In today’s fast-paced world, where financial decisions shape our lives and futures, establishing a healthy relationship with money is more crucial than ever. Understanding how to navigate the complexities of budgeting, investing, and saving can feel overwhelming, but it doesn’t have to be that way. Welcome to “,” where we will delve into the essential principles and practical techniques that can transform how you view and manage your finances. Whether you’re just starting your financial journey or looking to refine your existing strategies, this guide aims to equip you with the tools you need to foster a positive and empowering connection with your financial landscape. Join us as we explore actionable insights and expert advice that will pave the way for financial confidence and well-being.

Table of contents

- Building a Solid Financial Foundation Through Budgeting

- Understanding the Psychology of Spending and Saving

- Navigating Debt: Strategies for Effective Management

- Investing Wisely for Long-Term Wealth Creation

- Insights and Conclusions

Building a Solid Financial Foundation Through Budgeting

Creating a budget is a transformative step toward achieving financial stability. By tracking your income and expenses, you gain invaluable insight into your spending habits and can identify areas where adjustments are necessary. Consider focusing on the following key elements when establishing your budget:

- Income Tracking: Record all sources of income, including salaries, side hustles, and passive earnings.

- Fixed and Variable Expenses: Categorize your expenses into fixed (housing,insurance) and variable (groceries,entertainment) to better understand your financial commitments.

- SMART Goals: Set Specific,Measurable,Achievable,Relevant,and Time-bound financial goals that align with your values and aspirations.

Once you’ve crafted your budget, the next step is to maintain it with discipline and regularity. Consider using budgeting tools and apps to automate tracking and keep you accountable. An effective approach is to set up a monthly review process to evaluate your progress and adjust your budget based on real-time data. Here’s a simple table structure to visualize your income versus expenses:

| Category | Income | Expenses | Net Balance |

|---|---|---|---|

| Salary | $4,500 | – | $4,500 |

| Groceries | – | -$300 | $4,200 |

| Rent | – | -$1,200 | $3,000 |

| Utilities | – | -$150 | $2,850 |

With consistent efforts and adjustments, you can build a robust financial foundation that not only safeguards against unexpected expenses but also enables you to invest in your future with confidence. Embrace the budgeting journey as an opportunity to develop a healthier, more empowering relationship with your finances.

Understanding the Psychology of Spending and Saving

Understanding our behavioral tendencies towards money is crucial for effectively managing our finances.Emotions play a critically important role in how we choose to spend or save.For many, spending can be a temporary escape from stress or boredom, leading to impulsive purchases that provide instant gratification. Conversely, saving tends to evoke feelings of security and control over our financial future. Recognizing these emotional triggers is the first step to transforming our spending habits into a more balanced and fulfilling financial strategy. Consider exploring your personal triggers that prompt spending by asking yourself:

- What circumstances drive me to make impulsive purchases?

- Are there specific emotional states that lead to excessive spending?

- How do I feel when I put money into savings versus when I make a purchase?

To cultivate a healthier relationship with money, it’s beneficial to adopt strategies that align with our psychological inclinations. For instance, implementing practices such as the 50/30/20 rule—where 50% of your income goes to needs, 30% to wants, and 20% to savings—helps create a structured approach to managing finances. This promotes conscious spending while prioritizing savings. Additionally,utilizing technologies like budgeting apps can provide a visual portrayal of spending habits,empowering individuals to make informed financial choices. Regular self-reflection on spending habits can also keep emotional spending in check.

| Spending behavior | Psychological Motivation | Recommended Strategy |

|---|---|---|

| Impulse Purchases | Seeking instant gratification | Establish a waiting period for purchases |

| Emotional spending | Using shopping as a coping mechanism | Practise mindfulness and consider alternatives like exercise |

| Neglecting Savings | Fear of missing out on experiences | Set specific financial goals that align with personal values |

Navigating Debt: Strategies for Effective Management

managing debt effectively requires a combination of knowledge, strategy, and discipline. Assess your current financial situation by creating a detailed list of your debts, including interest rates and remaining balances. This clarity will allow you to prioritize which debts to tackle first. Consider methods such as the snowball approach,where you pay off your smallest debts first to gain momentum,or the avalanche method,which focuses on paying off high-interest debts to save money in the long run.Also, make a habit of regularly reviewing your budget, adjusting spending habits, and finding ways to increase your income, whether through side jobs or selling unused items.

