In the ever-evolving landscape of finance, the principle of diversification remains a cornerstone of sound investment strategy. As markets fluctuate and economic climates shift,the ability to navigate these changes while safeguarding your assets is more crucial than ever. Welcome to “,” where we delve into the essential strategies and best practices for building a resilient investment portfolio.Whether you’re a seasoned investor or just begining your financial journey, understanding the intricacies of portfolio diversity can empower you to make informed decisions that align with your financial goals. Join us as we explore the benefits of a well-rounded investment approach, the various asset classes available, and actionable insights that can help you mitigate risk while maximizing potential returns. It’s time to take control of your financial future and unlock the power of a diversified portfolio.

Table of contents

- Understanding the Importance of Portfolio Diversity in Investment Strategy

- Key Asset Classes to Consider for a Well-balanced Portfolio

- Strategies for risk Management Through Diversification

- Tools and Resources for Monitoring and Adjusting Your Investment Portfolio

- Insights and Conclusions

understanding the Importance of Portfolio diversity in Investment Strategy

Diversifying your investment portfolio is akin to planting a garden with a variety of flowers; the more diversity you cultivate, the more resilient your overall investment strategy becomes. Embracing a mix of asset classes—such as stocks, bonds, real estate, and commodities—allows investors to hedge against the unavoidable fluctuations in market conditions. By not putting all your eggs in one basket, you can mitigate risks associated with market volatility. Studies show that a well-diversified portfolio can enhance returns while lowering overall risk, creating a win-win scenario for savvy investors.

When constructing a diversified portfolio, consider the following factors to optimize your strategy:

- Risk Tolerance: Understand your comfort level with risk to determine the right mix of assets.

- Investment Goals: Define your financial objectives to align your portfolio with your long-term vision.

- Asset Allocation: Regularly review and adjust your asset allocation to reflect changing market conditions and personal circumstances.

- Geographic Exposure: Incorporate global investments to protect against localized economic downturns.

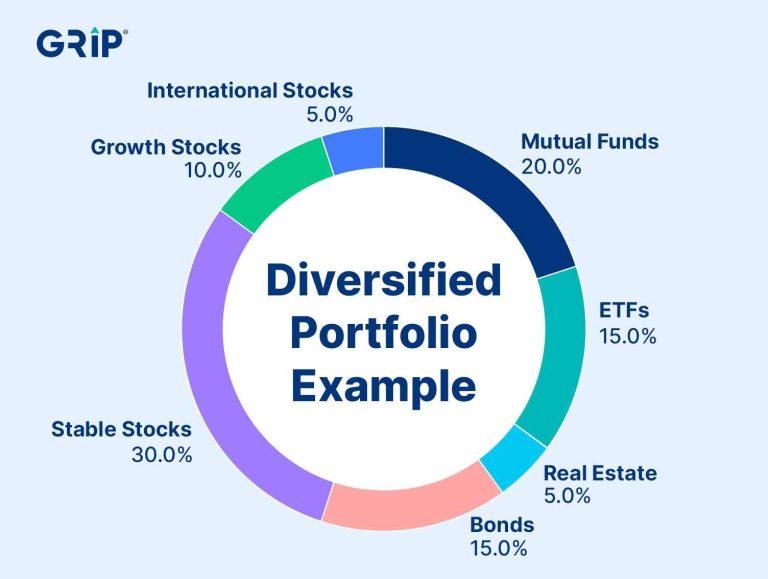

Below is a simplified table illustrating a basic diversified portfolio approach:

| Asset Class | Percentage Allocation |

|---|---|

| U.S. stocks | 40% |

| Bonds | 30% |

| International stocks | 20% |

| Real Estate | 10% |

Key asset Classes to Consider for a Well-Balanced Portfolio

Building a robust investment portfolio requires a strategic blend of diffrent asset classes, each offering unique benefits that can enhance overall returns and minimize risks. Equities are a cornerstone of any dynamic portfolio, known for their growth potential, especially over the long term. Investing in diversified stock funds or index funds can provide exposure to a broad range of companies while mitigating the volatility of individual stocks. Additionally, fixed-income securities such as bonds play a vital role by providing steady income and reducing the overall risk during market downturns. These can include government bonds, corporate bonds, or municipal bonds, tailored to fit your risk tolerance and investment horizon.

