: A Path too financial Stability

In today’s investment landscape, navigating the myriad of options can feel overwhelming, especially for those approaching the world of finance for the first time. Amidst the complexities of stock picking and market timing, one investment strategy stands out for its simplicity and effectiveness: index funds. These passive investment vehicles are designed to mirror the performance of a specific market index, offering investors a seamless way to achieve diversified exposure at a low cost.In this article, we’ll explore the nuances of index fund investing, uncovering strategies to master this approach for consistent growth. Whether you’re a seasoned investor looking to refine your portfolio or a beginner eager to build a solid financial foundation, understanding the power of index funds can help you achieve your long-term financial goals. Join us as we delve into the principles, benefits, and best practices that will empower you to harness the full potential of index fund investments.

table of Contents

- Understanding the Basics of Index Funds and Their Role in investment Portfolios

- Key Strategies for Selecting the Right Index Funds for Your Financial Goals

- Leveraging dollar-Cost Averaging to Maximize Your Investment Returns

- Monitoring and adjusting Your Index Fund Investments for Long-Term Success

- the Conclusion

Understanding the Basics of Index Funds and Their Role in Investment Portfolios

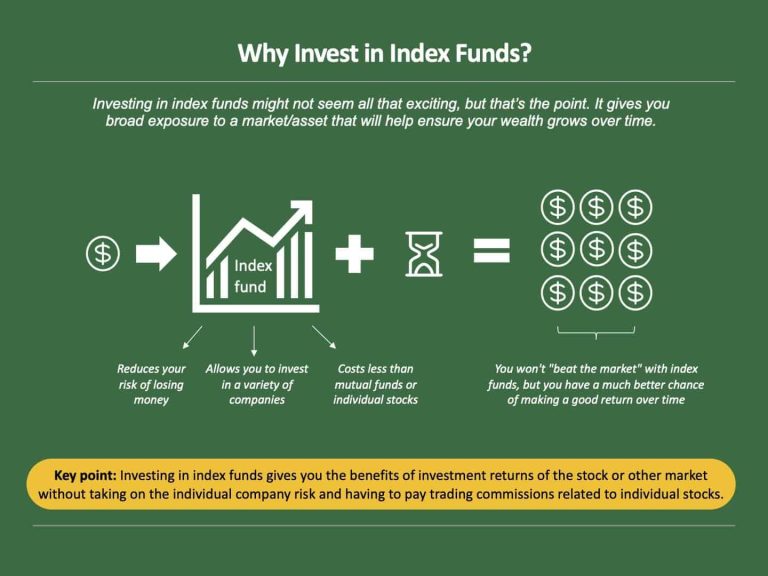

Index funds are a powerful investment vehicle designed to mirror the performance of a specific market index,such as the S&P 500 or the Nasdaq Composite. By pooling investor money to create a diversified portfolio, they offer a lower-cost option compared to actively managed funds. The primary features of index funds include:

- Low Expense Ratios: With minimal management fees, investors keep more of their returns.

- Broad Market Exposure: Index funds provide a stake in a wide range of stocks, reducing overall risk.

- Passive Management: Rather than relying on fund managers to pick stocks,index funds automatically track indices,simplifying the investment process.

Incorporating index funds into an investment portfolio can significantly enhance growth potential while mitigating risk.They are notably well-suited for long-term investors seeking consistent performance. consider the following benefits of incorporating index funds:

| Benefit | Description |

|---|---|

| Diversification | Reduces the impact of poor-performing investments by spreading risk across various sectors. |

| Simplicity | Easy to buy and manage, requiring minimal intervention from investors. |

| Tax Efficiency | Lower turnover rates result in fewer capital gains taxes, enhancing after-tax returns. |

Key Strategies for selecting the Right Index Funds for Your Financial Goals

When it comes to index funds, aligning your investment choices with your financial objectives is paramount. Start by understanding your investment goals. Are you looking to save for retirement, a child’s education, or simply to grow your wealth? Each goal may require a different approach. Additionally, consider your risk tolerance before diving in. If you prefer a more conservative investment style, opt for funds that track smaller indices or those with a history of stability. On the other hand, if you’re willing to accept higher volatility for potential returns, broader or more aggressive funds may be the way to go. Key factors to assess include:

- Expense Ratios: Choose funds with lower fees to maximize your returns.

