In today’s fast-paced world, were financial decisions are as commonplace as daily routines, mastering the art of money management has never been more crucial. The landscape of personal finance is continually evolving,marked by an array of choices ranging from investment opportunities to complex debt structures. Unfortunately, many individuals find themselves unprepared, navigating these waters without a solid foundation of financial literacy. In this article, we will explore the importance of understanding financial principles, the benefits of being financially literate, and practical steps you can take to enhance your financial know-how. Whether you’re a seasoned investor or just starting your financial journey, equipping yourself with the tools and knowledge to make informed decisions is essential for achieving your long-term goals and securing your financial future.Join us as we delve into why financial literacy is not just an asset but a necessity in navigating today’s intricate economic landscape.

Table of Contents

- Understanding Financial Literacy and Its Long-Term Benefits

- The Role of Budgeting in Achieving Financial wellness

- Investing Essentials: Building Wealth Through Informed Decisions

- Strategies for Enhancing Your Financial Literacy Today

- Closing Remarks

Understanding Financial Literacy and its Long-Term Benefits

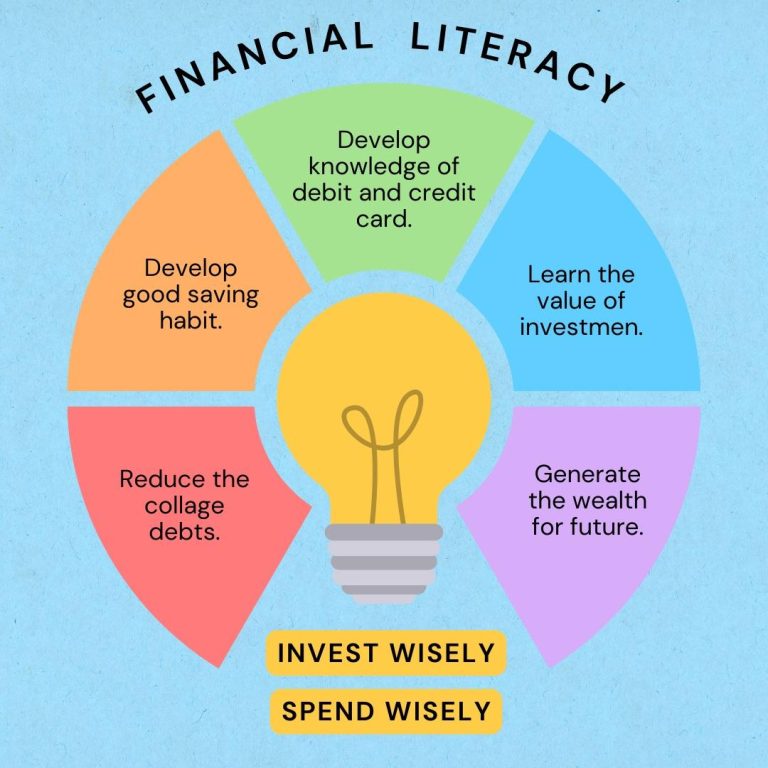

Financial literacy is about more than just understanding how money works; it encompasses the ability to make informed and effective decisions regarding financial resources. Individuals with strong financial literacy can navigate complex financial landscapes, whether it’s budgeting, investing, or planning for retirement. They possess the skills to critically assess financial products and services, which can lead to better choice-making and outcomes. As a result,this proficiency empowers people to achieve their financial goals,from buying a home to saving for their children’s education. In today’s world, where financial products are often intricate and misleading, the ability to discern fact from fiction is invaluable.

Moreover, the long-term benefits of being financially literate extend beyond individual gain. communities that prioritize financial education tend to experience overall economic advancement. When more individuals manage their finances wisely, the ripple effect can lead to increased savings rates, enhanced credit scores, and reduced levels of debt. Here are some key benefits:

- Improved decision-Making: People can analyze options and make choices that align with their values and needs.

- Increased Self-Confidence: Greater knowledge fosters confidence in financial decision-making.

- Debt Reduction: Well-informed individuals can strategize and implement debt-reduction plans more effectively.

