In today’s fast-paced consumer landscape, the allure of credit cards can make managing personal finances feel like walking a tightrope. for many, the convenience of swiping a card trumps the reality of accumulating debt, leading to a cycle of financial stress that can be hard to escape. However, mastering personal finance is not just about understanding the numbers; it’s about cultivating informed habits and strategic planning to secure your financial future. This article aims to empower you with proven strategies to avoid credit card debt,providing the tools you need to navigate the complexities of modern spending while maintaining financial health. Whether you are a seasoned budgeter or just starting your financial journey, these actionable tips will help you develop a proactive approach to credit management, lay the groundwork for long-term stability, and ultimately enable you to enjoy the benefits of financial freedom. Let’s dive in!

Table of Contents

- Understanding the Dynamics of Credit Card Debt and Its Impact on Personal Finances

- Creating a Strategic Budget to Manage Spending and Prioritize Savings

- Building an Emergency Fund to Mitigate the Need for Credit Card Use

- Implementing Effective Payment Strategies to Reduce Debt and Improve Credit Score

- Key Takeaways

Understanding the Dynamics of Credit Card Debt and Its Impact on Personal Finances

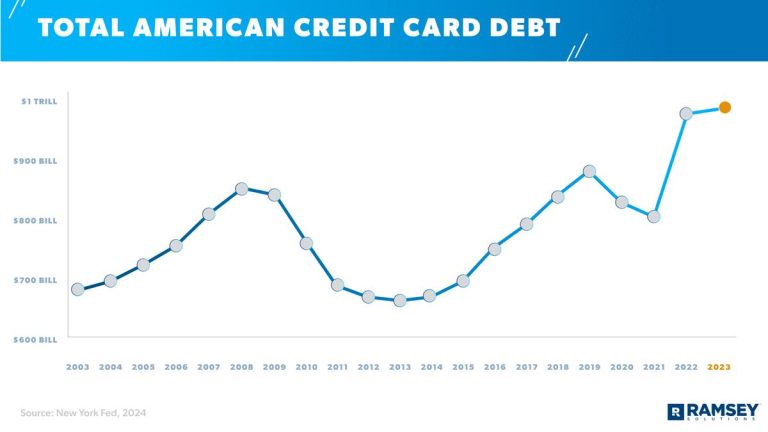

The intricate relationship between credit card debt and personal finances can often feel overwhelming,particularly in a consumer-driven society that encourages spending beyond one’s means. Credit card debt typically arises from a combination of impulsive purchasing, emergencies, and insufficient awareness of the long-term implications of high-interest debt. As balances accrue, individuals may find themselves trapped in a cycle of minimum payments and rising interest rates, further complicating their financial landscape. Understanding these dynamics is crucial for anyone seeking to enhance their financial literacy and make informed decisions that support long-term stability.

To effectively navigate the complexities of credit card debt,consider implementing these strategies:

- Create a budget: Establish a monthly budget that aligns with your income and expenses,prioritizing savings and necessary expenditures.

- Build an emergency fund: Set aside funds specifically for unexpected expenses, reducing the likelihood of resorting to credit cards.

- Educate yourself: Regularly research and stay updated on credit card terms and interest rates to make informed choices.

- Limit credit card use: Use credit cards only for planned purchases that you can afford to pay off each month.

| Strategy | Impact on Finances |

|---|---|

| Budgeting | Enhances spending awareness and controls expenses. |

| Emergency Fund | Reduces reliance on credit during financial crises. |

| Education | Empowers better financial decision-making. |

| Controlled use | Prevents overspending and accruing debt. |

Creating a Strategic Budget to Manage Spending and Prioritize Savings

Creating a strategic budget is essential for anyone looking to take control of their finances and avoid the pitfalls of credit card debt. Begin by assessing your current income and expenditures to gain a clear picture of your financial landscape. track your spending over a month to identify patterns and areas where you can cut back. Focus on essential expenses versus discretionary spending. Essential expenses might include:

