the process. From preparing your financial documents to understanding interest rates and repayment terms, we’ll equip you with the tools necessary to make informed decisions and successfully navigate the lending landscape.Join us as we break down each stage of the loan process, ensuring you’re not just a borrower, but a savvy financial strategist.

Table of Contents

- Understanding Different Types of Loans and Their Unique Requirements

- Preparing your Financial Profile for a Successful Loan Application

- Navigating the Loan Approval Process: Key Steps and Best Practices

- post-approval Strategies: Managing Your Loan Effectively

- The Way Forward

Understanding Different Types of Loans and Their unique Requirements

When navigating the world of financing, it’s crucial to recognize that not all loans are created equal. Each type caters to different financial needs, and understanding their specific requirements can make a significant difference in your borrowing experience. As an example, personal loans are typically unsecured and rely heavily on your credit score, while secured loans require collateral, offering lower interest rates but also posing a risk of losing the asset if you default. Other notable types include mortgages, which come with their own set of criteria based on property value and creditworthiness, and student loans, often subsidized by the government to ease the financial burden of education.

Here’s a brief overview of some key loan types and their essential requirements:

| Loan Type | Collateral Required | Typical Interest Rates |

|---|---|---|

| Personal Loan | No | 6% – 36% |

| Mortgage | Yes (property) | 3% – 6% |

| Auto Loan | Yes (vehicle) | 4% – 10% |

| Student Loan | No | 3% – 7% |

Additionally, various loans may have eligibility criteria based on income, employment status, and credit history. for example, FHA loans often target first-time homebuyers and require lower credit scores, while conventional loans might necessitate stronger financial profiles. Understanding the nuances between these loans will empower you to select the option that aligns best with your financial strategy, perhaps saving you time, money, and heartache in the future.

Preparing Your Financial Profile for a successful Loan Application

Before diving into the loan application process, it’s essential to create a robust financial profile that will make you an appealing candidate to lenders. Start by gathering all relevant financial documents such as your credit reports, income statements, and tax returns. This will help you understand your current financial situation and identify areas for improvement. ensure that your credit score is in good standing; a score above 700 is often seen as favorable. Additionally,track your debt-to-income ratio,which should ideally be below 43%.This will assure lenders that you can handle additional debt.

Furthermore, consider organizing your assets into a clear table for easy reference during the application process. here’s a simple layout that can help you visualize your financial standing:

| Asset Type | Value |

|---|---|

| Cash Savings | $10,000 |

| Investments | $25,000 |

| Real Estate | $200,000 |

| Retirement Accounts | $50,000 |

By compiling this financial profile and understanding your assets, you will be better prepared to discuss financing options with your lender. A proactive approach not only increases your chances of approval but can also position you to negotiate better terms on your loan.

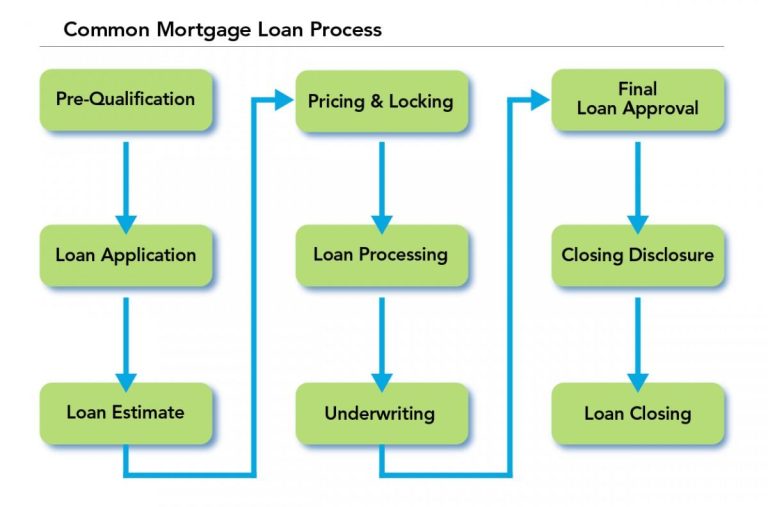

Navigating the Loan Approval Process: key Steps and Best Practices

Understanding the loan approval process is essential for any borrower looking to secure financing.Start by assessing your financial health, which includes reviewing your credit score, income stability, and existing debts. this analysis will help you determine how much you can afford and what types of loans might be accessible. Generally,lenders will require documentation such as proof of income,tax returns,and bank statements.Gathering these documents in advance not only streamlines the process but also enhances your credibility as a borrower.

Onc you’re ready to apply, focus on choosing the right lender. Research various banks and credit unions, as they may offer different rates and terms. It’s beneficial to compare loan estimates and look for any hidden fees associated with the loan. Consider factors like customer service and the lender’s responsiveness, as these can influence your overall experience. During the application phase,be obvious about your financial situation,and maintain interaction with your lender to ensure a smooth process. Establishing a good rapport may also give you leverage in negotiations.

Post-Approval Strategies: Managing Your Loan Effectively

Once your loan has been approved, the real work begins.managing your finances effectively is crucial to ensure you can meet repayment obligations without straining your budget. Start by creating a detailed monthly budget that accommodates your new loan payments. Prioritize your obligations and set aside funds for your loan payments as soon as you receive your income.This approach helps you avoid any potential late fees and maintain a healthy credit score. remember to consider additional costs that may arise, such as interest fluctuations and fees related to your loan.

Along with budgeting, it’s wise to establish a strategy for early repayment if your financial situation allows for it. Paying off your loan quicker than scheduled can significantly reduce the total interest paid over the loan’s life. Here are some effective strategies to consider:

- Make extra payments whenever possible.

- Round up your payments to the nearest hundred.

- Consider consolidating debt to lower your overall interest rate.

Keep an open line of communication with your lender. If you encounter financial difficulties, reaching out early can lead to options such as payment deferments or restructurings that could ease your burden.

The Way forward

navigating the loan process doesn’t have to be daunting. With the insights and strategies outlined in this guide, you are now equipped to approach bank financing with confidence and clarity. Remember, the key to mastering this process lies in thorough preparation—understanding your financial situation, researching different loan options, and maintaining open communication with your lender. By following these steps,you’ll not only enhance your chances of securing favorable terms but also empower yourself to make informed financial decisions that pave the way for a successful future.

As you embark on this journey, keep in mind that every financial decision is a stepping stone towards your goals, whether it’s buying a home, funding a business, or managing personal expenses. Don’t hesitate to revisit this guide whenever you need a refresher. Here’s to your financial success and a smooth loan process! If you have any questions or would like further assistance, feel free to reach out in the comments section below.Happy financing!