In today’s fast-paced financial landscape, effective budgeting has become an essential skill for achieving personal and financial goals. With countless budgeting methods vying for your attention, it can be challenging to find a system that offers both simplicity and effectiveness. Enter the 50/30/20 rule—a straightforward approach that allocates your after-tax income into three key categories: needs, wants, and savings or debt repayment. In this article, we’ll delve into the fundamentals of the 50/30/20 rule, demonstrating how this clear and structured framework can empower you to take control of your finances, make informed spending decisions, and ultimately pave the way toward a more secure financial future. Whether you’re a budgeting novice or looking to refine your existing strategy, mastering the 50/30/20 rule could be the key to transforming your financial habits and achieving lasting success.

Table of Contents

- Understanding the 50/30/20 Rule and Its Importance in Personal finance

- Breaking Down Your Budget: Allocating Needs, Wants, and Savings

- Practical Tips for Implementing the 50/30/20 Rule in Your Daily Life

- Common Challenges and Solutions for Sticking to Your Budgeting Plan

- In Conclusion

Understanding the 50/30/20 Rule and Its Importance in Personal Finance

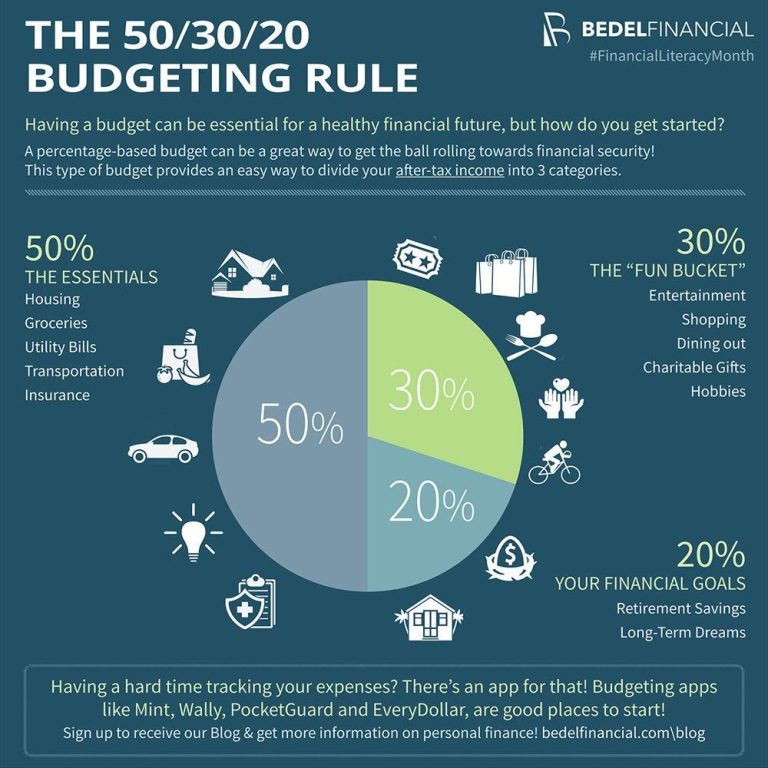

At its core, the 50/30/20 rule is a straightforward budgeting framework that divides your after-tax income into three categories: needs, wants, and savings or debt repayment. This method simplifies the budgeting process by providing clear guidelines on how to allocate each portion of your income.In this structure, 50% is dedicated to essential expenses, which include housing, utilities, and groceries. As an example, if your monthly income is $3,000, you’d allocate $1,500 to cover these necessary costs. Next, 30% is reserved for discretionary spending—essentially the fun stuff, such as dining out, entertainment, or hobbies. this part amounts to $900 per month in our example, ensuring you can enjoy life while remaining financially responsible. Lastly, 20% goes towards savings and debt repayments, promoting financial independence and helping you build an emergency fund or pay off loans. That would be $600 in this scenario.

Adopting this rule can significantly impact your financial health by instilling discipline and enabling you to prioritize your expenditures effectively. Consider the benefits of tracking your spending habits and understanding where your money goes. By applying the 50/30/20 rule, individuals can achieve a balanced budget, which can lead to reduced financial stress. To illustrate its submission, here’s a simple budget breakdown:

| Category | amount ($) |

|---|---|

| Essential Expenses (50%) | 1,500 |

| Discretionary Spending (30%) | 900 |

| Savings/Debt Repayment (20%) | 600 |

This visual depiction not only helps in grasping the concept but also reinforces the importance of adhering to the budget proportions. Whether you’re saving for a home, planning for retirement, or simply looking to have a clearer understanding of your financial landscape, implementing the 50/30/20 rule provides a solid foundation for achieving your financial goals with confidence and clarity.