- Rent or mortgage

- Utilities

- Groceries

- Transportation

Once you have your expenses categorized, allocate a specific portion of your income to savings goals. Implement the 50/30/20 rule as a guideline: 50% of your income for needs, 30% for wants, and 20% for savings and debt repayment. This approach not only helps in managing spending but also prioritizes saving for emergencies and future goals.Here’s a simple budget breakdown in table form:

| Category | Percentage | Amount ($) |

|---|---|---|

| Needs | 50% | $2,500 |

| Wants | 30% | $1,500 |

| Savings/Debt Repayment | 20% | $1,000 |

Building an Emergency Fund to Mitigate the Need for Credit Card Use

Establishing an emergency fund is a crucial step in safeguarding your financial health and reducing reliance on credit cards. Unexpected expenses can arise at any time,whether it’s a medical bill,car repair,or job loss,and having a financial cushion can prevent you from turning to credit in times of need. To build this fund effectively, consider the following strategies:

- Set a Clear Goal: Aim for a specific amount, typically three to six months’ worth of living expenses.

- automate savings: Set up an automatic transfer to a separate savings account dedicated to your emergency fund.

- Use Windfalls: direct bonuses, tax refunds, or any unexpected money towards your emergency savings.

- Cut Needless Expenses: Review your monthly budget to identify areas where you can reduce spending and redirect those funds to savings.

To help visualize your progress, maintaining a simple tracking system can be beneficial. Below is an example of how you can structure your monthly contributions and growth towards your emergency fund:

| Month | Contribution ($) | Balance ($) |

|---|---|---|

| January | 200 | 200 |

| February | 200 | 400 |

| March | 300 | 700 |

| April | 250 | 950 |

By consistently contributing to your emergency fund,you’ll not only gain peace of mind but also foster a habit that serves well in the long run. Regularly reassessing your savings goals and progress will empower you to adapt your strategy as your financial situation evolves.

implementing Effective Payment Strategies to Reduce Debt and Improve Credit Score

Implementing a structured payment strategy is crucial for managing your finances effectively, especially when it comes to tackling credit card debt.Start by prioritizing your payments based on interest rates. Focus on high-interest debts first while making the minimum payments on others. This approach not only helps in reducing the amount of interest accrued but also expedites your journey toward a debt-free life. Additionally,consider automating your payments to ensure you never miss a due date.This simple step can definitely help prevent late fees and keep your credit score intact, as timely payments are a significant factor in determining your score.

Another effective tactic is to create a budget that allocates a specified portion of your income toward debt repayment. Use a standard budgeting method such as the 50/30/20 rule: allocate 50% of your income for necessities, 30% for discretionary spending, and 20% for savings and debt repayment. To visualize your progress, you might find it helpful to maintain a simple table tracking your debt reduction over time. Here’s a sample layout:

| Month | debt Payment Made | Remaining Balance |

|---|---|---|

| January | $200 | $1,800 |

| February | $250 | $1,550 |

| March | $300 | $1,250 |

This approach not only allows you to track your payments and remaining balance but also boosts your confidence as you see tangible results from your efforts. by combining disciplined payment strategies with ongoing budget management, you’ll be well on your way to reducing debt and improving your credit score, effectively mastering your personal finances.

Key Takeaways

mastering personal finance is not just about budgeting wisely; it involves cultivating a mindset that prioritizes financial health and making informed choices about credit use. The strategies we’ve discussed—ranging from understanding your credit card terms to employing the snowball method for debt repayment—are essential tools in your arsenal against credit card debt. By implementing these best practices, you can take control of your finances and pave the way for a more secure future.Remember, the journey to financial mastery is a marathon, not a sprint. Stay disciplined,remain informed,and don’t hesitate to seek assistance when needed. With dedication and the right strategies, you can avoid the pitfalls of credit card debt and achieve the peace of mind that comes with financial freedom. Thank you for joining us on this journey toward mastering your personal finance—here’s to making empowered financial decisions!