In today’s ever-evolving financial landscape, teh age-old adage “don’t put all your eggs in one basket” resonates more than ever. Investors are continually faced with a plethora of opportunities and challenges, making the pursuit of portfolio diversity a critical component of successful investing. as market conditions shift, economic uncertainties loom, and new asset classes emerge, mastering the art of diversification is not just a strategy—it’s a necessity for long-term financial health. In this article, we will explore smart strategies for achieving a well-rounded portfolio that mitigates risk while maximizing potential returns. whether you’re a seasoned investor or just starting out, our insights will equip you with the tools to navigate the complexities of diversification and help you cultivate a resilient and dynamic investment portfolio. Let’s dive into the world of portfolio diversity and uncover actionable steps to bolster your investment strategy.

Table of Contents

- Understanding Portfolio Diversity and Its Importance for Long-Term Success

- Key Asset Classes to Consider for a Well-Balanced Investment Strategy

- Practical Tips for Assessing Risk Tolerance and Adjusting Your Portfolio

- Utilizing Modern Tools and Resources for Effective Portfolio Management

- Final Thoughts

Understanding Portfolio Diversity and Its Importance for Long-Term Success

Building a diversified portfolio is essential for mitigating risks and enhancing the potential for long-term gains in any investment strategy. By spreading investments across various asset classes, sectors, and geographical regions, investors can cushion their portfolios against market volatility. This strategy reduces the risk of significant losses stemming from adverse market movements in a single investment area. Key benefits of diversification include:

- risk Mitigation: By investing in a variety of assets, poor performance in one area can be offset by strength in others.

- Enhanced Returns: A diverse portfolio can capture returns from multiple sources, leading to better overall performance.

- Reduced Emotional Bias: Diversification encourages a disciplined investment approach, helping investors avoid impulsive decisions based on market fear or greed.

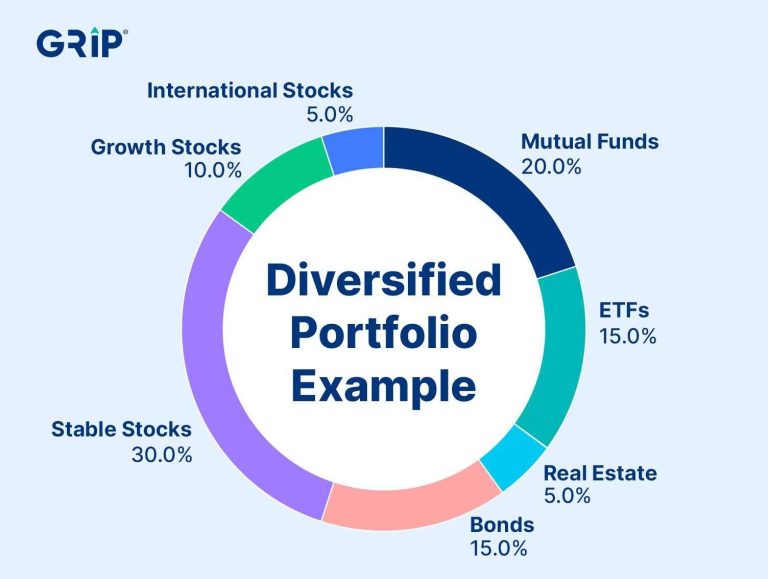

To effectively implement diversification, it’s crucial to understand the different types of investments available. Investors can consider a mix of stocks, bonds, real estate, and commodities, each of which tends to react differently to market conditions. A well-structured portfolio might resemble the following distribution:

| Asset Class | Percentage Allocation |

|---|---|

| Stocks | 50% |

| Bonds | 30% |

| Real Estate | 15% |

| Commodities | 5% |

This example illustrates a balanced approach that can be tailored according to individual risk tolerance, investment goals, and market conditions. By regularly reviewing and rebalancing the portfolio to maintain the desired allocation, investors can cultivate a resilient investment strategy capable of weathering the ups and downs of financial markets.

Key Asset Classes to Consider for a Well-Balanced Investment Strategy

Building a robust investment strategy involves understanding various asset classes that can contribute to overall portfolio resilience and growth. A well-rounded approach often incorporates a mix of equities, bonds, and alternatives to manage risk effectively while maximizing potential returns. Each asset class has its unique characteristics and responds differently to market conditions, making it essential to diversify. As a notable example, equities can offer considerable growth potential, while bonds provide stability and income, acting as a buffer against market volatility. Integrating option investments, such as real estate or commodities, can further enhance diversification, safeguarding your portfolio from economic downturns.