- Wealth Accumulation: A solid understanding of investment options can lead to significant growth over time.

| Financial Literacy Impact | Statistic |

|---|---|

| Individuals who budget regularly | 70% report less financial stress |

| People investing in stocks | 85% prefer to learn through experience |

| Households with financial plans | 60% achieve their savings goals |

The Role of Budgeting in Achieving Financial Wellness

Creating a budget is not merely a financial chore; it is indeed a strategic approach to achieving financial wellness. At its core, a budget serves as a roadmap, guiding individuals toward their financial goals. It allows for a clear overview of income versus expenses, enabling better decision-making and prioritization of needs over wants. With a well-designed budget, you can identify areas for potential savings, allocate funds for essential expenses, and set aside money for future endeavors, such as investments or emergency funds. This proactive financial planning fosters a sense of control, alleviating stress and anxiety tied to financial uncertainty.

moreover, mastering the art of budgeting equips individuals with valuable insights into their spending habits. By tracking expenditures, you can uncover patterns and make informed adjustments that align with your financial aspirations. consider incorporating the following budget categories to streamline your financial tracking:

- Fixed Expenses: Rent, utilities, loan payments.

- Variable Expenses: Groceries, entertainment, dining out.

- Savings and investments: Emergency fund, retirement contributions.

- debt Repayment: Credit card balances, student loans.

To illustrate the impact of budgeting on saving potential, refer to the table below, which highlights how minor adjustments in daily spending can accumulate to significant savings over time.

| Item | Daily Cost | Monthly Cost | Annual cost |

|---|---|---|---|

| Coffee Shop Visit | $5 | $150 | $1,800 |

| Takeout Lunch | $10 | $300 | $3,600 |

| Gym Membership | $50 | $50 | $600 |

Investing Essentials: Building Wealth Through informed Decisions

Understanding the dynamics of finance is not just about crunching numbers; it’s about making informed choices that pave the way for a brighter financial future. Investing wisely entails evaluating risk versus reward, knowing your financial goals, and keeping abreast of market trends. To navigate the complex waters of investing,consider the following key elements:

- Research: Always investigate potential investment opportunities thoroughly.

- Diversification: Spread your investments across various asset classes to mitigate risk.

- Long-term Viewpoint: Adopt a mindset geared towards growing your investments over time rather than seeking immediate returns.

- Continuous Learning: Stay updated with financial news and educational resources.

The very foundation of wealth-building lies in strategic planning and discipline. By consciously making investment choices based on sound principles, you can see your net worth increase sustainably. Here’s a simplified table illustrating some common investment options and their typical characteristics:

| Investment Type | Risk Level | Return Potential |

|---|---|---|

| Stocks | High | High |

| Bonds | Low to Moderate | Moderate |

| Real Estate | Moderate | Moderate to High |

| Mutual Funds | Moderate | Moderate |

Strategies for enhancing your Financial Literacy Today

Improving your financial literacy is more approachable than it might seem. Start by establishing a solid foundation with the basics of personal finance. Consider reading books or attending workshops that cover essential topics such as budgeting, saving, and investing. Engage with reputable online resources, including interactive courses, podcasts, and webinars hosted by financial experts. key areas to focus on include:

- Budgeting Techniques: Learn how to track your income and expenses effectively.

- Investment Principles: understand stocks, bonds, and mutual funds.

- Credit Management: Familiarize yourself with credit scores and how to improve them.

Another effective strategy is to leverage technology. Many apps can assist you in managing your finances, from expense tracking to investment management. Setting up notifications for bill payments can help you avoid late fees and understand your cash flow better. Consider these digital resources:

| App Name | purpose | Key Feature |

|---|---|---|

| Mint | Budgeting | Automatic expense tracking |

| Robinhood | Investing | No commission fees |

| Credit Karma | Credit Monitoring | Free credit score updates |

Closing Remarks

mastering money is not just a skill; it’s a necessity in our ever-evolving financial landscape. As we’ve explored, financial literacy equips us to navigate the complexities of personal finance, from budgeting and saving to investing and planning for retirement. The ability to make informed decisions can not only enhance our financial stability but also empower us to achieve our goals and dreams.

Embracing a mindset of continuous learning about finance will prepare you to face challenges head-on, fostering resilience against economic uncertainties. Whether you’re a student just starting your financial journey or a seasoned professional looking to refine your skills, the importance of financial literacy cannot be overstated.

Let’s commit to prioritizing our financial education—seeking out resources, engaging in discussions, and sharing knowledge with others. Together, we can create a culture of informed individuals who take control of their financial futures. Remember,when you master money,you don’t just manage your finances; you create opportunities for yourself and those around you. So, let’s get started on this empowering journey toward financial mastery today!