Additionally, seek options for consolidating your debts, such as a personal loan or a balance transfer credit card, to simplify your payment process and potentially lower your interest rates. Always be cautious with these options, ensuring you read the terms thoroughly to avoid hidden fees. Implementing automatic payments can also help to avoid late fees and maintain a consistent payment history. Below is a simple comparison of effective debt strategies:

| Strategy | Pros | Cons |

|---|---|---|

| Snowball Method | Boosts motivation through small wins | May incur higher overall interest costs |

| Avalanche Method | Saves money on interest payments | Requires more discipline and patience |

| Debt Consolidation | Simplifies payments and may lower rates | Potential fees and impacts credit score |

Investing Wisely for Long-Term Wealth Creation

Building long-term wealth requires a strategic approach that balances risk and reward. It’s essential to understand various investment vehicles, including stocks, bonds, real estate, and mutual funds. Each option has its unique characteristics, and selecting the right mix can enhance your financial portfolio. Consider starting with a well-diversified index fund, which offers broad market exposure with lower fees compared to actively managed funds. Furthermore, consistently contributing to your investment account, even small amounts, can lead to significant growth over time through the power of compound interest. Aim to automate your investments to establish a habitual savings discipline that keeps you on track.

additionally, staying informed and adaptable is crucial in today’s ever-changing economic landscape. Regularly review your financial plan and adjust your strategies based on market trends and personal circumstances. Here are some key practices to incorporate into your investment strategy:

- establish Clear Goals: Define your financial objectives to guide your investment choices.

- Diversify Your Portfolio: Spread your investments across various asset classes to mitigate risk.

- Educate Yourself: Continuously learn about market trends and investment strategies.

- Be Patient: Long-term investing requires discipline; avoid reacting impulsively to market fluctuations.

| investment Type | Risk Level | potential Returns |

|---|---|---|

| Stocks | High | 7-10% annually |

| Bonds | Low to Medium | 2-5% annually |

| Real Estate | Medium | 4-8% annually |

| Mutual Funds | Medium | 5-9% annually |

Insights and Conclusions

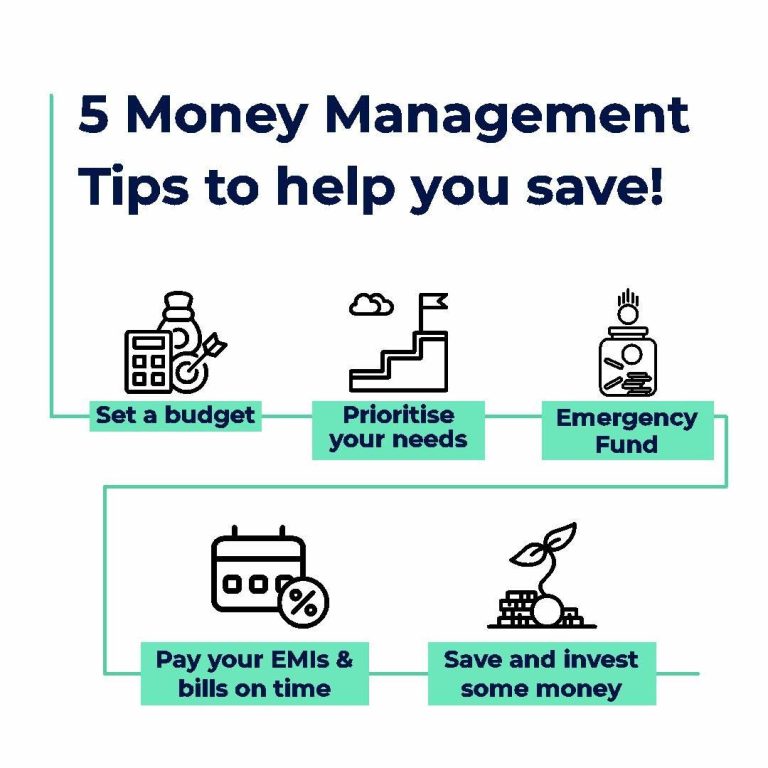

mastering money is not just about numbers and spreadsheets; it’s about fostering a relationship with your finances that is built on understanding, discipline, and growth. By implementing the strategies discussed in this article—setting clear goals, establishing a budget, prioritizing saving, and investing wisely—you can take significant steps toward achieving financial stability and independence. Remember that building a healthy financial relationship is a journey,not a destination. Be patient with yourself, celebrate your progress, and continuously educate yourself about money management.

As you embark on this journey, keep in mind that financial wellness is not solely about accumulating wealth—it’s about creating a life that reflects your values and aspirations. Embrace the process, stay proactive, and don’t hesitate to seek help when needed.With commitment and perseverance, you can transform your financial landscape and enjoy the peace of mind that comes from mastering your money. Thank you for reading, and here’s to your journey toward a healthier, more empowered financial future!