Moreover,real estate is another key asset class that offers not only potential capital gratitude but also income through rent,making it an attractive diversification tool.Commodities, whether through direct investment or ETFs, can serve as a hedge against inflation, providing tangible value that tends to fluctuate independently from stock market movements. Lastly, don’t overlook the benefits of option investments like private equity or hedge funds, which can introduce additional strategies and risk-adjusted returns to your portfolio. Together, these asset classes create a tapestry of opportunities designed to safeguard your investments while positioning you for future growth.

Strategies for Risk Management Through Diversification

Investors can effectively manage risk by incorporating a range of asset classes into their portfolios. This strategy minimizes potential losses by ensuring that not all investments are affected by the same market conditions. Key areas to consider when building a diversified portfolio include:

- Stocks: Invest in different sectors, such as technology, healthcare, and consumer goods, to spread out risk.

- Bonds: Include various types, such as government and corporate bonds, to balance out the volatility of stocks.

- Real Estate: Allocate a portion of your portfolio to real estate investment trusts (REITs) for a hedge against inflation.

- Commodities: Consider precious metals and energy resources as a buffer during economic downturns.

Another effective approach to diversification involves geographical dispersion. Investing in international markets can provide exposure to growth opportunities outside your home country, reducing dependency on local economic trends. A balanced allocation could resemble the following:

| Asset Class | Percentage Allocation |

|---|---|

| U.S. Stocks | 40% |

| International Stocks | 30% |

| Bonds | 20% |

| Real Estate & Commodities | 10% |

This combination not only broadens your investment exposure but also enhances the resilience of your portfolio against market fluctuations. By regularly reviewing and adjusting your allocations based on performance and changing market trends, you can achieve a well-balanced portfolio that aligns with your financial goals.

Tools and Resources for Monitoring and Adjusting Your Investment Portfolio

In the journey of mastering portfolio diversity, utilizing the right tools and resources is essential for effectively monitoring and adjusting your investments. A variety of financial platforms and applications can keep you informed about market trends and your asset performance. Some popular options include:

- Brokerage Platforms: Services like Fidelity, Schwab, and E*TRADE offer user-amiable interfaces with robust analytics tools.

- Portfolio Trackers: Applications such as Personal Capital or Morningstar allow for real-time tracking and performance evaluation.

- financial News Websites: Sites like Bloomberg and Yahoo Finance provide up-to-date news that may affect your investments.

In addition to these tools, leveraging educational resources can enhance your understanding of market dynamics and help you make informed decisions. Online courses, webinars, and financial newsletters can provide valuable insights into effective investing strategies. Here’s a table highlighting some effective educational resources:

| Resource Type | Examples | Focus Area |

|---|---|---|

| Online Courses | Coursera, Udemy | Investment Strategies |

| Webinars | Investopedia, marketwatch | Market Analysis |

| Newsletters | The Motley Fool, Seeking Alpha | Stock Recommendations |

Insights and Conclusions

mastering portfolio diversity is not merely a strategy but a basic philosophy for successful investing. As we’ve explored throughout this guide, a well-diversified portfolio can safeguard your investments against market volatility and elevate your potential for long-term growth.By understanding the different asset classes, evaluating your risk tolerance, and continually monitoring your holdings, you’re taking proactive steps toward achieving a balanced and resilient financial future.

Remember,investing is a journey,not a destination.As you refine your approach to portfolio diversity, stay informed about market trends and be ready to adapt your strategy as needed. The world of investing is ever-evolving, and being flexible will serve you well.

We hope this guide empowers you to make informed decisions that align with your financial goals. Whether you’re just starting out or looking to enhance an existing portfolio, the principles of diversification will always be your allies. embrace the art of strategic investing, and watch your financial confidence—and your wealth—grow. Happy investing!