- Performance History: Analyze how the fund has performed over the years compared to its benchmark.

- Tax Efficiency: Consider the tax implications of the fun’s distributions.

Another effective strategy when selecting index funds is to diversify across various asset classes.This diversification can help balance risk and improve potential returns. You may also want to create a custom portfolio incorporating domestic and international stocks, bonds, and real estate investment trusts (REITs). To visualize this approach more clearly, refer to the table below:

| Asset Class | Percentage Allocation |

|---|---|

| U.S. Stocks | 40% |

| International Stocks | 30% |

| Bonds | 20% |

| REITs | 10% |

Crafting a well-rounded approach will not only help protect your investments but will also place you in a better position for long-term growth as you refine your strategy over time. Regularly reviewing and rebalancing your fund selections will ensure that your portfolio continues to align with your evolving financial landscape.

Leveraging Dollar-Cost Averaging to maximize Your Investment Returns

One of the most effective strategies for enhancing your investment portfolio while mitigating risk is through dollar-cost averaging. This method involves consistently investing a fixed amount of money at regular intervals, irrespective of market conditions. By doing so, you effectively reduce the emotional impact of market volatility, enabling you to purchase more shares when prices are lower and fewer shares when prices are higher. This disciplined approach not only helps in building wealth over time but also aligns with the principles of index fund investments, wich aim to track the performance of a particular market index.

To illustrate the potential benefits of this strategy, consider the following hypothetical scenario of investing in an index fund using dollar-cost averaging. Let’s say you commit to investing $100 every month for six months:

| Month | Investment Amount | Price per Share | Shares Purchased |

|---|---|---|---|

| 1 | $100 | $10 | 10 |

| 2 | $100 | $8 | 12.5 |

| 3 | $100 | $12 | 8.33 |

| 4 | $100 | $9 | 11.11 |

| 5 | $100 | $11 | 9.09 |

| 6 | $100 | $10 | 10 |

By the end of six months,you would have invested a total of $600 and accumulated approximately 59.03 shares, compared to possibly purchasing only 50 shares had you invested your entire amount at the onset in the first month. This strategy not only minimizes the risks associated with timing the market but also supports consistent growth through regular participation in the market’s ups and downs. As you continue to invest consistently, you may find that this steady approach is one of the keys to not only building a resilient investment portfolio but also achieving your long-term financial goals.

Monitoring and Adjusting Your Index Fund Investments for Long-Term Success

Monitoring your index fund investments is essential for ensuring they align with your long-term financial goals.Regularly review performance metrics and consider adjusting your holdings based on shifts in the market or changes in your personal circumstances. Key aspects to focus on include:

- Performance Analysis: Examine how your investments compare to relevant benchmarks.

- Expense Ratios: Ensure that you’re aware of any changes in fees that might affect your returns.

- Rebalancing Needs: Assess if your asset allocation remains in line with your desired risk level.

Incorporating an adaptive strategy can lead to better investment outcomes. For instance, utilize a systematic approach to rebalancing your portfolio, which may involve selling a portion of your top-performing funds and reallocating those funds towards underperforming ones to maintain your intended investment strategy. You might also consider the following factors:

- Market Trends: Be mindful of economic conditions and industry developments that could influence performance.

- Personal Goals: Adjust your investment strategy in response to any significant life changes, such as starting a family or nearing retirement.

| Adjustment Frequency | Recommendation | Rationale |

|---|---|---|

| Quarterly | Review Top Holdings | To ensure alignment with market leaders. |

| Annually | Rebalance Portfolio | To maintain desired asset allocation. |

| as Needed | Adjust Based on Life Changes | To reflect changes in risk tolerance and goals. |

the Conclusion

mastering index fund investments can be a powerful strategy for achieving consistent growth in your portfolio. By understanding the fundamentals of indexing, selecting the right funds, and maintaining a disciplined approach to investing, you position yourself to benefit from the broad market’s performance over time. Remember, investing is a marathon, not a sprint.The key lies in patience, informed decision-making, and a commitment to your long-term financial goals.

As you embark on or continue your journey with index funds,keep educating yourself on market trends and reallocating as necessary to stay aligned with your investment strategy. With dedication and the right knowledge, you can harness the potential of index funds to build wealth and secure your financial future. Thank you for reading, and here’s to your investment success!