Breaking Down Your Budget: Allocating Needs, Wants, and Savings

Allocating your income effectively is crucial to maintaining a healthy financial lifestyle.The 50/30/20 rule serves as a practical blueprint for dividing your income into three distinct categories: needs, wants, and savings. Needs cover essential expenses that you cannot live without, such as housing, utilities, groceries, and healthcare. Aim to keep this category under 50% of your income. Examples include:

- Rent or mortgage payments

- Basic utilities (electricity,water,internet)

- Essential groceries

- Health insurance and medical expenses

Next,it’s critically important to allocate up to 30% of your income toward wants. These are non-essential items that enhance your life but are not required for survival.Cutting back on wants could offer additional financial versatility. Consider the following categories for your “wants”:

- Dining out and entertainment

- Travel and vacations

- Hobbies and leisure activities

- Fashion and beauty products

aim to reserve at least 20% of your income for savings and debt repayment. This category is vital for building financial security and achieving your long-term goals. Here’s how you can break it down:

| Type of Savings | Suggested Allocation |

|---|---|

| Emergency Fund | 10% |

| Retirement Savings | 5% |

| Debt Payment | 5% |

Following this guideline not only helps you to keep your financial responsibilities in check, but also allows for personal growth through savings, ensuring a secure future. Remember,adjusting the percentages to better fit your unique lifestyle and circumstances is entirely appropriate,as long as you remain committed to maintaining a balanced budget.

Practical Tips for Implementing the 50/30/20 Rule in Your Daily Life

To effectively implement the 50/30/20 rule in your daily life, start by meticulously tracking your income and expenses. Utilize budgeting apps or spreadsheets to categorize your spending into three distinct groups: needs, wants, and savings. This clarity will help you understand if your current spending aligns with the recommended 50/30/20 distribution. Remember to reassess your expenses regularly to ensure you’re staying on target. A practical tactic is to set aside a specific day each month to review your finances; this can be an excellent way to stay accountable and adjust your spending habits accordingly.

additionally, it can be beneficial to automate your savings to adhere to the 20% allocation more effortlessly. Consider setting up an automatic transfer to a savings account or investment fund as soon as you receive your income. This way, you’re less tempted to spend that portion on non-essentials. Also, when analyzing your wants, prioritize purchases that truly add value to your life—think of experiences rather than material possessions. Here’s a simple table to visualize how you can effectively allocate your monthly budget:

| Category | Percentage | Monthly Amount (Based on $3,000 Income) |

|---|---|---|

| Needs | 50% | $1,500 |

| Wants | 30% | $900 |

| Savings | 20% | $600 |

Common Challenges and Solutions for Sticking to Your Budgeting Plan

Sticking to a budgeting plan can frequently enough feel more challenging than it should be. Many find themselves falling off track due to unexpected expenses, lifestyle changes, or simply poor planning. Identifying your triggers is critical; whether it’s impulse shopping or unplanned outings, recognizing these patterns can help you preemptively strategize. Here are some practical solutions to keep you grounded:

- Create an emergency fund: This buffer allows you to handle unexpected costs without derailing your budget.

- Set realistic goals: Small, achievable milestones can help maintain motivation and reduce feelings of overwhelm.

- Automate savings: By setting up automatic transfers to your savings account, you ensure that you pay yourself first.

Another common obstacle is the temptation to deviate from planned spending categories. Lifestyle inflation, where your spending increases as your income rises, can sneak up on anyone. To tackle this effectively, regularly review and adjust your budget to reflect changes in your financial situation. Consider implementing the following tactics:

- Track your expenses: Use budgeting apps or spreadsheets to gain a clearer understanding of your spending habits.

- Engage in accountability: Share your goals with a trusted friend or a family member to help stay committed.

- Reward yourself: Incorporate small rewards in your budget for sticking to your goals, ensuring that financial discipline remains appealing.

to sum up

mastering the 50/30/20 rule is not just about numbers; it’s about gaining control over your financial life and paving the way for a secure future. By allocating 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment, you can establish a balanced budget that reflects your priorities and values. This straightforward framework offers the flexibility to adapt your spending as your circumstances change, while also encouraging mindful financial decisions.

as you embark on your budgeting journey, remember that consistency is key. It may take a little time to perfect your approach, and that’s perfectly okay. Celebrate your progress, adjust as necessary, and don’t hesitate to seek out resources and tools that can definitely help streamline your budgeting process.

With dedication and discipline, the 50/30/20 rule can transform your financial habits, leading to greater peace of mind and the ability to achieve your long-term goals. So take a deep breath,embrace the process,and start turning your financial aspirations into reality. Happy budgeting!