: A Comprehensive Guide

In an increasingly globalized world, the need for seamless international money transfers has never been more pertinent. Whether you’re sending money to family overseas, paying for international services, or investing in foreign markets, understanding how to navigate the intricacies of cross-border transactions can save you time, money, and potential headaches. While various options exist—from online platforms to peer-to-peer services—transferring funds through your bank remains one of the most widely used methods, offering a sense of security and familiarity. In this article, we will demystify the process of international money transfers through your bank, sharing tips on how to optimize your transfers, avoid unnecessary fees, and ensure that your money reaches its destination safely and efficiently. Join us as we explore the essential steps to mastering this vital financial service, empowering you to make informed decisions in your global transactions.

Table of Contents

- Understanding the Basics of International Money transfers Through Your Bank

- Evaluating fees and Exchange Rates for Cost-Effective Transfers

- Tips for Ensuring Secure and Timely Transactions

- Navigating Regulatory Requirements for Smooth International Transfers

- Closing Remarks

Understanding the basics of International Money Transfers Through Your Bank

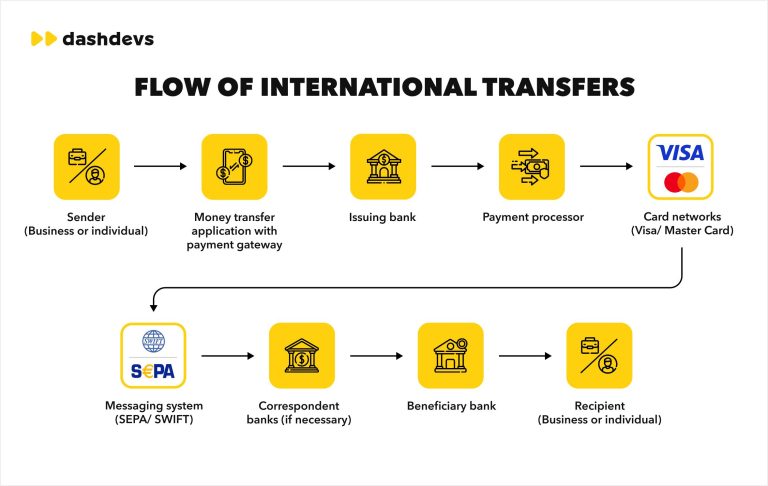

When considering an international money transfer through your bank, it’s essential to grasp the basic processes involved. Typically, the process starts with setting up a wire transfer request either online or in-person at your bank. Here are some critical factors to keep in mind:

- Exchange Rates: Banks often charge a margin on the exchange rate, which can significantly impact your total transfer amount.

- Fees: Be aware of both sending and receiving fees that vary by institution and destination.

- Transfer Time: International transfers can take anywhere from a few hours to several days, depending on the involved banks and countries.

Understanding these aspects helps you make informed decisions and choose the right bank for your international transfer needs. Additionally, you might encounter different methods of transferring money, such as online bank transfers, international wire services, or specialized money transfer companies.Each method comes with its unique advantages:

| Transfer Method | Pros | Cons |

|---|---|---|

| Bank Wire Transfer | Secure, widespread access | higher fees |

| Online Transfer Services | Competitive rates, user-amiable | Potential delays |

| Peer-to-Peer Apps | Fast, convenient | Limited to certain regions |

Evaluating Fees and Exchange Rates for Cost-Effective Transfers

When planning an international money transfer through your bank, it is indeed essential to scrutinize both the fees associated with the transfer and the exchange rates being offered. Banks frequently enough charge a flat fee, a percentage of the transfer amount, or a combination of both. Understanding how these fees are structured can save you significant amounts in the long run. Here are some critical considerations to keep in mind:

- Flat vs. Percentage Fees: Determine which type of fee structure your bank employs and how it impacts your total transaction cost.

- Hidden Fees: Watch for additional charges that might not be instantly apparent, such as intermediary banks or processing fees.

- Daily Exchange Rates: Banks might not offer the most favorable exchange rates; compare these rates with mid-market rates for an accurate assessment.

To illustrate the difference in costs that can arise from varying fees and exchange rates,consider the following table:

| Bank | Transfer amount | Fees | Exchange Rate | Total Cost |

|---|---|---|---|---|

| Bank A | $1,000 | $25 | 1 USD = 0.85 EUR | $1,175 |

| Bank B | $1,000 | $15 | 1 USD = 0.88 EUR | $1,130 |

This example clearly shows how varying fees and exchange rates can effect the total cost of your transfer. By conducting thorough research and asking your bank the right questions, you can select the most cost-effective option, ensuring your international money transfer is as efficient and economical as possible.

Tips for Ensuring Secure and Timely Transactions

When it comes to making international money transfers, security and timeliness are paramount. To safeguard your finances, always use a bank that employs advanced encryption protocols and fraud detection systems.Before initiating a transfer, look for the following best practices:

- Confirm the recipient’s details with utmost accuracy.

- Utilize two-factor authentication for an additional layer of security.

- Monitor your bank account regularly for any unauthorized transactions.

- Choose a reputable bank with experience in international transfers.

To ensure that your funds reach the recipient without unnecessary delays, familiarize yourself with the bank’s transfer policies, including processing times and cut-off hours. Oftentimes, there are certain steps you can take to expedite the process:

| Tip | Details |

|---|---|

| Transfer during business hours | this helps avoid delays associated with weekend or holiday processing. |

| Use online banking | Many institutions offer faster processing for digital transactions compared to manual ones. |

| Stay informed on currency exchange rates | A favorable rate can save you money and time during conversions. |

Navigating Regulatory Requirements for Smooth International Transfers

When engaging in international money transfers,understanding and adhering to various regulatory requirements is paramount. Different countries have their own set of rules governing financial transactions,which may include restrictions on the amount transferred,necessary documentation,and compliance with anti-money laundering (AML) laws. To successfully navigate this landscape, it is crucial to familiarize yourself with the key factors influencing cross-border payments, such as:

- Know Your Customer (KYC): Banks often require extensive documentation to verify the identity of the sender and recipient.

- Currency Controls: Some nations impose limits on how much money can be sent abroad; understanding these restrictions can help you plan better.

- Tax Implications: Different jurisdictions may have varying tax obligations for international transactions that you should consider.

To streamline the transfer process, it’s also advisable to consult with your bank regarding their specific requirements, as these can vary significantly. Many banks offer resources for helping customers understand the compliance process, including checklists or customer service representatives who specialize in international transfers. Additionally, a good practice is to maintain an organized record of all relevant transactions and communications. This diligence not only provides clarity but also can be vital in case of disputes or audits.

| Regulatory Requirement | Description | Importance |

|---|---|---|

| KYC Documentation | Proof of identity and address required. | helps prevent fraud and money laundering. |

| AML Compliance | Adherence to laws preventing illegal activities. | Protects the bank and its customers. |

| international Fees | Bank charges for processing transfers. | Essential for budgeting and minimizing costs. |

Closing Remarks

mastering international money transfers through your bank can significantly enhance your financial management and open up a world of opportunities for both personal and business transactions. By understanding the nuances of exchange rates, fees, and transfer times, you can make informed decisions that maximize the value of your hard-earned money. Don’t hesitate to leverage the digital tools and resources your bank offers, as they can simplify the process and save you time. As you embark on your international transfer journey, remember to stay informed about the regulations and trends that may affect your transactions. With the right knowledge and approach, you can navigate the complexities of global finance confidently and efficiently. Thank you for joining us on this exploration of international money transfers; we hope you feel empowered to take control of your financial future on a global scale. Happy transferring!