Here’s a swift overview of key asset classes to consider:

| Asset Class | Description | Considerations |

|---|---|---|

| Equities | Stocks representing ownership in companies. | Higher potential returns; more volatile. |

| Bonds | Debt securities issued by governments or corporations. | Steady income; generally lower risk. |

| Real Estate | Physical properties or real estate investment trusts (REITs). | Hedge against inflation; illiquid. |

| Commodities | Physical goods like gold, oil, or agricultural products. | Can protect against inflation; price volatility. |

Investors should continuously assess their risk tolerance and financial goals when selecting asset classes, ensuring that their portfolio remains aligned with their investment strategy. By thoughtfully allocating resources across these diverse categories, you can perhaps enhance returns while mitigating risks. Regular portfolio reviews and adjustments, based on market conditions and individual circumstances, will aid in maintaining the right balance and maximizing investment outcomes.

Practical Tips for Assessing Risk Tolerance and Adjusting Your Portfolio

Understanding your risk tolerance is crucial for effective investment management.Begin by taking a self-assessment of your financial situation and emotional response to potential losses. Consider the following aspects:

- Time Horizon: Evaluate how long you plan to invest before needing to access your funds.

- Financial Goals: Clearly outline what you aim to achieve—retirement, a new home, or perhaps funding an education.

- Past Experiences: reflect on how you’ve reacted in volatile markets; were you anxious or did you stay the course?

After assessing your risk tolerance,it’s time to adjust your portfolio accordingly. Diversifying your assets across various categories can mitigate risk substantially. Use the following table to guide your allocation strategy:

| Asset Class | Recommended allocation (%) |

|---|---|

| Stocks | 60-80 |

| Bonds | 15-30 |

| real Estate | 5-10 |

| Cash/Cash Equivalents | 5-10 |

Periodically revisit your portfolio to ensure it aligns with your risk tolerance and market changes. Be open to adjustments, maintaining a mindset that balances growth with risk management.

Utilizing Modern Tools and Resources for Effective Portfolio Management

In today’s fast-paced financial landscape,leveraging technological innovations can enhance portfolio management strategies significantly. By utilizing modern tools, investors can easily analyze market trends and make more informed decisions. Some of the key resources that can improve effectiveness include:

- Investment Apps: These platforms allow for real-time tracking of portfolios and offer insights into diversification opportunities.

- Robo-Advisors: automated services that can create tailored investment strategies based on individual risk tolerances and financial goals.

- Financial News Aggregators: Real-time updates on market conditions ensure investors stay informed on relevant developments that could impact their portfolios.

Additionally, embracing data analytics can provide a more nuanced view of potential investments.Tools that analyze ancient performance and predict future trends can lead to smarter asset allocation. Consider incorporating:

| Tool | Purpose | Benefit |

|---|---|---|

| Charting software | Visualize market trends | identify entry and exit points |

| Risk Assessment Tools | Evaluate investment risks | Mitigate potential losses |

| Portfolio Rebalancing Tools | Maintain desired asset allocation | Enhance long-term returns |

Final Thoughts

mastering portfolio diversity is not merely a strategy, but a vital beliefs for today’s investors navigating the complexities of financial markets. By spreading risk across various asset classes, sectors, and geographic regions, you not only build resilience against market volatility but also open the door to growth opportunities that can enhance your overall returns.

As you’ve seen, implementing smart strategies—whether it’s thru thorough research, periodic rebalancing, or understanding macroeconomic trends—can significantly elevate your investment game. Remember, the goal isn’t just about maximizing profits but also about safeguarding your investments against potential downturns.

Investing is a journey,and a diverse portfolio acts as your roadmap,guiding you toward your financial goals with greater confidence. As you continue to refine your approach,keep these principles in mind. Embrace learning, stay adaptable, and be proactive in your investment decisions.

Thank you for reading,and may your investment journey be as diverse and rewarding as the portfolio you create! If you have questions or want to share your own strategies,feel free to comment below or reach out. Happy investing!